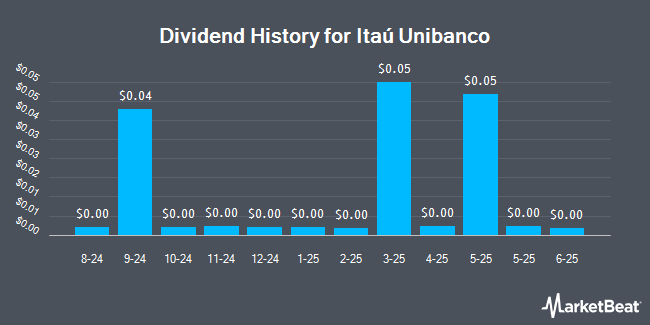

Itaú Unibanco Holding S.A. (NYSE:ITUB - Get Free Report) declared a dividend on Thursday, October 31st, NASDAQ reports. Stockholders of record on Monday, December 2nd will be paid a dividend of 0.0031 per share by the bank on Thursday, January 9th. The ex-dividend date of this dividend is Monday, December 2nd.

Itaú Unibanco has raised its dividend payment by an average of 26.3% annually over the last three years. Itaú Unibanco has a payout ratio of 4.8% indicating that its dividend is sufficiently covered by earnings. Equities research analysts expect Itaú Unibanco to earn $0.88 per share next year, which means the company should continue to be able to cover its $0.04 annual dividend with an expected future payout ratio of 4.5%.

Itaú Unibanco Price Performance

Shares of ITUB stock traded down $0.11 during mid-day trading on Friday, reaching $5.94. The company's stock had a trading volume of 23,790,671 shares, compared to its average volume of 17,861,041. Itaú Unibanco has a 1-year low of $5.47 and a 1-year high of $7.27. The company has a market cap of $58.22 billion, a P/E ratio of 7.82, a PEG ratio of 0.79 and a beta of 0.97. The company has a debt-to-equity ratio of 2.34, a quick ratio of 1.07 and a current ratio of 1.07. The firm's 50-day moving average is $6.46 and its two-hundred day moving average is $6.27.

Itaú Unibanco (NYSE:ITUB - Get Free Report) last announced its earnings results on Tuesday, August 6th. The bank reported $0.20 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.19 by $0.01. The business had revenue of $16.54 billion during the quarter, compared to analysts' expectations of $7.72 billion. Itaú Unibanco had a net margin of 11.39% and a return on equity of 19.14%. During the same quarter last year, the company posted $0.18 EPS. On average, research analysts predict that Itaú Unibanco will post 0.78 earnings per share for the current year.

Analyst Ratings Changes

Separately, UBS Group cut shares of Itaú Unibanco from a "buy" rating to a "neutral" rating in a research report on Thursday, August 22nd.

View Our Latest Stock Analysis on ITUB

Itaú Unibanco Company Profile

(

Get Free Report)

Itaú Unibanco Holding SA offers a range of financial products and services to individuals and corporate customers in Brazil and internationally. The company operates through three segments: Retail Banking, Wholesale Banking, and Activities with the Market + Corporation. It offers current account; loans; credit and debit cards; investment and commercial banking services; real estate lending services; financing and investment services; economic, financial and brokerage advisory; and leasing and foreign exchange services.

Featured Stories

Before you consider Itaú Unibanco, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Itaú Unibanco wasn't on the list.

While Itaú Unibanco currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.