Raymond James & Associates reduced its stake in shares of InterContinental Hotels Group PLC (NYSE:IHG - Free Report) by 13.3% during the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 106,785 shares of the company's stock after selling 16,447 shares during the period. Raymond James & Associates owned 0.07% of InterContinental Hotels Group worth $11,799,000 as of its most recent SEC filing.

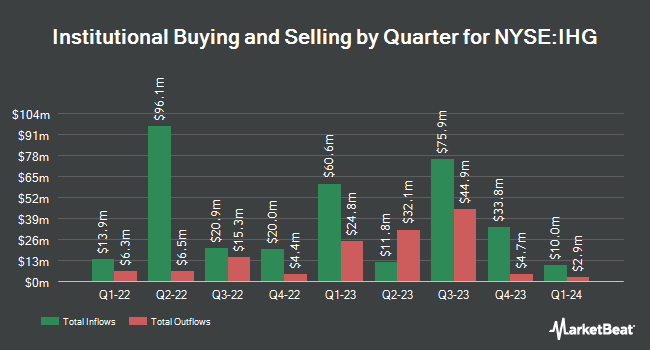

Several other institutional investors and hedge funds have also made changes to their positions in IHG. Park Avenue Securities LLC acquired a new position in shares of InterContinental Hotels Group in the first quarter worth $223,000. Allspring Global Investments Holdings LLC purchased a new stake in shares of InterContinental Hotels Group in the first quarter valued at about $48,000. Private Advisor Group LLC raised its holdings in InterContinental Hotels Group by 20.5% during the first quarter. Private Advisor Group LLC now owns 3,212 shares of the company's stock worth $339,000 after purchasing an additional 547 shares in the last quarter. BNP Paribas Financial Markets raised its holdings in InterContinental Hotels Group by 130.0% during the first quarter. BNP Paribas Financial Markets now owns 36,288 shares of the company's stock worth $3,834,000 after purchasing an additional 20,511 shares in the last quarter. Finally, Rehmann Capital Advisory Group raised its holdings in InterContinental Hotels Group by 37.3% during the first quarter. Rehmann Capital Advisory Group now owns 3,146 shares of the company's stock worth $332,000 after purchasing an additional 855 shares in the last quarter. 15.09% of the stock is currently owned by institutional investors and hedge funds.

InterContinental Hotels Group Price Performance

InterContinental Hotels Group stock traded up $0.19 during midday trading on Tuesday, hitting $113.27. 142,487 shares of the stock were exchanged, compared to its average volume of 177,614. InterContinental Hotels Group PLC has a 1 year low of $71.01 and a 1 year high of $115.25. The firm has a market cap of $18.04 billion, a P/E ratio of 23.12, a P/E/G ratio of 1.81 and a beta of 1.32. The company has a 50 day moving average price of $106.95 and a two-hundred day moving average price of $103.36.

InterContinental Hotels Group Increases Dividend

The firm also recently declared a Semi-Annual dividend, which was paid on Thursday, October 3rd. Stockholders of record on Friday, August 30th were issued a $0.532 dividend. The ex-dividend date of this dividend was Friday, August 30th. This is a positive change from InterContinental Hotels Group's previous Semi-Annual dividend of $0.30. This represents a dividend yield of 1.6%. InterContinental Hotels Group's payout ratio is 21.63%.

Analyst Upgrades and Downgrades

Separately, The Goldman Sachs Group raised shares of InterContinental Hotels Group from a "neutral" rating to a "buy" rating in a report on Wednesday, September 18th. One analyst has rated the stock with a sell rating, four have given a hold rating and one has assigned a buy rating to the company's stock. Based on data from MarketBeat.com, the company currently has an average rating of "Hold".

View Our Latest Research Report on InterContinental Hotels Group

InterContinental Hotels Group Company Profile

(

Free Report)

InterContinental Hotels Group PLC owns, manages, franchises, and leases hotels in the Americas, Europe, Asia, the Middle East, Africa, and Greater China. The company operates hotels under the Six Senses, Regent, InterContinental Hotels & Resorts, Vignette Collection, Kimpton Hotels & Restaurants, Hotel Indigo, voco, HUALUXE, Crowne Plaza, Iberostar Beachfront Resorts, EVEN, Holiday Inn Express, Holiday Inn, Garner, avid hotels, Atwell Suites, Staybridge Suites, Iberostar Beachfront Resorts, Holiday Inn Club Vacations, and Candlewood Suites brand names.

Featured Stories

Before you consider InterContinental Hotels Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and InterContinental Hotels Group wasn't on the list.

While InterContinental Hotels Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.