New York State Teachers Retirement System lessened its holdings in shares of Jefferies Financial Group Inc. (NYSE:JEF - Free Report) by 6.7% during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 213,989 shares of the financial services provider's stock after selling 15,428 shares during the period. New York State Teachers Retirement System owned approximately 0.10% of Jefferies Financial Group worth $13,171,000 at the end of the most recent quarter.

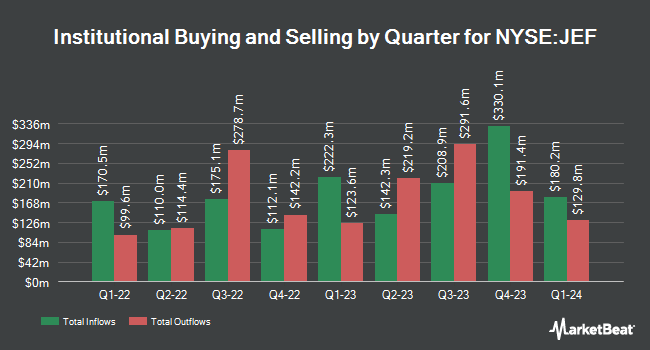

Other hedge funds have also recently bought and sold shares of the company. Marshall Wace LLP lifted its position in Jefferies Financial Group by 365.9% in the 2nd quarter. Marshall Wace LLP now owns 1,947,192 shares of the financial services provider's stock valued at $96,892,000 after acquiring an additional 1,529,218 shares in the last quarter. Artemis Investment Management LLP bought a new stake in Jefferies Financial Group in the 2nd quarter valued at approximately $58,211,000. Allspring Global Investments Holdings LLC lifted its stake in Jefferies Financial Group by 15.3% in the 2nd quarter. Allspring Global Investments Holdings LLC now owns 7,049,815 shares of the financial services provider's stock valued at $350,799,000 after acquiring an additional 936,424 shares in the last quarter. Migdal Insurance & Financial Holdings Ltd. bought a new position in shares of Jefferies Financial Group during the 2nd quarter worth approximately $21,148,000. Finally, Barrow Hanley Mewhinney & Strauss LLC grew its stake in shares of Jefferies Financial Group by 12.9% during the 2nd quarter. Barrow Hanley Mewhinney & Strauss LLC now owns 3,396,255 shares of the financial services provider's stock worth $168,998,000 after acquiring an additional 389,385 shares in the last quarter. 60.88% of the stock is currently owned by institutional investors and hedge funds.

Insider Activity

In related news, Director Mitsui Financial Grou Sumitomo purchased 9,247,081 shares of the stock in a transaction on Thursday, September 19th. The shares were purchased at an average cost of $59.67 per share, with a total value of $551,773,323.27. Following the acquisition, the director now directly owns 9,247,081 shares in the company, valued at $551,773,323.27. The acquisition was disclosed in a document filed with the SEC, which is accessible through this link. In other news, Director Mitsui Financial Grou Sumitomo acquired 9,247,081 shares of the stock in a transaction on Thursday, September 19th. The shares were purchased at an average price of $59.67 per share, for a total transaction of $551,773,323.27. Following the transaction, the director now directly owns 9,247,081 shares of the company's stock, valued at approximately $551,773,323.27. The acquisition was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, Director Robert D. Beyer sold 46,200 shares of the business's stock in a transaction dated Thursday, October 31st. The shares were sold at an average price of $64.07, for a total transaction of $2,960,034.00. Following the completion of the sale, the director now directly owns 100,375 shares of the company's stock, valued at approximately $6,431,026.25. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 493,526 shares of company stock valued at $31,703,689 over the last ninety days. 20.40% of the stock is currently owned by company insiders.

Wall Street Analysts Forecast Growth

Several research analysts recently commented on the stock. Oppenheimer increased their target price on shares of Jefferies Financial Group from $64.00 to $66.00 and gave the stock an "outperform" rating in a report on Friday, September 13th. Morgan Stanley increased their price objective on shares of Jefferies Financial Group from $59.00 to $64.00 and gave the stock an "equal weight" rating in a research note on Monday, September 23rd. Finally, UBS Group initiated coverage on Jefferies Financial Group in a research report on Tuesday, September 17th. They issued a "buy" rating and a $67.00 target price on the stock.

Get Our Latest Research Report on JEF

Jefferies Financial Group Stock Performance

Shares of JEF traded up $0.24 during midday trading on Friday, reaching $64.22. The stock had a trading volume of 868,426 shares, compared to its average volume of 1,317,486. The company has a current ratio of 1.03, a quick ratio of 1.03 and a debt-to-equity ratio of 1.53. The firm has a 50 day simple moving average of $61.79 and a 200-day simple moving average of $53.77. The firm has a market cap of $13.20 billion, a PE ratio of 27.44 and a beta of 1.31. Jefferies Financial Group Inc. has a one year low of $32.75 and a one year high of $67.79.

Jefferies Financial Group (NYSE:JEF - Get Free Report) last announced its quarterly earnings results on Wednesday, September 25th. The financial services provider reported $0.75 earnings per share for the quarter, missing analysts' consensus estimates of $0.78 by ($0.03). The business had revenue of $1.68 billion for the quarter, compared to analyst estimates of $1.71 billion. Jefferies Financial Group had a return on equity of 6.40% and a net margin of 9.27%. Jefferies Financial Group's quarterly revenue was up 42.4% compared to the same quarter last year. During the same period last year, the firm earned $0.32 EPS. As a group, sell-side analysts anticipate that Jefferies Financial Group Inc. will post 3.13 EPS for the current year.

Jefferies Financial Group Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Wednesday, November 27th. Shareholders of record on Monday, November 18th will be issued a $0.35 dividend. The ex-dividend date is Monday, November 18th. This represents a $1.40 annualized dividend and a dividend yield of 2.18%. Jefferies Financial Group's dividend payout ratio is currently 59.83%.

Jefferies Financial Group Company Profile

(

Free Report)

Jefferies Financial Group Inc operates as an investment banking and capital markets firm in the Americas, Europe, the Middle East, and the Asia-Pacific. The company operates in two segments, Investment Banking and Capital Markets, and Asset Management. It provides investment banking, advisory services with respect to mergers or acquisitions, debt financing, restructurings or recapitalizations, and private capital advisory transactions; underwriting and placement services related to corporate debt, municipal bonds, mortgage-backed and asset-backed securities, equity and equity-linked securities, and loan syndication services; and corporate lending services.

Recommended Stories

Before you consider Jefferies Financial Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Jefferies Financial Group wasn't on the list.

While Jefferies Financial Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report