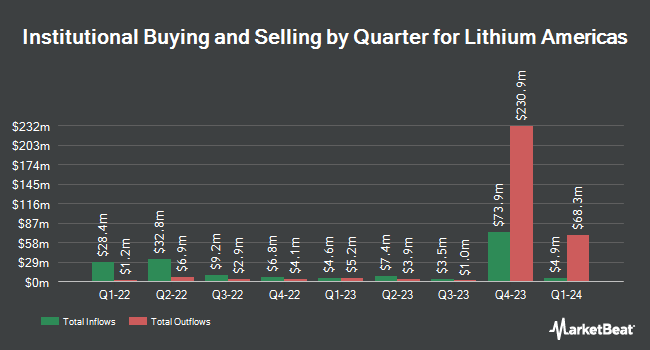

Aquila Investment Management LLC reduced its stake in shares of Lithium Americas Corp. (NYSE:LAC - Free Report) by 47.1% in the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 450,000 shares of the company's stock after selling 400,000 shares during the quarter. Aquila Investment Management LLC owned about 0.20% of Lithium Americas worth $1,215,000 at the end of the most recent quarter.

Other institutional investors have also recently added to or reduced their stakes in the company. Signaturefd LLC lifted its holdings in shares of Lithium Americas by 1,450.5% in the third quarter. Signaturefd LLC now owns 30,995 shares of the company's stock valued at $84,000 after buying an additional 28,996 shares during the period. Koss Olinger Consulting LLC lifted its holdings in shares of Lithium Americas by 41.8% in the third quarter. Koss Olinger Consulting LLC now owns 129,211 shares of the company's stock valued at $349,000 after buying an additional 38,062 shares during the period. Teamwork Financial Advisors LLC lifted its holdings in shares of Lithium Americas by 2,274.3% in the third quarter. Teamwork Financial Advisors LLC now owns 398,760 shares of the company's stock valued at $1,077,000 after buying an additional 381,965 shares during the period. Vontobel Holding Ltd. lifted its holdings in shares of Lithium Americas by 37.1% during the third quarter. Vontobel Holding Ltd. now owns 21,926 shares of the company's stock valued at $59,000 after purchasing an additional 5,930 shares during the last quarter. Finally, Creative Planning lifted its holdings in shares of Lithium Americas by 21.8% during the third quarter. Creative Planning now owns 33,276 shares of the company's stock valued at $90,000 after purchasing an additional 5,945 shares during the last quarter.

Lithium Americas Stock Down 4.2 %

NYSE:LAC traded down $0.14 during trading hours on Wednesday, hitting $3.19. 10,146,627 shares of the company's stock traded hands, compared to its average volume of 4,702,120. Lithium Americas Corp. has a twelve month low of $2.02 and a twelve month high of $7.86. The stock's fifty day moving average price is $2.61 and its two-hundred day moving average price is $3.27.

Lithium Americas (NYSE:LAC - Get Free Report) last posted its quarterly earnings results on Tuesday, August 13th. The company reported ($0.05) earnings per share for the quarter, missing the consensus estimate of ($0.03) by ($0.02). On average, sell-side analysts forecast that Lithium Americas Corp. will post -0.09 earnings per share for the current fiscal year.

Wall Street Analyst Weigh In

Several equities research analysts have recently commented on LAC shares. Piper Sandler started coverage on Lithium Americas in a report on Monday, July 29th. They set a "neutral" rating and a $3.90 target price for the company. Scotiabank reduced their target price on Lithium Americas from $3.00 to $2.50 and set a "sector perform" rating for the company in a report on Friday, October 18th. National Bank Financial raised Lithium Americas from a "sector perform" rating to an "outperform" rating in a report on Thursday, October 17th. B. Riley reduced their target price on Lithium Americas from $4.50 to $4.00 and set a "buy" rating for the company in a report on Friday, August 16th. Finally, Deutsche Bank Aktiengesellschaft reduced their target price on Lithium Americas from $3.00 to $2.50 and set a "hold" rating for the company in a report on Friday, August 16th. Five analysts have rated the stock with a hold rating and five have given a buy rating to the company's stock. According to data from MarketBeat, Lithium Americas presently has a consensus rating of "Moderate Buy" and a consensus price target of $5.50.

Get Our Latest Analysis on Lithium Americas

Lithium Americas Profile

(

Free Report)

Lithium Americas Corp. engages in the exploration and development of lithium properties in the United States and Canada. It holds a 100% interest in the Thacker Pass project located in northern Nevada, as well as investments in exploration properties in the United States and Canada. Lithium Americas Corp.

Recommended Stories

Before you consider Lithium Americas, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lithium Americas wasn't on the list.

While Lithium Americas currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.