New York State Common Retirement Fund raised its stake in Installed Building Products, Inc. (NYSE:IBP - Free Report) by 29.3% during the third quarter, according to the company in its most recent Form 13F filing with the SEC. The institutional investor owned 92,077 shares of the construction company's stock after buying an additional 20,860 shares during the quarter. New York State Common Retirement Fund owned about 0.32% of Installed Building Products worth $22,676,000 at the end of the most recent reporting period.

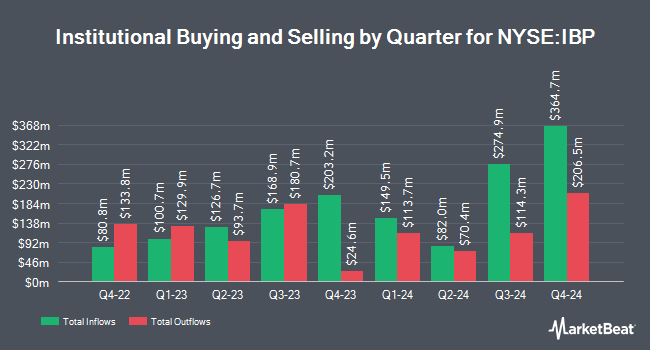

Several other institutional investors and hedge funds also recently made changes to their positions in the stock. Allspring Global Investments Holdings LLC bought a new stake in Installed Building Products in the 1st quarter valued at $29,000. Sequoia Financial Advisors LLC bought a new stake in shares of Installed Building Products in the first quarter valued at about $238,000. BNP Paribas Financial Markets grew its holdings in shares of Installed Building Products by 11.8% during the first quarter. BNP Paribas Financial Markets now owns 29,278 shares of the construction company's stock worth $7,575,000 after buying an additional 3,096 shares in the last quarter. Texas Permanent School Fund Corp grew its stake in shares of Installed Building Products by 0.7% during the 1st quarter. Texas Permanent School Fund Corp now owns 20,517 shares of the construction company's stock worth $5,308,000 after acquiring an additional 147 shares in the last quarter. Finally, Duality Advisers LP raised its holdings in shares of Installed Building Products by 32.2% in the first quarter. Duality Advisers LP now owns 13,899 shares of the construction company's stock valued at $3,596,000 after purchasing an additional 3,389 shares during the last quarter. Institutional investors and hedge funds own 99.61% of the company's stock.

Analysts Set New Price Targets

Several research analysts recently commented on the stock. The Goldman Sachs Group increased their target price on shares of Installed Building Products from $260.00 to $295.00 and gave the stock a "buy" rating in a report on Friday, August 2nd. Jefferies Financial Group increased their price objective on shares of Installed Building Products from $240.00 to $252.00 and gave the stock a "hold" rating in a research note on Wednesday, October 9th. Stephens reaffirmed an "equal weight" rating and issued a $240.00 target price on shares of Installed Building Products in a research report on Monday, August 5th. Evercore ISI increased their price target on Installed Building Products from $271.00 to $272.00 and gave the company an "outperform" rating in a research report on Wednesday, October 16th. Finally, StockNews.com downgraded Installed Building Products from a "buy" rating to a "hold" rating in a research note on Wednesday, October 30th. Six investment analysts have rated the stock with a hold rating and five have given a buy rating to the company. Based on data from MarketBeat, the company has an average rating of "Hold" and a consensus target price of $254.40.

View Our Latest Stock Analysis on Installed Building Products

Installed Building Products Stock Performance

Installed Building Products stock traded up $11.49 during mid-day trading on Tuesday, hitting $232.56. 387,616 shares of the company's stock traded hands, compared to its average volume of 289,354. The company has a debt-to-equity ratio of 1.24, a current ratio of 3.08 and a quick ratio of 2.59. The firm has a 50 day simple moving average of $231.10 and a two-hundred day simple moving average of $225.38. Installed Building Products, Inc. has a fifty-two week low of $115.25 and a fifty-two week high of $281.04. The stock has a market cap of $6.57 billion, a price-to-earnings ratio of 24.67 and a beta of 1.95.

Installed Building Products Company Profile

(

Free Report)

Installed Building Products, Inc, together with its subsidiaries, engages in the installation of insulation, waterproofing, fire-stopping, fireproofing, garage doors, rain gutters, window blinds, shower doors, closet shelving and mirrors, and other products in the United States. It operates through Installation, Distribution, and Manufacturing operation segments.

Read More

Before you consider Installed Building Products, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Installed Building Products wasn't on the list.

While Installed Building Products currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.