TKG Advisors LLC purchased a new stake in Jones Lang LaSalle Incorporated (NYSE:JLL - Free Report) during the 3rd quarter, according to its most recent Form 13F filing with the SEC. The institutional investor purchased 18,577 shares of the financial services provider's stock, valued at approximately $5,012,000. Jones Lang LaSalle accounts for about 2.5% of TKG Advisors LLC's portfolio, making the stock its 10th biggest position.

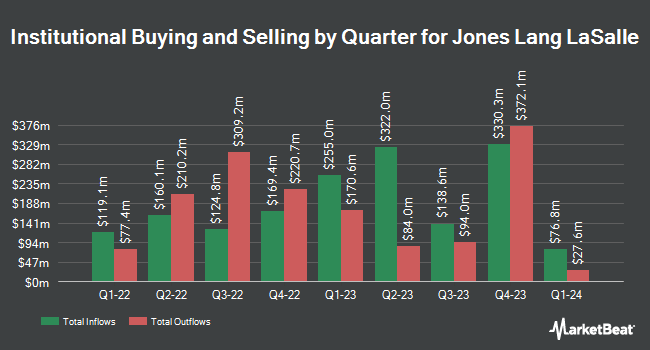

Several other large investors have also recently bought and sold shares of JLL. EdgePoint Investment Group Inc. increased its holdings in shares of Jones Lang LaSalle by 27.3% during the first quarter. EdgePoint Investment Group Inc. now owns 2,072,046 shares of the financial services provider's stock worth $404,235,000 after purchasing an additional 443,992 shares during the period. Dimensional Fund Advisors LP increased its holdings in shares of Jones Lang LaSalle by 1.9% during the second quarter. Dimensional Fund Advisors LP now owns 1,472,703 shares of the financial services provider's stock worth $302,318,000 after purchasing an additional 26,814 shares during the period. Massachusetts Financial Services Co. MA increased its holdings in shares of Jones Lang LaSalle by 20.9% during the second quarter. Massachusetts Financial Services Co. MA now owns 1,049,392 shares of the financial services provider's stock worth $215,419,000 after purchasing an additional 181,246 shares during the period. Boston Trust Walden Corp increased its holdings in shares of Jones Lang LaSalle by 1.2% during the second quarter. Boston Trust Walden Corp now owns 672,994 shares of the financial services provider's stock worth $138,152,000 after purchasing an additional 7,698 shares during the period. Finally, Swedbank AB bought a new position in shares of Jones Lang LaSalle during the first quarter worth approximately $97,018,000. 94.80% of the stock is owned by institutional investors.

Wall Street Analyst Weigh In

Several research analysts have recently commented on JLL shares. StockNews.com raised shares of Jones Lang LaSalle from a "buy" rating to a "strong-buy" rating in a report on Friday, September 13th. Raymond James lifted their price objective on shares of Jones Lang LaSalle from $246.00 to $268.00 and gave the company a "strong-buy" rating in a research note on Thursday, July 25th. Finally, Keefe, Bruyette & Woods lifted their price objective on shares of Jones Lang LaSalle from $240.00 to $250.00 and gave the company a "market perform" rating in a research note on Thursday, August 8th. Two equities research analysts have rated the stock with a hold rating, three have assigned a buy rating and two have issued a strong buy rating to the stock. Based on data from MarketBeat.com, Jones Lang LaSalle has a consensus rating of "Buy" and an average price target of $246.80.

Check Out Our Latest Stock Analysis on JLL

Jones Lang LaSalle Trading Up 1.1 %

Shares of NYSE:JLL traded up $2.86 during mid-day trading on Monday, reaching $267.86. 247,498 shares of the company's stock were exchanged, compared to its average volume of 282,676. The firm has a market capitalization of $12.71 billion, a price-to-earnings ratio of 33.86 and a beta of 1.37. The business's fifty day moving average price is $261.44 and its 200-day moving average price is $229.42. The company has a debt-to-equity ratio of 0.31, a quick ratio of 2.58 and a current ratio of 2.58. Jones Lang LaSalle Incorporated has a twelve month low of $136.83 and a twelve month high of $280.48.

Jones Lang LaSalle (NYSE:JLL - Get Free Report) last announced its earnings results on Tuesday, August 6th. The financial services provider reported $2.55 earnings per share for the quarter, topping analysts' consensus estimates of $2.30 by $0.25. Jones Lang LaSalle had a net margin of 1.76% and a return on equity of 8.03%. The business had revenue of $5.63 billion during the quarter, compared to the consensus estimate of $5.48 billion. During the same quarter last year, the firm earned $0.50 earnings per share. Jones Lang LaSalle's quarterly revenue was up 11.4% on a year-over-year basis. On average, research analysts predict that Jones Lang LaSalle Incorporated will post 12.59 EPS for the current fiscal year.

Jones Lang LaSalle Company Profile

(

Free Report)

Jones Lang LaSalle Incorporated operates as a commercial real estate and investment management company. It engages in the buying, building, occupying, managing, and investing in a commercial, industrial, hotel, residential, and retail properties in Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Recommended Stories

Before you consider Jones Lang LaSalle, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Jones Lang LaSalle wasn't on the list.

While Jones Lang LaSalle currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.