Deltec Asset Management LLC lessened its holdings in KB Financial Group Inc. (NYSE:KB - Free Report) by 55.5% during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission. The fund owned 19,300 shares of the bank's stock after selling 24,100 shares during the quarter. Deltec Asset Management LLC's holdings in KB Financial Group were worth $1,192,000 at the end of the most recent reporting period.

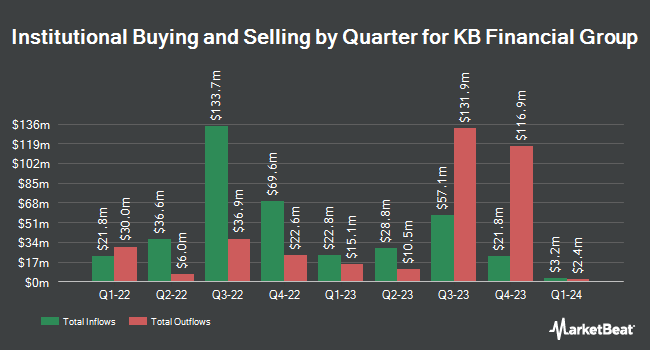

Other institutional investors also recently modified their holdings of the company. CWM LLC increased its holdings in KB Financial Group by 5.7% in the third quarter. CWM LLC now owns 2,851 shares of the bank's stock valued at $176,000 after purchasing an additional 155 shares during the last quarter. EverSource Wealth Advisors LLC raised its position in shares of KB Financial Group by 3.0% in the 2nd quarter. EverSource Wealth Advisors LLC now owns 6,496 shares of the bank's stock valued at $368,000 after acquiring an additional 192 shares during the period. Adero Partners LLC boosted its stake in KB Financial Group by 4.2% during the 2nd quarter. Adero Partners LLC now owns 4,802 shares of the bank's stock worth $272,000 after acquiring an additional 193 shares during the last quarter. Bleakley Financial Group LLC grew its holdings in KB Financial Group by 1.6% during the third quarter. Bleakley Financial Group LLC now owns 13,248 shares of the bank's stock valued at $818,000 after purchasing an additional 208 shares during the period. Finally, Thornburg Investment Management Inc. increased its stake in KB Financial Group by 1.7% in the second quarter. Thornburg Investment Management Inc. now owns 14,239 shares of the bank's stock valued at $848,000 after purchasing an additional 242 shares in the last quarter. Institutional investors and hedge funds own 11.52% of the company's stock.

Analyst Ratings Changes

Separately, StockNews.com raised shares of KB Financial Group from a "hold" rating to a "buy" rating in a research report on Tuesday.

Get Our Latest Research Report on KB Financial Group

KB Financial Group Trading Down 2.1 %

KB stock traded down $1.44 during midday trading on Wednesday, hitting $67.37. 105,012 shares of the company's stock were exchanged, compared to its average volume of 201,492. KB Financial Group Inc. has a one year low of $36.57 and a one year high of $72.89. The company has a debt-to-equity ratio of 2.33, a quick ratio of 1.67 and a current ratio of 1.67. The company has a market cap of $27.18 billion, a PE ratio of 8.42, a price-to-earnings-growth ratio of 0.47 and a beta of 0.98. The stock's fifty day moving average price is $64.43 and its 200-day moving average price is $60.10.

KB Financial Group (NYSE:KB - Get Free Report) last released its quarterly earnings data on Wednesday, August 14th. The bank reported $3.06 earnings per share for the quarter, beating the consensus estimate of $2.70 by $0.36. KB Financial Group had a return on equity of 7.29% and a net margin of 12.13%. The business had revenue of $3.18 billion for the quarter. Research analysts predict that KB Financial Group Inc. will post 9.4 earnings per share for the current fiscal year.

KB Financial Group Company Profile

(

Free Report)

KB Financial Group Inc provides a range of banking and related financial services to consumers and corporations in South Korea, the United States, New Zealand, China, Cambodia, the United Kingdom, Indonesia, and internationally. The company operates through Retail Banking, Corporate Banking, Other Banking Services, Credit Card, Securities, Life Insurance, and Non-Life Insurance segments.

Featured Stories

Before you consider KB Financial Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and KB Financial Group wasn't on the list.

While KB Financial Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.