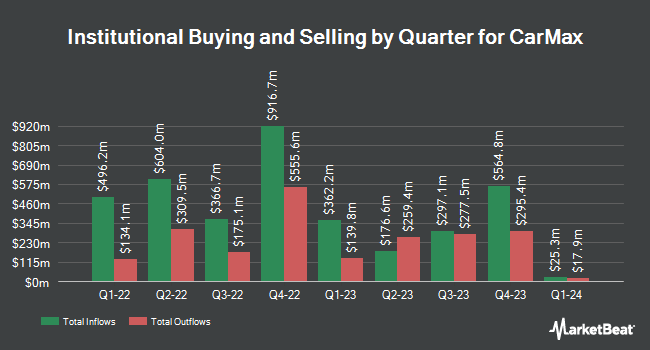

Patriot Financial Group Insurance Agency LLC increased its holdings in shares of CarMax, Inc. (NYSE:KMX - Free Report) by 18.5% in the 2nd quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 23,728 shares of the company's stock after purchasing an additional 3,703 shares during the quarter. Patriot Financial Group Insurance Agency LLC's holdings in CarMax were worth $1,740,000 at the end of the most recent quarter.

Other institutional investors and hedge funds have also recently added to or reduced their stakes in the company. BNP Paribas Financial Markets grew its holdings in shares of CarMax by 16.4% during the fourth quarter. BNP Paribas Financial Markets now owns 127,402 shares of the company's stock worth $9,777,000 after purchasing an additional 17,973 shares during the last quarter. CANADA LIFE ASSURANCE Co boosted its holdings in shares of CarMax by 29.1% in the first quarter. CANADA LIFE ASSURANCE Co now owns 167,138 shares of the company's stock valued at $14,573,000 after acquiring an additional 37,660 shares during the period. Fairview Capital Investment Management LLC grew its position in shares of CarMax by 7.0% during the fourth quarter. Fairview Capital Investment Management LLC now owns 251,530 shares of the company's stock worth $19,302,000 after acquiring an additional 16,438 shares during the last quarter. Quadrature Capital Ltd acquired a new position in shares of CarMax in the 4th quarter valued at $5,637,000. Finally, Charles Schwab Investment Management Inc. raised its position in CarMax by 3.1% in the 4th quarter. Charles Schwab Investment Management Inc. now owns 991,111 shares of the company's stock valued at $76,058,000 after purchasing an additional 30,107 shares during the last quarter.

Insider Activity

In other CarMax news, SVP Jon G. Daniels sold 1,231 shares of the firm's stock in a transaction dated Wednesday, June 26th. The shares were sold at an average price of $72.46, for a total transaction of $89,198.26. Following the sale, the senior vice president now directly owns 995 shares of the company's stock, valued at approximately $72,097.70. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through the SEC website. In other news, COO Charles Joseph Wilson sold 10,021 shares of the company's stock in a transaction dated Tuesday, July 23rd. The shares were sold at an average price of $80.02, for a total transaction of $801,880.42. Following the completion of the transaction, the chief operating officer now owns 15,609 shares of the company's stock, valued at approximately $1,249,032.18. The transaction was disclosed in a filing with the SEC, which is available at this hyperlink. Also, SVP Jon G. Daniels sold 1,231 shares of the firm's stock in a transaction that occurred on Wednesday, June 26th. The stock was sold at an average price of $72.46, for a total transaction of $89,198.26. Following the completion of the sale, the senior vice president now directly owns 995 shares in the company, valued at $72,097.70. The disclosure for this sale can be found here. Insiders have sold 185,243 shares of company stock worth $14,893,042 over the last three months. 1.66% of the stock is currently owned by corporate insiders.

Wall Street Analysts Forecast Growth

A number of brokerages have recently commented on KMX. Oppenheimer reaffirmed an "outperform" rating and issued a $105.00 target price on shares of CarMax in a report on Monday, June 24th. Morgan Stanley reaffirmed an "overweight" rating and set a $80.00 price target on shares of CarMax in a report on Friday, June 21st. Royal Bank of Canada boosted their price objective on shares of CarMax from $73.00 to $75.00 and gave the company an "outperform" rating in a research note on Monday, June 24th. Wedbush restated an "outperform" rating and set a $95.00 price objective on shares of CarMax in a research report on Friday, August 16th. Finally, Evercore ISI boosted their price target on shares of CarMax from $68.00 to $72.00 and gave the stock an "in-line" rating in a research note on Tuesday, July 16th. Three analysts have rated the stock with a sell rating, five have issued a hold rating and six have assigned a buy rating to the stock. Based on data from MarketBeat.com, CarMax has a consensus rating of "Hold" and an average price target of $76.25.

Check Out Our Latest Research Report on CarMax

CarMax Price Performance

KMX traded down $0.61 during midday trading on Tuesday, reaching $84.41. 1,080,500 shares of the company's stock were exchanged, compared to its average volume of 1,927,441. CarMax, Inc. has a 1-year low of $59.66 and a 1-year high of $88.22. The stock has a market capitalization of $13.17 billion, a PE ratio of 32.97, a P/E/G ratio of 1.66 and a beta of 1.69. The company has a debt-to-equity ratio of 2.95, a current ratio of 2.50 and a quick ratio of 0.60. The business's 50-day moving average price is $77.63 and its 200 day moving average price is $75.77.

CarMax (NYSE:KMX - Get Free Report) last issued its quarterly earnings data on Friday, June 21st. The company reported $0.97 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.94 by $0.03. The firm had revenue of $7.11 billion during the quarter, compared to the consensus estimate of $7.16 billion. CarMax had a return on equity of 6.64% and a net margin of 1.55%. The company's quarterly revenue was down 7.5% compared to the same quarter last year. During the same period in the previous year, the firm posted $1.16 EPS. As a group, equities analysts anticipate that CarMax, Inc. will post 2.99 EPS for the current fiscal year.

CarMax Profile

(

Free Report)

CarMax, Inc, through its subsidiaries, operates as a retailer of used vehicles and related products in the United States. It operates in two segments: CarMax Sales Operations and CarMax Auto Finance. The CarMax Sales Operations segment offers customers a range of makes and models of used vehicles, including domestic, imported, and luxury vehicles, as well as hybrid and electric vehicles; used vehicle auctions; extended protection plans to customers at the time of sale; and reconditioning and vehicle repair services.

Featured Articles

Want to see what other hedge funds are holding KMX? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for CarMax, Inc. (NYSE:KMX - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider CarMax, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CarMax wasn't on the list.

While CarMax currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2024 and why they should be in your portfolio.

Get This Free Report