Intact Investment Management Inc. boosted its stake in shares of Lithium Americas (Argentina) Corp. (NYSE:LAAC - Free Report) by 47.3% during the 3rd quarter, according to its most recent 13F filing with the SEC. The firm owned 510,200 shares of the company's stock after buying an additional 163,800 shares during the period. Intact Investment Management Inc. owned approximately 0.32% of Lithium Americas (Argentina) worth $1,671,000 at the end of the most recent quarter.

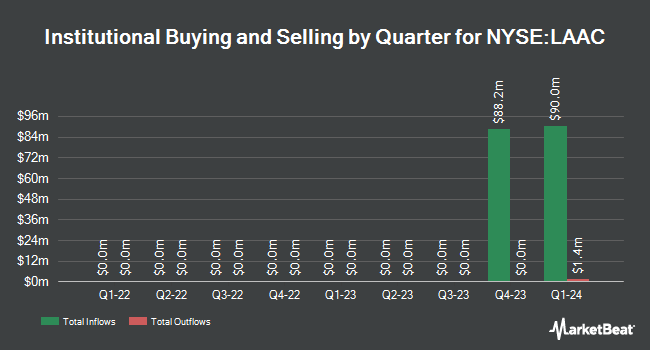

Several other hedge funds and other institutional investors also recently bought and sold shares of LAAC. M&G Plc purchased a new position in Lithium Americas (Argentina) in the 1st quarter worth about $5,944,000. Decade Renewable Partners LP increased its holdings in shares of Lithium Americas (Argentina) by 102.7% during the second quarter. Decade Renewable Partners LP now owns 547,625 shares of the company's stock valued at $1,752,000 after acquiring an additional 277,500 shares in the last quarter. Vanguard Group Inc. grew its position in Lithium Americas (Argentina) by 0.6% during the 1st quarter. Vanguard Group Inc. now owns 3,560,536 shares of the company's stock worth $19,191,000 after purchasing an additional 21,456 shares during the last quarter. SG Americas Securities LLC raised its stake in Lithium Americas (Argentina) by 24.5% in the 1st quarter. SG Americas Securities LLC now owns 49,868 shares of the company's stock worth $269,000 after acquiring an additional 9,827 shares during the last quarter. Finally, Van ECK Associates Corp raised its stake in shares of Lithium Americas (Argentina) by 13.2% in the second quarter. Van ECK Associates Corp now owns 2,614,946 shares of the company's stock worth $8,366,000 after purchasing an additional 304,590 shares during the last quarter. Hedge funds and other institutional investors own 49.17% of the company's stock.

Wall Street Analyst Weigh In

LAAC has been the subject of several analyst reports. Scotiabank decreased their price objective on Lithium Americas (Argentina) from $8.00 to $4.25 and set a "sector outperform" rating for the company in a report on Thursday, August 15th. HSBC raised shares of Lithium Americas (Argentina) from a "hold" rating to a "buy" rating in a research note on Wednesday, August 14th. Finally, Hsbc Global Res upgraded Lithium Americas (Argentina) to a "strong-buy" rating in a report on Wednesday, August 14th. Four equities research analysts have rated the stock with a hold rating, three have assigned a buy rating and one has given a strong buy rating to the company's stock. According to data from MarketBeat, the company currently has an average rating of "Moderate Buy" and a consensus target price of $7.05.

View Our Latest Report on LAAC

Lithium Americas (Argentina) Price Performance

Shares of LAAC stock traded up $0.01 on Tuesday, hitting $3.51. The stock had a trading volume of 1,192,399 shares, compared to its average volume of 1,517,445. The company's 50 day moving average price is $3.05 and its 200-day moving average price is $3.52. Lithium Americas has a 1 year low of $2.07 and a 1 year high of $6.69. The firm has a market capitalization of $568.33 million, a P/E ratio of 0.45 and a beta of 1.33.

Lithium Americas (Argentina) (NYSE:LAAC - Get Free Report) last posted its quarterly earnings data on Tuesday, August 13th. The company reported ($0.05) EPS for the quarter, missing the consensus estimate of ($0.03) by ($0.02). On average, equities analysts forecast that Lithium Americas will post -0.02 EPS for the current year.

Lithium Americas (Argentina) Company Profile

(

Free Report)

Lithium Americas (Argentina) Corp. operates as a resource company. The company explores for lithium deposits. The company owns interests in the Cauchari-Olaroz project located in Jujuy province of Argentina. It also has a pipeline of development and exploration stage projects, including the Pastos Grandes project and the Sal de la Puna project located in Salta Province in northwestern Argentina.

See Also

Before you consider Lithium Americas (Argentina), you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lithium Americas (Argentina) wasn't on the list.

While Lithium Americas (Argentina) currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.