LendingClub (NYSE:LC - Free Report) had its target price lifted by Wedbush from $14.00 to $17.00 in a research report sent to investors on Thursday, Benzinga reports. Wedbush currently has an outperform rating on the credit services provider's stock.

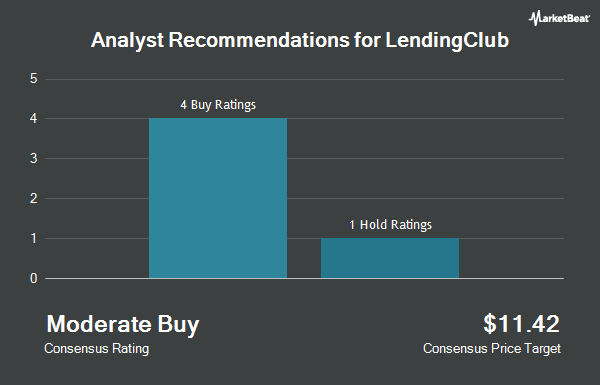

Several other brokerages have also weighed in on LC. StockNews.com raised LendingClub from a "sell" rating to a "hold" rating in a report on Thursday, August 1st. Compass Point upped their price target on LendingClub from $13.00 to $15.00 and gave the company a "buy" rating in a research report on Wednesday, July 31st. JPMorgan Chase & Co. lifted their price objective on shares of LendingClub from $12.00 to $14.00 and gave the stock an "overweight" rating in a report on Tuesday, August 20th. Keefe, Bruyette & Woods raised shares of LendingClub from a "market perform" rating to an "outperform" rating and increased their target price for the stock from $11.50 to $15.00 in a report on Thursday, October 10th. Finally, Jefferies Financial Group lifted their price target on shares of LendingClub from $11.00 to $12.00 and gave the company a "buy" rating in a report on Thursday, July 18th. One investment analyst has rated the stock with a hold rating and seven have assigned a buy rating to the company's stock. According to MarketBeat, LendingClub currently has a consensus rating of "Moderate Buy" and an average price target of $14.29.

Get Our Latest Report on LC

LendingClub Stock Performance

LendingClub stock traded up $1.35 during trading on Thursday, hitting $13.81. The company's stock had a trading volume of 8,588,719 shares, compared to its average volume of 1,442,114. The stock's fifty day moving average is $11.64 and its 200 day moving average is $9.98. LendingClub has a 1-year low of $4.73 and a 1-year high of $15.52. The stock has a market capitalization of $1.53 billion, a price-to-earnings ratio of 40.62 and a beta of 2.04.

LendingClub (NYSE:LC - Get Free Report) last issued its earnings results on Wednesday, October 23rd. The credit services provider reported $0.13 earnings per share for the quarter, topping the consensus estimate of $0.07 by $0.06. The company had revenue of $201.90 million during the quarter, compared to the consensus estimate of $190.40 million. LendingClub had a return on equity of 3.38% and a net margin of 5.61%. The company's revenue was up .5% compared to the same quarter last year. During the same quarter in the prior year, the business earned $0.05 earnings per share. On average, research analysts anticipate that LendingClub will post 0.38 EPS for the current fiscal year.

Insider Activity

In related news, CEO Scott Sanborn sold 17,000 shares of the company's stock in a transaction dated Thursday, August 8th. The shares were sold at an average price of $10.25, for a total value of $174,250.00. Following the completion of the sale, the chief executive officer now owns 1,383,362 shares of the company's stock, valued at $14,179,460.50. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available through the SEC website. Over the last ninety days, insiders have sold 51,703 shares of company stock valued at $562,705. Company insiders own 3.31% of the company's stock.

Institutional Inflows and Outflows

Several large investors have recently bought and sold shares of LC. Vanguard Group Inc. lifted its holdings in LendingClub by 1.6% in the 1st quarter. Vanguard Group Inc. now owns 11,446,014 shares of the credit services provider's stock valued at $100,610,000 after acquiring an additional 175,706 shares during the last quarter. Dimensional Fund Advisors LP raised its holdings in shares of LendingClub by 5.4% in the 2nd quarter. Dimensional Fund Advisors LP now owns 5,898,545 shares of the credit services provider's stock worth $49,901,000 after purchasing an additional 300,536 shares in the last quarter. American Century Companies Inc. raised its holdings in shares of LendingClub by 24.8% in the 2nd quarter. American Century Companies Inc. now owns 1,658,679 shares of the credit services provider's stock worth $14,032,000 after purchasing an additional 329,279 shares in the last quarter. Assenagon Asset Management S.A. lifted its stake in LendingClub by 120.3% during the third quarter. Assenagon Asset Management S.A. now owns 1,517,986 shares of the credit services provider's stock valued at $17,351,000 after purchasing an additional 828,958 shares during the last quarter. Finally, Wellington Management Group LLP boosted its holdings in LendingClub by 176.1% during the fourth quarter. Wellington Management Group LLP now owns 1,344,295 shares of the credit services provider's stock worth $11,749,000 after buying an additional 857,371 shares in the last quarter. Institutional investors own 74.08% of the company's stock.

About LendingClub

(

Get Free Report)

LendingClub Corporation, operates as a bank holding company, that provides range of financial products and services in the United States. It offers deposit products, including savings accounts, checking accounts, and certificates of deposit. The company also provides loan products, such as consumer loans comprising unsecured personal loans, secured auto refinance loans, and patient and education finance loans; and commercial loans, including small business loans.

Further Reading

Before you consider LendingClub, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and LendingClub wasn't on the list.

While LendingClub currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.