Lecap Asset Management Ltd. purchased a new stake in Kimco Realty Corp (NYSE:KIM - Free Report) during the 3rd quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The fund purchased 66,517 shares of the real estate investment trust's stock, valued at approximately $1,545,000.

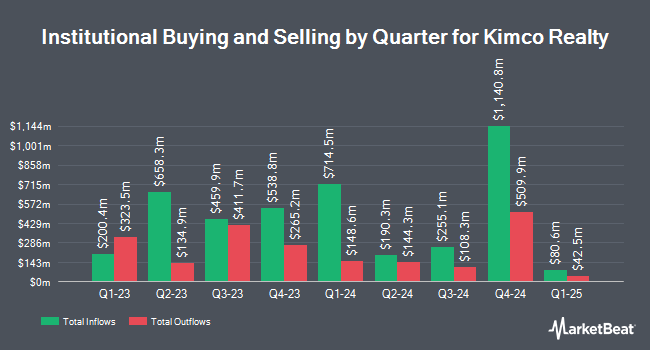

Several other institutional investors have also recently added to or reduced their stakes in the business. Blue Trust Inc. lifted its holdings in Kimco Realty by 613.5% during the 2nd quarter. Blue Trust Inc. now owns 2,112 shares of the real estate investment trust's stock worth $41,000 after purchasing an additional 1,816 shares in the last quarter. EverSource Wealth Advisors LLC lifted its stake in shares of Kimco Realty by 52.6% in the 1st quarter. EverSource Wealth Advisors LLC now owns 2,243 shares of the real estate investment trust's stock valued at $42,000 after purchasing an additional 773 shares during the period. Castleview Partners LLC purchased a new position in shares of Kimco Realty in the 3rd quarter valued at approximately $77,000. UMB Bank n.a. increased its position in Kimco Realty by 112.6% during the 2nd quarter. UMB Bank n.a. now owns 3,374 shares of the real estate investment trust's stock valued at $66,000 after buying an additional 1,787 shares in the last quarter. Finally, Fidelis Capital Partners LLC bought a new position in Kimco Realty during the 1st quarter valued at approximately $70,000. 89.25% of the stock is owned by institutional investors and hedge funds.

Insider Transactions at Kimco Realty

In other Kimco Realty news, COO David Jamieson sold 50,000 shares of the stock in a transaction on Friday, August 2nd. The stock was sold at an average price of $21.92, for a total value of $1,096,000.00. Following the transaction, the chief operating officer now directly owns 337,111 shares in the company, valued at approximately $7,389,473.12. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. 2.20% of the stock is currently owned by insiders.

Kimco Realty Stock Down 0.0 %

Shares of NYSE:KIM traded down $0.01 during mid-day trading on Thursday, hitting $23.95. 2,860,695 shares of the company traded hands, compared to its average volume of 4,602,438. Kimco Realty Corp has a 52-week low of $16.34 and a 52-week high of $24.67. The firm has a market cap of $16.15 billion, a P/E ratio of 45.19, a PEG ratio of 3.95 and a beta of 1.50. The company has a debt-to-equity ratio of 0.72, a quick ratio of 1.73 and a current ratio of 1.73. The firm's 50 day simple moving average is $23.34 and its 200 day simple moving average is $20.85.

Kimco Realty (NYSE:KIM - Get Free Report) last announced its quarterly earnings results on Thursday, August 1st. The real estate investment trust reported $0.17 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.40 by ($0.23). The business had revenue of $500.20 million for the quarter, compared to analyst estimates of $500.87 million. Kimco Realty had a return on equity of 3.59% and a net margin of 19.28%. The company's revenue was up 13.0% compared to the same quarter last year. During the same quarter last year, the firm posted $0.39 EPS. On average, equities analysts anticipate that Kimco Realty Corp will post 1.62 EPS for the current year.

Kimco Realty Announces Dividend

The business also recently announced a quarterly dividend, which was paid on Thursday, September 19th. Stockholders of record on Thursday, September 5th were issued a $0.24 dividend. The ex-dividend date of this dividend was Thursday, September 5th. This represents a $0.96 dividend on an annualized basis and a dividend yield of 4.01%. Kimco Realty's payout ratio is presently 181.13%.

Wall Street Analyst Weigh In

Several brokerages have recently commented on KIM. Truist Financial boosted their price objective on Kimco Realty from $22.00 to $24.00 and gave the company a "hold" rating in a research report on Wednesday, August 28th. Wells Fargo & Company boosted their price target on Kimco Realty from $21.00 to $24.00 and gave the company an "equal weight" rating in a report on Wednesday, August 28th. Robert W. Baird upped their target price on Kimco Realty from $21.00 to $23.00 and gave the stock an "outperform" rating in a report on Thursday, August 8th. Evercore ISI increased their price objective on Kimco Realty from $22.00 to $23.00 and gave the company an "in-line" rating in a report on Monday, September 16th. Finally, The Goldman Sachs Group upped their target price on Kimco Realty from $20.00 to $22.50 and gave the company a "neutral" rating in a research report on Thursday, September 12th. Nine research analysts have rated the stock with a hold rating, five have issued a buy rating and two have given a strong buy rating to the stock. According to MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and a consensus target price of $23.55.

Check Out Our Latest Research Report on KIM

About Kimco Realty

(

Free Report)

Kimco Realty Corp. is a real estate investment trust (REIT) headquartered in New Hyde Park, N.Y., that is one of North America's largest publicly traded owners and operators of open-air shopping centers. As of December 31, 2018, the company owned interests in 437 U.S. shopping centers comprising 76 million square feet of leasable space primarily concentrated in the top major metropolitan markets.

Recommended Stories

Before you consider Kimco Realty, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kimco Realty wasn't on the list.

While Kimco Realty currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.