Kontoor Brands (NYSE:KTB - Get Free Report) was downgraded by Stifel Nicolaus from a "buy" rating to a "hold" rating in a report issued on Friday, Marketbeat reports. They currently have a $93.00 price target on the stock, up from their prior price target of $89.00. Stifel Nicolaus' price objective suggests a potential upside of 13.89% from the company's current price.

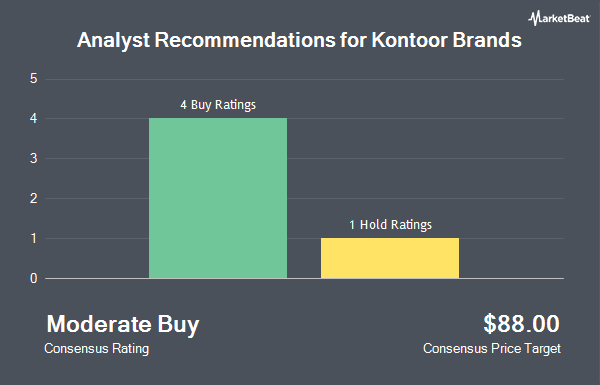

A number of other brokerages have also commented on KTB. Guggenheim lifted their price target on shares of Kontoor Brands from $75.00 to $80.00 and gave the stock a "buy" rating in a report on Friday, August 2nd. Wells Fargo & Company lifted their target price on Kontoor Brands from $80.00 to $90.00 and gave the stock an "overweight" rating in a report on Wednesday, October 23rd. Barclays upped their price target on Kontoor Brands from $76.00 to $83.00 and gave the company an "overweight" rating in a research report on Friday, August 2nd. Finally, UBS Group raised their price objective on Kontoor Brands from $90.00 to $103.00 and gave the stock a "buy" rating in a research report on Friday, October 18th. Two investment analysts have rated the stock with a hold rating and five have assigned a buy rating to the company. According to data from MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and a consensus target price of $95.00.

View Our Latest Stock Analysis on KTB

Kontoor Brands Price Performance

Shares of NYSE KTB traded down $3.97 during trading hours on Friday, hitting $81.66. 1,158,691 shares of the stock were exchanged, compared to its average volume of 485,484. The company's fifty day simple moving average is $77.65 and its two-hundred day simple moving average is $71.15. The company has a market cap of $4.55 billion, a PE ratio of 19.30, a price-to-earnings-growth ratio of 1.99 and a beta of 1.20. The company has a debt-to-equity ratio of 2.04, a quick ratio of 1.43 and a current ratio of 2.74. Kontoor Brands has a 1-year low of $39.90 and a 1-year high of $89.76.

Kontoor Brands (NYSE:KTB - Get Free Report) last posted its earnings results on Thursday, October 31st. The company reported $1.37 EPS for the quarter, topping analysts' consensus estimates of $1.25 by $0.12. The firm had revenue of $670.19 million during the quarter, compared to analysts' expectations of $663.45 million. Kontoor Brands had a net margin of 9.35% and a return on equity of 72.43%. The business's revenue for the quarter was up 2.4% compared to the same quarter last year. During the same quarter in the prior year, the business earned $1.22 earnings per share. On average, sell-side analysts predict that Kontoor Brands will post 4.8 EPS for the current year.

Institutional Investors Weigh In On Kontoor Brands

Large investors have recently modified their holdings of the stock. Arizona State Retirement System lifted its holdings in Kontoor Brands by 1.1% during the second quarter. Arizona State Retirement System now owns 14,050 shares of the company's stock valued at $929,000 after purchasing an additional 154 shares during the last quarter. SG Americas Securities LLC lifted its stake in shares of Kontoor Brands by 5.0% during the 2nd quarter. SG Americas Securities LLC now owns 3,544 shares of the company's stock valued at $234,000 after buying an additional 169 shares in the last quarter. Envestnet Portfolio Solutions Inc. boosted its holdings in Kontoor Brands by 3.6% in the 2nd quarter. Envestnet Portfolio Solutions Inc. now owns 4,979 shares of the company's stock worth $329,000 after buying an additional 175 shares during the period. Louisiana State Employees Retirement System grew its stake in Kontoor Brands by 0.8% in the 2nd quarter. Louisiana State Employees Retirement System now owns 25,000 shares of the company's stock valued at $1,654,000 after buying an additional 200 shares in the last quarter. Finally, Hsbc Holdings PLC raised its holdings in Kontoor Brands by 2.2% during the 2nd quarter. Hsbc Holdings PLC now owns 9,340 shares of the company's stock valued at $616,000 after acquiring an additional 203 shares during the period. Hedge funds and other institutional investors own 93.06% of the company's stock.

About Kontoor Brands

(

Get Free Report)

Kontoor Brands, Inc, a lifestyle apparel company, designs, produces, procures, markets, distributes, and licenses denim, apparel, footwear, and accessories, primarily under the Wrangler and Lee brands. The company operates through two segments: Wrangler and Lee. It licenses and sells apparel under the Rock & Republic brand name.

Featured Articles

Before you consider Kontoor Brands, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kontoor Brands wasn't on the list.

While Kontoor Brands currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.