Macquarie began coverage on shares of Klaviyo (NYSE:KVYO - Free Report) in a research report report published on Thursday morning, MarketBeat reports. The firm issued a neutral rating and a $36.00 price target on the stock.

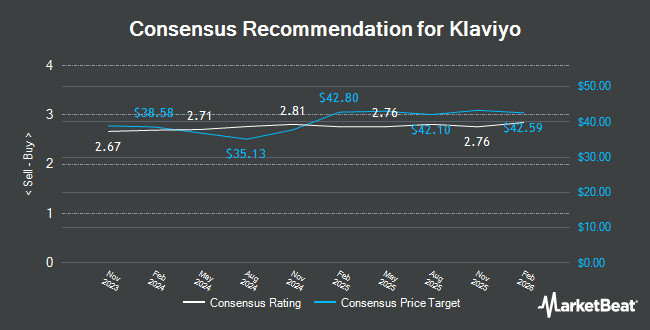

Other equities research analysts have also recently issued research reports about the company. Needham & Company LLC reaffirmed a "buy" rating and set a $40.00 price target on shares of Klaviyo in a report on Wednesday, September 4th. Barclays lifted their price target on Klaviyo from $32.00 to $41.00 and gave the company an "overweight" rating in a report on Friday, October 11th. Benchmark reaffirmed a "buy" rating and set a $42.00 price target on shares of Klaviyo in a report on Thursday, October 24th. Wells Fargo & Company reaffirmed a "buy" rating on shares of Klaviyo in a report on Friday, October 18th. Finally, KeyCorp raised Klaviyo from a "sector weight" rating to an "overweight" rating and set a $33.00 target price on the stock in a report on Thursday, August 8th. Three research analysts have rated the stock with a hold rating and fifteen have assigned a buy rating to the company's stock. According to MarketBeat.com, the company currently has an average rating of "Moderate Buy" and a consensus target price of $37.29.

Check Out Our Latest Report on KVYO

Klaviyo Stock Down 1.6 %

Shares of Klaviyo stock traded down $0.61 during trading hours on Thursday, hitting $38.01. 834,180 shares of the company's stock traded hands, compared to its average volume of 1,119,615. The stock has a 50 day simple moving average of $34.52 and a 200-day simple moving average of $28.06. The company has a market cap of $10.14 billion and a PE ratio of -26.96. Klaviyo has a twelve month low of $21.26 and a twelve month high of $39.92.

Klaviyo (NYSE:KVYO - Get Free Report) last issued its earnings results on Wednesday, August 7th. The company reported $0.15 EPS for the quarter, beating analysts' consensus estimates of $0.10 by $0.05. Klaviyo had a negative return on equity of 32.19% and a negative net margin of 42.15%. The company had revenue of $222.21 million during the quarter, compared to the consensus estimate of $212.34 million. During the same period in the previous year, the firm posted $0.09 earnings per share. Klaviyo's quarterly revenue was up 35.0% compared to the same quarter last year.

Insider Activity

In other news, President Stephen Eric Rowland sold 18,114 shares of the business's stock in a transaction on Tuesday, October 15th. The shares were sold at an average price of $37.19, for a total transaction of $673,659.66. Following the transaction, the president now directly owns 192,488 shares in the company, valued at $7,158,628.72. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available at this link. In related news, President Stephen Eric Rowland sold 18,114 shares of Klaviyo stock in a transaction on Tuesday, October 15th. The shares were sold at an average price of $37.19, for a total value of $673,659.66. Following the completion of the sale, the president now owns 192,488 shares of the company's stock, valued at approximately $7,158,628.72. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, CFO Amanda Whalen sold 60,000 shares of Klaviyo stock in a transaction on Friday, August 9th. The shares were sold at an average price of $30.23, for a total transaction of $1,813,800.00. Following the completion of the sale, the chief financial officer now directly owns 435,993 shares of the company's stock, valued at approximately $13,180,068.39. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 871,477 shares of company stock worth $27,610,861 in the last ninety days. Corporate insiders own 53.24% of the company's stock.

Institutional Inflows and Outflows

A number of large investors have recently made changes to their positions in the stock. nVerses Capital LLC acquired a new position in shares of Klaviyo during the third quarter valued at about $53,000. William Marsh Rice University bought a new stake in Klaviyo in the third quarter valued at about $245,000. Renaissance Capital LLC increased its stake in Klaviyo by 134.6% in the third quarter. Renaissance Capital LLC now owns 78,401 shares of the company's stock valued at $2,774,000 after acquiring an additional 44,977 shares during the period. Cabot Wealth Management Inc. increased its stake in Klaviyo by 101.1% in the third quarter. Cabot Wealth Management Inc. now owns 90,425 shares of the company's stock valued at $3,199,000 after acquiring an additional 45,451 shares during the period. Finally, Creative Planning bought a new stake in Klaviyo in the third quarter valued at about $254,000. Institutional investors and hedge funds own 45.43% of the company's stock.

About Klaviyo

(

Get Free Report)

Klaviyo, Inc, a technology company, provides a software-as-a-service platform in the United States, other Americas, the Asia-Pacific, Europe, the Middle East, and Africa. The company offers Klaviyo, a cloud-native platform for data store, segmentation engine, campaigns and flows, and messaging infrastructure.

Featured Articles

Before you consider Klaviyo, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Klaviyo wasn't on the list.

While Klaviyo currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.