Kontoor Brands (NYSE:KTB - Free Report) had its target price increased by Guggenheim from $80.00 to $100.00 in a research note published on Friday morning, Benzinga reports. The firm currently has a buy rating on the stock.

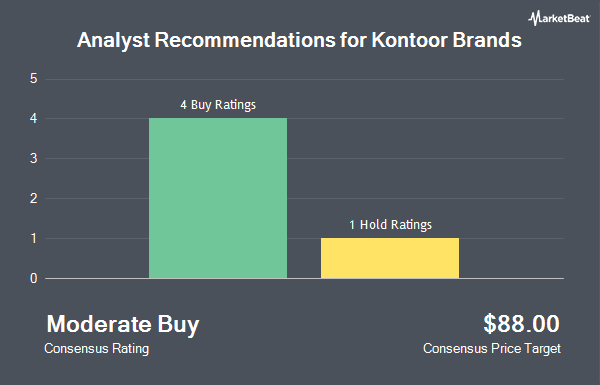

Several other equities analysts also recently commented on the company. Wells Fargo & Company increased their target price on Kontoor Brands from $80.00 to $90.00 and gave the company an "overweight" rating in a research report on Wednesday, October 23rd. UBS Group lifted their target price on shares of Kontoor Brands from $103.00 to $110.00 and gave the stock a "buy" rating in a research report on Friday. Barclays upped their price target on shares of Kontoor Brands from $83.00 to $100.00 and gave the company an "overweight" rating in a research report on Friday. Finally, Stifel Nicolaus downgraded shares of Kontoor Brands from a "buy" rating to a "hold" rating and raised their price target for the company from $89.00 to $93.00 in a research note on Friday. Two research analysts have rated the stock with a hold rating and five have assigned a buy rating to the stock. According to MarketBeat, Kontoor Brands currently has an average rating of "Moderate Buy" and a consensus price target of $95.00.

Check Out Our Latest Stock Report on KTB

Kontoor Brands Price Performance

Shares of NYSE KTB traded down $3.97 during trading hours on Friday, hitting $81.66. 1,158,691 shares of the stock were exchanged, compared to its average volume of 485,484. The company's fifty day simple moving average is $77.81 and its two-hundred day simple moving average is $71.34. The company has a market cap of $4.55 billion, a PE ratio of 18.39, a price-to-earnings-growth ratio of 1.99 and a beta of 1.20. The company has a debt-to-equity ratio of 2.04, a quick ratio of 1.43 and a current ratio of 2.74. Kontoor Brands has a 1-year low of $39.90 and a 1-year high of $89.76.

Kontoor Brands (NYSE:KTB - Get Free Report) last announced its quarterly earnings data on Thursday, October 31st. The company reported $1.37 earnings per share for the quarter, topping the consensus estimate of $1.25 by $0.12. Kontoor Brands had a return on equity of 72.43% and a net margin of 9.35%. The business had revenue of $670.19 million during the quarter, compared to the consensus estimate of $663.45 million. During the same period in the prior year, the company earned $1.22 EPS. Kontoor Brands's revenue for the quarter was up 2.4% on a year-over-year basis. On average, sell-side analysts predict that Kontoor Brands will post 4.8 EPS for the current year.

Kontoor Brands Increases Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Thursday, December 19th. Shareholders of record on Monday, December 9th will be issued a dividend of $0.52 per share. This is an increase from Kontoor Brands's previous quarterly dividend of $0.50. The ex-dividend date is Monday, December 9th. This represents a $2.08 annualized dividend and a yield of 2.55%. Kontoor Brands's dividend payout ratio is presently 46.85%.

Hedge Funds Weigh In On Kontoor Brands

Hedge funds have recently added to or reduced their stakes in the stock. Millennium Management LLC raised its holdings in shares of Kontoor Brands by 351.7% in the second quarter. Millennium Management LLC now owns 347,325 shares of the company's stock valued at $22,976,000 after purchasing an additional 270,427 shares during the last quarter. Marshall Wace LLP boosted its stake in shares of Kontoor Brands by 159.0% in the 2nd quarter. Marshall Wace LLP now owns 335,385 shares of the company's stock worth $22,186,000 after buying an additional 205,885 shares during the last quarter. Pacer Advisors Inc. grew its holdings in shares of Kontoor Brands by 10.9% in the second quarter. Pacer Advisors Inc. now owns 2,043,637 shares of the company's stock valued at $135,187,000 after acquiring an additional 201,399 shares in the last quarter. Bwcp LP purchased a new stake in shares of Kontoor Brands during the second quarter valued at approximately $11,890,000. Finally, Squarepoint Ops LLC increased its position in shares of Kontoor Brands by 123.7% during the second quarter. Squarepoint Ops LLC now owns 220,065 shares of the company's stock valued at $14,557,000 after acquiring an additional 121,689 shares during the last quarter. Institutional investors and hedge funds own 93.06% of the company's stock.

About Kontoor Brands

(

Get Free Report)

Kontoor Brands, Inc, a lifestyle apparel company, designs, produces, procures, markets, distributes, and licenses denim, apparel, footwear, and accessories, primarily under the Wrangler and Lee brands. The company operates through two segments: Wrangler and Lee. It licenses and sells apparel under the Rock & Republic brand name.

Read More

Before you consider Kontoor Brands, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kontoor Brands wasn't on the list.

While Kontoor Brands currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.