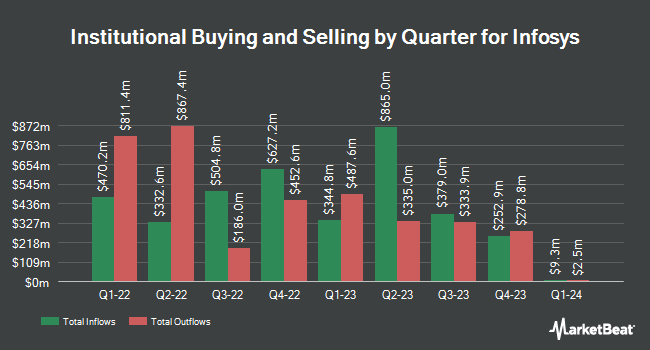

Allspring Global Investments Holdings LLC cut its holdings in Infosys Limited (NYSE:INFY - Free Report) by 22.3% during the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 1,374,117 shares of the technology company's stock after selling 394,082 shares during the period. Allspring Global Investments Holdings LLC's holdings in Infosys were worth $30,602,000 as of its most recent SEC filing.

Other large investors also recently added to or reduced their stakes in the company. GAMMA Investing LLC lifted its holdings in Infosys by 33.0% in the 1st quarter. GAMMA Investing LLC now owns 2,390 shares of the technology company's stock worth $43,000 after purchasing an additional 593 shares in the last quarter. Hilltop National Bank raised its holdings in shares of Infosys by 50.8% during the 2nd quarter. Hilltop National Bank now owns 2,979 shares of the technology company's stock worth $55,000 after acquiring an additional 1,004 shares in the last quarter. Whittier Trust Co. of Nevada Inc. raised its holdings in shares of Infosys by 126.7% during the 2nd quarter. Whittier Trust Co. of Nevada Inc. now owns 3,029 shares of the technology company's stock worth $56,000 after acquiring an additional 1,693 shares in the last quarter. Ridgewood Investments LLC purchased a new stake in shares of Infosys during the 2nd quarter worth approximately $162,000. Finally, Bank Pictet & Cie Europe AG purchased a new stake in shares of Infosys during the 2nd quarter worth approximately $194,000. 10.89% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

INFY has been the topic of several recent research reports. Erste Group Bank raised Infosys from a "hold" rating to a "buy" rating in a report on Wednesday, September 11th. Investec cut Infosys from a "hold" rating to a "sell" rating in a report on Thursday, October 3rd. StockNews.com cut Infosys from a "buy" rating to a "hold" rating in a report on Monday. Macquarie raised Infosys from an "underperform" rating to a "neutral" rating in a report on Friday, July 19th. Finally, BMO Capital Markets boosted their target price on Infosys from $23.00 to $25.00 and gave the company a "market perform" rating in a research report on Friday, October 18th. Two research analysts have rated the stock with a sell rating, five have given a hold rating and six have issued a buy rating to the company. According to data from MarketBeat, the stock presently has a consensus rating of "Hold" and an average target price of $20.85.

Check Out Our Latest Research Report on INFY

Infosys Trading Down 0.7 %

Shares of INFY traded down $0.16 during midday trading on Thursday, reaching $22.05. 7,199,587 shares of the stock were exchanged, compared to its average volume of 9,313,621. Infosys Limited has a 52 week low of $16.04 and a 52 week high of $23.48. The company's 50 day moving average is $22.71 and its two-hundred day moving average is $20.08. The company has a market capitalization of $91.29 billion, a P/E ratio of 29.01, a PEG ratio of 3.68 and a beta of 0.99.

Infosys (NYSE:INFY - Get Free Report) last issued its quarterly earnings data on Thursday, October 17th. The technology company reported $0.19 earnings per share for the quarter, hitting analysts' consensus estimates of $0.19. The firm had revenue of $4.89 billion during the quarter, compared to analysts' expectations of $4.89 billion. Infosys had a return on equity of 32.01% and a net margin of 17.18%. During the same period in the prior year, the business posted $0.18 EPS. On average, sell-side analysts expect that Infosys Limited will post 0.75 EPS for the current year.

Infosys Increases Dividend

The firm also recently declared a semi-annual dividend, which will be paid on Tuesday, October 29th. Shareholders of record on Friday, January 1st will be paid a $0.2126 dividend. The ex-dividend date is Tuesday, October 29th. This is a boost from Infosys's previous semi-annual dividend of $0.20. This represents a yield of 1.1%. Infosys's dividend payout ratio (DPR) is 55.26%.

Infosys Profile

(

Free Report)

Infosys Limited, together with its subsidiaries, provides consulting, technology, outsourcing, and next-generation digital services in North America, Europe, India, and internationally. It provides digital marketing and digital workplace, digital commerce, digital experience and interactions, metaverse, data analytics and AI, applied AI, generative AI, sustainability, blockchain, engineering, Internet of Things, enterprise agile DevOps, application modernization, cloud, digital process automation, digital supply chain, Microsoft business application and cloud business, service experience transformation, energy transition, cyber security, and quality engineering solutions; Oracle, SAP, and Saleforce solutions; API economy and microservices; and Topaz, an AI-first set of services, solutions, and platforms using generative AI technologies.

See Also

Before you consider Infosys, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Infosys wasn't on the list.

While Infosys currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.