LDR Capital Management LLC trimmed its holdings in Kite Realty Group Trust (NYSE:KRG - Free Report) by 22.8% in the third quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 131,208 shares of the real estate investment trust's stock after selling 38,809 shares during the quarter. Kite Realty Group Trust comprises approximately 3.9% of LDR Capital Management LLC's portfolio, making the stock its 5th biggest position. LDR Capital Management LLC owned approximately 0.06% of Kite Realty Group Trust worth $3,485,000 as of its most recent SEC filing.

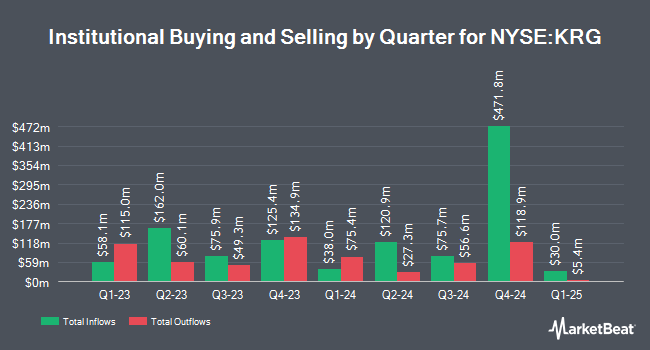

Several other hedge funds also recently added to or reduced their stakes in KRG. Quadrature Capital Ltd purchased a new position in shares of Kite Realty Group Trust during the fourth quarter worth about $314,000. Los Angeles Capital Management LLC acquired a new position in Kite Realty Group Trust during the first quarter worth approximately $524,000. State of Michigan Retirement System lifted its stake in Kite Realty Group Trust by 2.5% in the first quarter. State of Michigan Retirement System now owns 53,895 shares of the real estate investment trust's stock valued at $1,168,000 after buying an additional 1,300 shares during the last quarter. State of Alaska Department of Revenue boosted its holdings in shares of Kite Realty Group Trust by 0.5% in the first quarter. State of Alaska Department of Revenue now owns 126,703 shares of the real estate investment trust's stock valued at $2,745,000 after acquiring an additional 649 shares during the period. Finally, Principal Financial Group Inc. boosted its holdings in shares of Kite Realty Group Trust by 15.8% in the first quarter. Principal Financial Group Inc. now owns 948,658 shares of the real estate investment trust's stock valued at $20,567,000 after acquiring an additional 129,510 shares during the period. 90.81% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Ratings Changes

KRG has been the subject of several research reports. Wells Fargo & Company upgraded shares of Kite Realty Group Trust from an "underweight" rating to an "equal weight" rating and increased their price target for the stock from $23.00 to $26.00 in a research note on Wednesday, August 28th. Raymond James raised Kite Realty Group Trust from a "market perform" rating to a "strong-buy" rating and set a $28.00 price target on the stock in a report on Friday, August 16th. Compass Point upped their price objective on Kite Realty Group Trust from $29.00 to $32.00 and gave the company a "buy" rating in a research note on Wednesday, September 4th. Robert W. Baird lifted their target price on Kite Realty Group Trust from $25.00 to $26.00 and gave the company a "neutral" rating in a research note on Wednesday, July 31st. Finally, KeyCorp increased their price target on Kite Realty Group Trust from $25.00 to $28.00 and gave the stock an "overweight" rating in a report on Tuesday, August 20th. Three investment analysts have rated the stock with a hold rating, four have issued a buy rating and one has issued a strong buy rating to the company. According to data from MarketBeat, Kite Realty Group Trust has a consensus rating of "Moderate Buy" and a consensus target price of $28.00.

View Our Latest Research Report on Kite Realty Group Trust

Insiders Place Their Bets

In other news, Director Steven P. Grimes sold 37,295 shares of the business's stock in a transaction that occurred on Monday, September 16th. The stock was sold at an average price of $26.80, for a total transaction of $999,506.00. Following the sale, the director now owns 732,252 shares of the company's stock, valued at $19,624,353.60. The trade was a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. 2.00% of the stock is currently owned by company insiders.

Kite Realty Group Trust Price Performance

Kite Realty Group Trust stock traded up $0.23 during midday trading on Tuesday, reaching $26.13. The company's stock had a trading volume of 1,258,550 shares, compared to its average volume of 1,592,653. The firm has a market capitalization of $5.74 billion, a PE ratio of 99.58, a P/E/G ratio of 3.93 and a beta of 1.29. Kite Realty Group Trust has a fifty-two week low of $19.64 and a fifty-two week high of $27.15. The stock's 50 day simple moving average is $25.93 and its 200 day simple moving average is $23.43. The company has a debt-to-equity ratio of 0.88, a quick ratio of 2.08 and a current ratio of 2.08.

Kite Realty Group Trust Increases Dividend

The business also recently disclosed a quarterly dividend, which was paid on Wednesday, October 16th. Investors of record on Wednesday, October 9th were issued a dividend of $0.26 per share. The ex-dividend date was Wednesday, October 9th. This represents a $1.04 dividend on an annualized basis and a yield of 3.98%. This is an increase from Kite Realty Group Trust's previous quarterly dividend of $0.25. Kite Realty Group Trust's payout ratio is currently 400.00%.

About Kite Realty Group Trust

(

Free Report)

Kite Realty Group Trust NYSE: KRG is a real estate investment trust (REIT) headquartered in Indianapolis, IN that is one of the largest publicly traded owners and operators of open-air shopping centers and mixed-use assets. The Company's primarily grocery-anchored portfolio is located in high-growth Sun Belt and select strategic gateway markets.

Recommended Stories

Before you consider Kite Realty Group Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kite Realty Group Trust wasn't on the list.

While Kite Realty Group Trust currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.