Lithia Motors (NYSE:LAD - Get Free Report) was downgraded by StockNews.com from a "hold" rating to a "sell" rating in a research report issued to clients and investors on Monday.

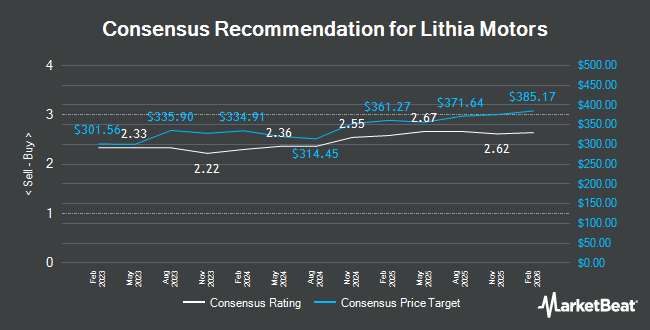

LAD has been the subject of several other reports. Wells Fargo & Company raised their price objective on shares of Lithia Motors from $299.00 to $343.00 and gave the stock an "equal weight" rating in a research report on Thursday, October 24th. Stephens raised their price objective on shares of Lithia Motors from $360.00 to $405.00 and gave the stock an "overweight" rating in a research report on Thursday, October 24th. JPMorgan Chase & Co. raised their target price on shares of Lithia Motors from $315.00 to $375.00 and gave the stock an "overweight" rating in a report on Tuesday, September 10th. The Goldman Sachs Group raised their target price on shares of Lithia Motors from $300.00 to $335.00 and gave the stock a "neutral" rating in a report on Friday, August 2nd. Finally, Guggenheim raised their target price on shares of Lithia Motors from $350.00 to $380.00 and gave the stock a "buy" rating in a report on Thursday, October 24th. One investment analyst has rated the stock with a sell rating, four have given a hold rating and six have issued a buy rating to the stock. According to MarketBeat.com, Lithia Motors presently has an average rating of "Hold" and an average target price of $350.80.

Get Our Latest Stock Analysis on Lithia Motors

Lithia Motors Stock Performance

LAD stock traded up $6.27 during mid-day trading on Monday, hitting $344.08. 242,874 shares of the company were exchanged, compared to its average volume of 256,897. The business has a 50 day simple moving average of $304.96 and a 200-day simple moving average of $277.87. The company has a current ratio of 1.18, a quick ratio of 0.27 and a debt-to-equity ratio of 1.23. The stock has a market capitalization of $9.17 billion, a PE ratio of 11.74 and a beta of 1.63. Lithia Motors has a 1-year low of $243.00 and a 1-year high of $347.60.

Lithia Motors (NYSE:LAD - Get Free Report) last issued its quarterly earnings data on Wednesday, October 23rd. The company reported $8.21 earnings per share (EPS) for the quarter, topping the consensus estimate of $7.60 by $0.61. The firm had revenue of $9.22 billion during the quarter, compared to the consensus estimate of $9.46 billion. Lithia Motors had a net margin of 2.31% and a return on equity of 12.95%. The business's revenue for the quarter was up 11.4% compared to the same quarter last year. During the same period last year, the business posted $9.25 earnings per share. On average, equities analysts forecast that Lithia Motors will post 28.88 earnings per share for the current year.

Insider Activity at Lithia Motors

In related news, COO Chris Holzshu sold 8,520 shares of Lithia Motors stock in a transaction that occurred on Thursday, October 24th. The shares were sold at an average price of $335.21, for a total value of $2,855,989.20. Following the transaction, the chief operating officer now directly owns 32,054 shares of the company's stock, valued at $10,744,821.34. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available through this link. In other Lithia Motors news, Director Sidney B. Deboer sold 10,777 shares of the firm's stock in a transaction that occurred on Friday, September 13th. The shares were sold at an average price of $275.93, for a total value of $2,973,697.61. Following the sale, the director now owns 35,352 shares in the company, valued at $9,754,677.36. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available at this link. Also, COO Chris Holzshu sold 8,520 shares of the firm's stock in a transaction that occurred on Thursday, October 24th. The shares were sold at an average price of $335.21, for a total transaction of $2,855,989.20. Following the completion of the sale, the chief operating officer now owns 32,054 shares in the company, valued at $10,744,821.34. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 31,235 shares of company stock valued at $9,301,973 over the last three months. 1.79% of the stock is owned by insiders.

Institutional Trading of Lithia Motors

A number of hedge funds have recently added to or reduced their stakes in the stock. Barrow Hanley Mewhinney & Strauss LLC lifted its holdings in shares of Lithia Motors by 14.7% during the second quarter. Barrow Hanley Mewhinney & Strauss LLC now owns 1,700,893 shares of the company's stock worth $429,390,000 after purchasing an additional 217,867 shares during the period. Dimensional Fund Advisors LP lifted its holdings in shares of Lithia Motors by 25.0% during the second quarter. Dimensional Fund Advisors LP now owns 1,016,520 shares of the company's stock worth $256,621,000 after purchasing an additional 203,543 shares during the period. Canada Pension Plan Investment Board lifted its holdings in shares of Lithia Motors by 7.2% during the first quarter. Canada Pension Plan Investment Board now owns 727,849 shares of the company's stock worth $218,981,000 after purchasing an additional 48,938 shares during the period. River Road Asset Management LLC lifted its holdings in shares of Lithia Motors by 27.5% during the third quarter. River Road Asset Management LLC now owns 365,184 shares of the company's stock worth $115,997,000 after purchasing an additional 78,784 shares during the period. Finally, Bank of New York Mellon Corp lifted its holdings in shares of Lithia Motors by 2.1% during the second quarter. Bank of New York Mellon Corp now owns 260,470 shares of the company's stock worth $65,756,000 after purchasing an additional 5,390 shares during the period.

Lithia Motors Company Profile

(

Get Free Report)

Lithia Motors, Inc operates as an automotive retailer worldwide. It operates in two segments, Vehicle Operations and Financing Operations. The company's Vehicle Operations segment sells new and used vehicles; provides parts, repair, and maintenance services; vehicle finance; and insurance products. Its Financing Operations segment provides financing to customers buying and leasing retail vehicles.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Lithia Motors, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lithia Motors wasn't on the list.

While Lithia Motors currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.