IQVIA (NYSE:IQV - Get Free Report) was upgraded by research analysts at StockNews.com from a "hold" rating to a "buy" rating in a research note issued on Wednesday.

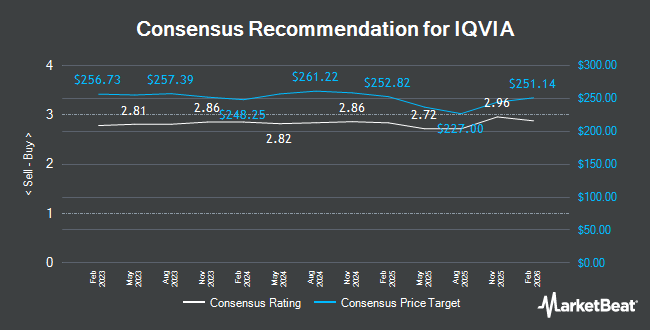

IQV has been the subject of several other research reports. Truist Financial decreased their target price on IQVIA from $300.00 to $286.00 and set a "buy" rating for the company in a research note on Monday, October 14th. Robert W. Baird raised their price objective on shares of IQVIA from $251.00 to $256.00 and gave the stock a "neutral" rating in a research note on Friday, September 20th. Evercore ISI cut their target price on shares of IQVIA from $270.00 to $265.00 and set an "outperform" rating for the company in a research note on Tuesday, October 8th. Redburn Atlantic initiated coverage on shares of IQVIA in a research report on Monday, October 14th. They issued a "buy" rating and a $276.00 price target on the stock. Finally, Royal Bank of Canada assumed coverage on shares of IQVIA in a research report on Wednesday, September 4th. They set an "outperform" rating and a $275.00 price objective for the company. Four analysts have rated the stock with a hold rating, thirteen have assigned a buy rating and one has assigned a strong buy rating to the stock. According to data from MarketBeat, IQVIA currently has a consensus rating of "Moderate Buy" and an average price target of $267.27.

Get Our Latest Report on IQVIA

IQVIA Stock Performance

Shares of IQVIA stock traded down $0.21 on Wednesday, reaching $216.13. The stock had a trading volume of 959,218 shares, compared to its average volume of 1,071,177. The company has a debt-to-equity ratio of 1.80, a quick ratio of 0.85 and a current ratio of 0.85. The business's 50-day moving average price is $236.50 and its two-hundred day moving average price is $230.16. The stock has a market cap of $39.40 billion, a P/E ratio of 28.10, a price-to-earnings-growth ratio of 2.09 and a beta of 1.49. IQVIA has a fifty-two week low of $167.42 and a fifty-two week high of $261.73.

Insider Buying and Selling at IQVIA

In other news, insider Eric Sherbet sold 1,300 shares of the stock in a transaction that occurred on Tuesday, August 27th. The shares were sold at an average price of $246.33, for a total transaction of $320,229.00. Following the sale, the insider now directly owns 19,536 shares of the company's stock, valued at $4,812,302.88. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Corporate insiders own 1.60% of the company's stock.

Institutional Trading of IQVIA

Several institutional investors and hedge funds have recently added to or reduced their stakes in the company. Versant Capital Management Inc boosted its position in shares of IQVIA by 733.3% in the 2nd quarter. Versant Capital Management Inc now owns 125 shares of the medical research company's stock worth $26,000 after purchasing an additional 110 shares during the last quarter. Opal Wealth Advisors LLC acquired a new position in shares of IQVIA during the 2nd quarter worth about $27,000. Park Place Capital Corp bought a new stake in shares of IQVIA in the 3rd quarter valued at about $28,000. Itau Unibanco Holding S.A. acquired a new stake in shares of IQVIA in the 2nd quarter valued at approximately $29,000. Finally, International Assets Investment Management LLC bought a new position in IQVIA during the 2nd quarter worth approximately $32,000. 89.62% of the stock is owned by institutional investors.

About IQVIA

(

Get Free Report)

IQVIA Holdings Inc engages in the provision of advanced analytics, technology solutions, and clinical research services to the life sciences industry in the Americas, Europe, Africa, and the Asia-Pacific. It operates through three segments: Technology & Analytics Solutions, Research & Development Solutions, and Contract Sales & Medical Solutions.

Featured Stories

Before you consider IQVIA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and IQVIA wasn't on the list.

While IQVIA currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.