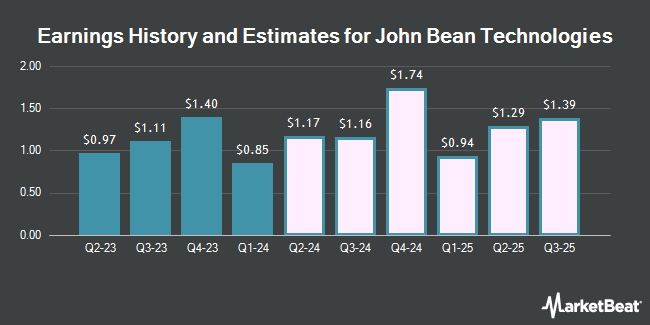

John Bean Technologies Co. (NYSE:JBT - Free Report) - Analysts at Seaport Res Ptn dropped their FY2025 earnings per share (EPS) estimates for John Bean Technologies in a research note issued to investors on Wednesday, October 23rd. Seaport Res Ptn analyst W. Liptak now forecasts that the industrial products company will post earnings per share of $5.63 for the year, down from their prior estimate of $5.67. The consensus estimate for John Bean Technologies' current full-year earnings is $5.18 per share.

John Bean Technologies (NYSE:JBT - Get Free Report) last announced its earnings results on Tuesday, October 22nd. The industrial products company reported $1.50 earnings per share for the quarter, beating analysts' consensus estimates of $1.41 by $0.09. The company had revenue of $453.80 million during the quarter, compared to analyst estimates of $442.20 million. John Bean Technologies had a return on equity of 9.67% and a net margin of 36.66%. The firm's quarterly revenue was up 12.4% compared to the same quarter last year. During the same period last year, the company posted $1.11 earnings per share.

John Bean Technologies Trading Down 3.1 %

JBT stock traded down $3.61 during midday trading on Friday, reaching $114.41. The stock had a trading volume of 430,277 shares, compared to its average volume of 268,294. The business has a fifty day simple moving average of $93.77 and a two-hundred day simple moving average of $93.93. The company has a quick ratio of 1.96, a current ratio of 2.54 and a debt-to-equity ratio of 0.43. The firm has a market cap of $3.64 billion, a price-to-earnings ratio of 6.11, a PEG ratio of 1.35 and a beta of 1.25. John Bean Technologies has a twelve month low of $82.64 and a twelve month high of $118.55.

John Bean Technologies Dividend Announcement

The company also recently disclosed a quarterly dividend, which was paid on Tuesday, September 3rd. Investors of record on Monday, August 19th were given a $0.10 dividend. The ex-dividend date was Monday, August 19th. This represents a $0.40 dividend on an annualized basis and a yield of 0.35%. John Bean Technologies's payout ratio is 2.13%.

Institutional Trading of John Bean Technologies

A number of hedge funds and other institutional investors have recently added to or reduced their stakes in JBT. SG Americas Securities LLC boosted its holdings in John Bean Technologies by 192.5% during the second quarter. SG Americas Securities LLC now owns 8,911 shares of the industrial products company's stock worth $846,000 after buying an additional 5,865 shares during the last quarter. UniSuper Management Pty Ltd bought a new position in John Bean Technologies during the first quarter worth about $685,000. Homestead Advisers Corp boosted its holdings in John Bean Technologies by 31.6% during the first quarter. Homestead Advisers Corp now owns 34,600 shares of the industrial products company's stock worth $3,629,000 after buying an additional 8,300 shares during the last quarter. Edgestream Partners L.P. bought a new position in John Bean Technologies during the first quarter worth about $1,902,000. Finally, D. E. Shaw & Co. Inc. boosted its holdings in John Bean Technologies by 37.2% during the second quarter. D. E. Shaw & Co. Inc. now owns 236,865 shares of the industrial products company's stock worth $22,495,000 after buying an additional 64,280 shares during the last quarter. 98.92% of the stock is currently owned by institutional investors and hedge funds.

About John Bean Technologies

(

Get Free Report)

John Bean Technologies Corporation provides technology solutions to food and beverage industry in North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin America. It offers value-added processing that includes chilling, mixing/grinding, injecting, blending, marinating, tumbling, flattening, forming, portioning, coating, cooking, frying, freezing, extracting, pasteurizing, sterilizing, concentrating, high pressure processing, weighing, inspecting, filling, closing, sealing, end of line material handling, and packaging solutions to the food, beverage, and health market.

Recommended Stories

Before you consider John Bean Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and John Bean Technologies wasn't on the list.

While John Bean Technologies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.