Kinross Gold (NYSE:KGC - Get Free Report) TSE: K was downgraded by analysts at StockNews.com from a "strong-buy" rating to a "buy" rating in a research report issued to clients and investors on Friday.

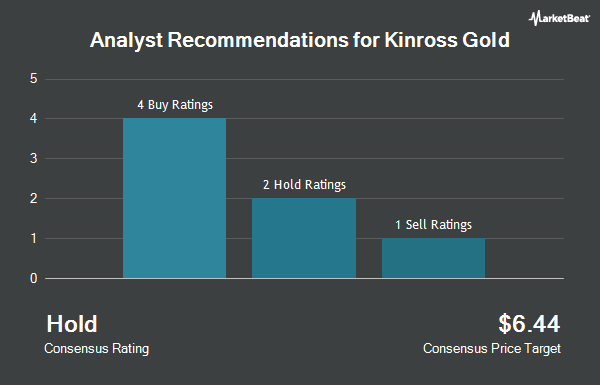

A number of other research analysts have also recently weighed in on KGC. Jefferies Financial Group lifted their target price on shares of Kinross Gold from $9.00 to $10.00 and gave the company a "hold" rating in a research note on Friday, October 4th. CIBC lifted their target price on Kinross Gold from $8.15 to $12.00 and gave the company an "outperformer" rating in a research report on Wednesday, July 10th. Finally, Scotiabank raised their price objective on Kinross Gold from $9.50 to $11.00 and gave the company a "sector outperform" rating in a research report on Monday, August 19th. Two analysts have rated the stock with a hold rating and four have given a buy rating to the company's stock. Based on data from MarketBeat.com, the company has a consensus rating of "Moderate Buy" and a consensus price target of $9.50.

View Our Latest Stock Report on Kinross Gold

Kinross Gold Price Performance

NYSE KGC traded down $0.11 during trading hours on Friday, reaching $9.98. 13,867,456 shares of the stock traded hands, compared to its average volume of 15,249,173. Kinross Gold has a 1 year low of $4.75 and a 1 year high of $10.82. The company has a market cap of $12.26 billion, a price-to-earnings ratio of 24.33, a price-to-earnings-growth ratio of 0.55 and a beta of 1.24. The stock has a 50 day simple moving average of $9.62 and a two-hundred day simple moving average of $8.58. The company has a debt-to-equity ratio of 0.19, a current ratio of 1.27 and a quick ratio of 0.52.

Kinross Gold (NYSE:KGC - Get Free Report) TSE: K last issued its quarterly earnings results on Wednesday, July 31st. The mining company reported $0.14 earnings per share for the quarter, topping the consensus estimate of $0.13 by $0.01. The company had revenue of $1.22 billion for the quarter, compared to analysts' expectations of $1.20 billion. Kinross Gold had a return on equity of 9.32% and a net margin of 10.91%. The firm's revenue for the quarter was up 11.6% on a year-over-year basis. During the same period in the prior year, the firm earned $0.14 earnings per share. On average, analysts predict that Kinross Gold will post 0.64 EPS for the current fiscal year.

Hedge Funds Weigh In On Kinross Gold

Hedge funds and other institutional investors have recently bought and sold shares of the company. Hussman Strategic Advisors Inc. lifted its stake in shares of Kinross Gold by 25.0% during the 1st quarter. Hussman Strategic Advisors Inc. now owns 127,500 shares of the mining company's stock worth $782,000 after purchasing an additional 25,500 shares during the period. Daiwa Securities Group Inc. lifted its stake in shares of Kinross Gold by 616.7% during the first quarter. Daiwa Securities Group Inc. now owns 25,800 shares of the mining company's stock worth $158,000 after purchasing an additional 22,200 shares in the last quarter. Quantbot Technologies LP acquired a new position in Kinross Gold during the 1st quarter worth approximately $1,095,000. Primoris Wealth Advisors LLC purchased a new position in shares of Kinross Gold in the first quarter valued at $164,000. Finally, First Eagle Investment Management LLC purchased a new position in Kinross Gold in the 1st quarter valued at about $23,907,000. 63.69% of the stock is owned by institutional investors and hedge funds.

Kinross Gold Company Profile

(

Get Free Report)

Kinross Gold Corporation, together with its subsidiaries, engages in the acquisition, exploration, and development of gold properties principally in the United States, Brazil, Chile, Canada, and Mauritania. The company operates the Fort Knox mine and the Manh Choh project in Alaska, as well as the Round Mountain and the Bald Mountain mines in Nevada, the United States; the Paracatu mine in Brazil; the La Coipa and the Lobo-Marte project in Chile; the Tasiast mine in Mauritania; and the Great Bear project in Canada.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Kinross Gold, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kinross Gold wasn't on the list.

While Kinross Gold currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.