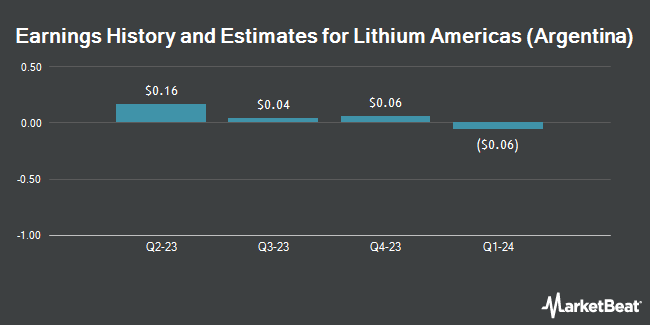

Lithium Americas (Argentina) Corp. (NYSE:LAAC - Free Report) - Investment analysts at B. Riley issued their Q2 2024 earnings per share estimates for shares of Lithium Americas (Argentina) in a research report issued to clients and investors on Wednesday, July 31st. B. Riley analyst M. Key forecasts that the company will post earnings of $0.00 per share for the quarter. The consensus estimate for Lithium Americas (Argentina)'s current full-year earnings is $0.13 per share. B. Riley also issued estimates for Lithium Americas (Argentina)'s Q4 2024 earnings at $0.04 EPS.

LAAC has been the subject of several other reports. Stifel Nicolaus cut their price target on shares of Lithium Americas (Argentina) from $18.50 to $12.00 and set a "buy" rating for the company in a report on Tuesday, May 21st. National Bankshares set a $6.00 target price on Lithium Americas (Argentina) and gave the stock a "sector perform" rating in a research report on Thursday, June 6th. Finally, National Bank Financial upgraded Lithium Americas (Argentina) to a "hold" rating in a research note on Wednesday, June 5th. Four research analysts have rated the stock with a hold rating and three have given a buy rating to the stock. According to MarketBeat, the company has a consensus rating of "Hold" and a consensus target price of $8.83.

View Our Latest Report on Lithium Americas (Argentina)

Lithium Americas (Argentina) Price Performance

Shares of NYSE:LAAC traded down $0.31 during trading on Thursday, hitting $2.72. 1,661,194 shares of the company were exchanged, compared to its average volume of 1,478,176. Lithium Americas has a 52-week low of $2.71 and a 52-week high of $8.79. The stock has a 50 day moving average of $3.55 and a 200 day moving average of $4.42. The company has a market cap of $437.74 million, a PE ratio of 0.34 and a beta of 1.35.

Lithium Americas (Argentina) (NYSE:LAAC - Get Free Report) last announced its quarterly earnings data on Monday, May 13th. The company reported ($0.06) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.04 by ($0.10). During the same quarter last year, the company posted ($0.04) earnings per share.

Institutional Trading of Lithium Americas (Argentina)

Several large investors have recently added to or reduced their stakes in the stock. Mather Group LLC. purchased a new position in shares of Lithium Americas (Argentina) during the 1st quarter worth approximately $27,000. Allworth Financial LP bought a new position in shares of Lithium Americas (Argentina) in the 4th quarter worth about $32,000. Fifth Third Bancorp increased its stake in shares of Lithium Americas (Argentina) by 67.9% in the 2nd quarter. Fifth Third Bancorp now owns 9,895 shares of the company's stock worth $32,000 after acquiring an additional 4,000 shares in the last quarter. Scarborough Advisors LLC bought a new stake in Lithium Americas (Argentina) during the fourth quarter worth about $53,000. Finally, Teamwork Financial Advisors LLC purchased a new stake in Lithium Americas (Argentina) in the first quarter worth about $54,000. Institutional investors own 49.17% of the company's stock.

Lithium Americas (Argentina) Company Profile

(

Get Free Report)

Lithium Americas (Argentina) Corp. operates as a resource company. The company explores for lithium deposits. The company owns interests in the Cauchari-Olaroz project located in Jujuy province of Argentina. It also has a pipeline of development and exploration stage projects, including the Pastos Grandes project and the Sal de la Puna project located in Salta Province in northwestern Argentina.

Read More

Before you consider Lithium Americas (Argentina), you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lithium Americas (Argentina) wasn't on the list.

While Lithium Americas (Argentina) currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.