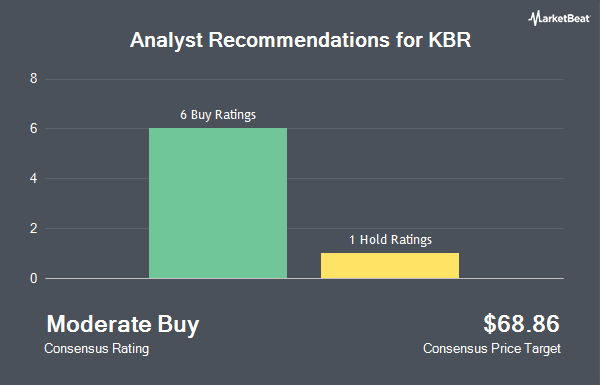

Shares of KBR, Inc. (NYSE:KBR - Get Free Report) have earned an average recommendation of "Moderate Buy" from the eight brokerages that are presently covering the firm, MarketBeat reports. One investment analyst has rated the stock with a hold rating and seven have given a buy rating to the company. The average twelve-month target price among brokerages that have issued a report on the stock in the last year is $78.75.

A number of equities analysts have recently commented on KBR shares. Citigroup boosted their price target on KBR from $76.00 to $82.00 and gave the stock a "buy" rating in a report on Tuesday. KeyCorp boosted their price objective on KBR from $73.00 to $75.00 and gave the stock an "overweight" rating in a research report on Tuesday, October 8th. StockNews.com lowered KBR from a "strong-buy" rating to a "buy" rating in a research report on Sunday, October 6th. TD Cowen lowered KBR from a "buy" rating to a "hold" rating and set a $72.00 price target on the stock. in a research report on Friday, September 6th. Finally, DA Davidson upped their price target on KBR from $78.00 to $84.00 and gave the company a "buy" rating in a research report on Friday.

Get Our Latest Stock Report on KBR

KBR Price Performance

NYSE KBR traded down $0.30 during midday trading on Friday, hitting $66.75. The company had a trading volume of 898,255 shares, compared to its average volume of 946,692. The company has a market capitalization of $8.88 billion, a PE ratio of 45.41, a P/E/G ratio of 1.45 and a beta of 0.90. The company has a current ratio of 1.10, a quick ratio of 1.10 and a debt-to-equity ratio of 1.35. The firm has a 50-day moving average price of $66.22 and a 200-day moving average price of $65.37. KBR has a twelve month low of $49.37 and a twelve month high of $71.38.

KBR (NYSE:KBR - Get Free Report) last announced its quarterly earnings data on Wednesday, October 23rd. The construction company reported $0.84 earnings per share for the quarter, meeting the consensus estimate of $0.84. The firm had revenue of $1.95 billion during the quarter, compared to analysts' expectations of $1.95 billion. KBR had a return on equity of 27.92% and a net margin of 2.77%. The company's quarterly revenue was up 10.0% compared to the same quarter last year. During the same period in the previous year, the firm earned $0.75 EPS. As a group, analysts anticipate that KBR will post 3.25 earnings per share for the current fiscal year.

KBR Announces Dividend

The firm also recently declared a quarterly dividend, which will be paid on Wednesday, January 15th. Investors of record on Friday, December 13th will be issued a dividend of $0.15 per share. The ex-dividend date of this dividend is Friday, December 13th. This represents a $0.60 dividend on an annualized basis and a yield of 0.90%. KBR's dividend payout ratio (DPR) is currently 40.82%.

Insiders Place Their Bets

In other news, insider Jalal Ibrahim sold 35,000 shares of KBR stock in a transaction on Monday, August 19th. The stock was sold at an average price of $66.56, for a total value of $2,329,600.00. Following the completion of the transaction, the insider now directly owns 106,550 shares in the company, valued at approximately $7,091,968. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. Company insiders own 1.08% of the company's stock.

Institutional Investors Weigh In On KBR

A number of hedge funds and other institutional investors have recently modified their holdings of KBR. Larson Financial Group LLC increased its holdings in KBR by 2,029.2% during the 2nd quarter. Larson Financial Group LLC now owns 511 shares of the construction company's stock valued at $33,000 after purchasing an additional 487 shares during the period. CWM LLC lifted its holdings in shares of KBR by 39.4% during the 2nd quarter. CWM LLC now owns 817 shares of the construction company's stock valued at $52,000 after buying an additional 231 shares during the period. Quarry LP lifted its holdings in shares of KBR by 454.7% during the 2nd quarter. Quarry LP now owns 821 shares of the construction company's stock valued at $53,000 after buying an additional 673 shares during the period. Eastern Bank purchased a new stake in shares of KBR in the 3rd quarter worth $65,000. Finally, Fifth Third Bancorp increased its stake in shares of KBR by 17.5% in the 2nd quarter. Fifth Third Bancorp now owns 1,204 shares of the construction company's stock worth $77,000 after purchasing an additional 179 shares in the last quarter. Institutional investors own 97.02% of the company's stock.

About KBR

(

Get Free ReportKBR, Inc provides scientific, technology, and engineering solutions to governments and commercial customers worldwide. It operates through Government Solutions and Sustainable Technology Solutions segments. The Government Solutions segment offers life-cycle support solutions to defense, intelligence, space, aviation, and other programs and missions for military and other government agencies in the United States, the United Kingdom, and Australia.

Read More

Before you consider KBR, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and KBR wasn't on the list.

While KBR currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.