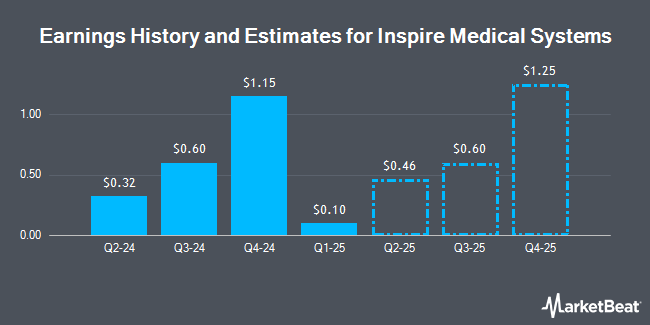

Inspire Medical Systems (NYSE:INSP - Get Free Report) issued an update on its FY 2024 earnings guidance on Monday morning. The company provided earnings per share guidance of 1.200-1.400 for the period, compared to the consensus earnings per share estimate of 0.680. The company issued revenue guidance of $793.0 million-$798.0 million, compared to the consensus revenue estimate of $795.2 million. Inspire Medical Systems also updated its FY24 guidance to $1.20-1.40 EPS.

Analyst Upgrades and Downgrades

A number of brokerages have issued reports on INSP. KeyCorp dropped their target price on shares of Inspire Medical Systems from $278.00 to $236.00 and set an "overweight" rating on the stock in a research report on Wednesday, August 7th. Robert W. Baird cut their target price on Inspire Medical Systems from $220.00 to $200.00 and set an "outperform" rating for the company in a research note on Wednesday, August 7th. Leerink Partners raised their price objective on shares of Inspire Medical Systems from $167.00 to $197.00 and gave the company a "market perform" rating in a research note on Tuesday, September 10th. Royal Bank of Canada reaffirmed an "outperform" rating and set a $260.00 price objective on shares of Inspire Medical Systems in a report on Wednesday, August 7th. Finally, Truist Financial reissued a "buy" rating and issued a $240.00 target price (up previously from $217.00) on shares of Inspire Medical Systems in a research note on Monday, September 30th. Four equities research analysts have rated the stock with a hold rating and eight have assigned a buy rating to the company's stock. Based on data from MarketBeat, the company presently has an average rating of "Moderate Buy" and a consensus price target of $219.58.

View Our Latest Research Report on INSP

Inspire Medical Systems Price Performance

Shares of NYSE INSP traded up $2.00 during midday trading on Monday, reaching $192.71. 792,459 shares of the company traded hands, compared to its average volume of 595,077. The stock has a 50-day moving average price of $201.08 and a 200 day moving average price of $180.27. The company has a market cap of $5.75 billion, a price-to-earnings ratio of 1,059.50 and a beta of 1.36. Inspire Medical Systems has a 52 week low of $123.00 and a 52 week high of $257.40.

Inspire Medical Systems (NYSE:INSP - Get Free Report) last issued its quarterly earnings results on Tuesday, August 6th. The company reported $0.32 EPS for the quarter, topping the consensus estimate of ($0.14) by $0.46. Inspire Medical Systems had a net margin of 0.85% and a return on equity of 1.03%. The firm had revenue of $195.89 million for the quarter, compared to analysts' expectations of $189.08 million. During the same period in the previous year, the business earned ($0.41) earnings per share. Inspire Medical Systems's revenue for the quarter was up 29.6% compared to the same quarter last year. As a group, analysts expect that Inspire Medical Systems will post 0.75 EPS for the current year.

Insiders Place Their Bets

In other Inspire Medical Systems news, insider Randy Ban sold 4,861 shares of Inspire Medical Systems stock in a transaction that occurred on Friday, August 16th. The shares were sold at an average price of $188.55, for a total value of $916,541.55. Following the completion of the sale, the insider now directly owns 3,056 shares in the company, valued at $576,208.80. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. In other Inspire Medical Systems news, Director Shawn Mccormick sold 800 shares of the business's stock in a transaction on Monday, September 9th. The shares were sold at an average price of $220.00, for a total transaction of $176,000.00. Following the completion of the transaction, the director now owns 23,140 shares of the company's stock, valued at $5,090,800. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, insider Randy Ban sold 4,861 shares of the firm's stock in a transaction dated Friday, August 16th. The shares were sold at an average price of $188.55, for a total value of $916,541.55. Following the completion of the sale, the insider now directly owns 3,056 shares in the company, valued at approximately $576,208.80. This represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 5,692 shares of company stock valued at $1,099,207 in the last three months. Insiders own 4.10% of the company's stock.

About Inspire Medical Systems

(

Get Free Report)

Inspire Medical Systems, Inc, a medical technology company, focuses on the development and commercialization of minimally invasive solutions for patients with obstructive sleep apnea (OSA) in the United States and internationally. The company offers Inspire system, a neurostimulation technology that provides a safe and effective treatment for moderate to severe OSA.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Inspire Medical Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Inspire Medical Systems wasn't on the list.

While Inspire Medical Systems currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.