DekaBank Deutsche Girozentrale lifted its stake in Lear Co. (NYSE:LEA - Free Report) by 24.7% in the third quarter, according to the company in its most recent 13F filing with the SEC. The firm owned 66,098 shares of the auto parts company's stock after purchasing an additional 13,097 shares during the quarter. DekaBank Deutsche Girozentrale owned about 0.12% of Lear worth $7,376,000 at the end of the most recent reporting period.

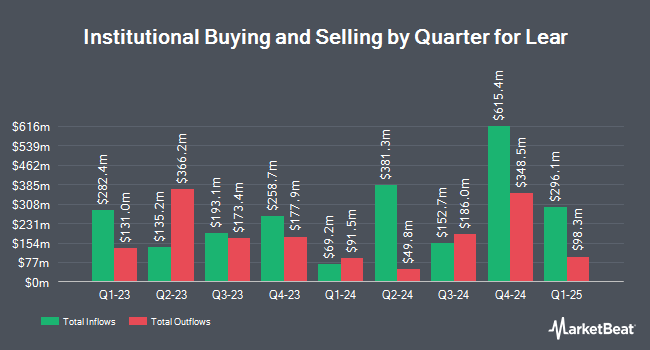

Several other large investors have also recently modified their holdings of the stock. Headlands Technologies LLC purchased a new stake in Lear in the 1st quarter worth about $29,000. Altshuler Shaham Ltd purchased a new stake in shares of Lear in the second quarter worth approximately $26,000. EverSource Wealth Advisors LLC lifted its stake in shares of Lear by 70.5% during the 2nd quarter. EverSource Wealth Advisors LLC now owns 266 shares of the auto parts company's stock worth $32,000 after acquiring an additional 110 shares during the last quarter. Blue Trust Inc. boosted its holdings in Lear by 240.4% during the 3rd quarter. Blue Trust Inc. now owns 303 shares of the auto parts company's stock valued at $35,000 after acquiring an additional 214 shares during the period. Finally, Signaturefd LLC grew its position in Lear by 71.6% in the 3rd quarter. Signaturefd LLC now owns 333 shares of the auto parts company's stock valued at $36,000 after acquiring an additional 139 shares during the last quarter. Institutional investors own 97.04% of the company's stock.

Analysts Set New Price Targets

A number of brokerages have recently issued reports on LEA. UBS Group lowered their target price on shares of Lear from $136.00 to $128.00 and set a "neutral" rating for the company in a research note on Wednesday, July 10th. Deutsche Bank Aktiengesellschaft restated a "hold" rating and issued a $132.00 target price on shares of Lear in a research note on Tuesday, September 10th. Wells Fargo & Company decreased their price target on shares of Lear from $114.00 to $106.00 and set an "equal weight" rating for the company in a research note on Friday, October 25th. Bank of America dropped their price objective on Lear from $180.00 to $170.00 and set a "buy" rating on the stock in a research note on Monday, October 14th. Finally, The Goldman Sachs Group decreased their target price on Lear from $144.00 to $135.00 and set a "buy" rating for the company in a research report on Tuesday, October 1st. Eight equities research analysts have rated the stock with a hold rating and six have given a buy rating to the company's stock. According to data from MarketBeat.com, the company currently has an average rating of "Hold" and an average price target of $141.08.

Get Our Latest Stock Analysis on LEA

Lear Stock Performance

Shares of LEA stock traded down $2.07 during mid-day trading on Thursday, reaching $95.75. The stock had a trading volume of 711,374 shares, compared to its average volume of 658,482. The company has a current ratio of 1.34, a quick ratio of 1.04 and a debt-to-equity ratio of 0.56. Lear Co. has a 1-year low of $95.63 and a 1-year high of $147.11. The firm has a market cap of $5.20 billion, a price-to-earnings ratio of 10.07, a PEG ratio of 0.50 and a beta of 1.44. The business's fifty day moving average is $107.74 and its 200-day moving average is $116.67.

Lear (NYSE:LEA - Get Free Report) last released its earnings results on Thursday, October 24th. The auto parts company reported $2.89 EPS for the quarter, topping analysts' consensus estimates of $2.57 by $0.32. Lear had a net margin of 2.30% and a return on equity of 14.75%. The business had revenue of $5.58 billion during the quarter, compared to analysts' expectations of $5.52 billion. During the same quarter in the previous year, the company earned $2.87 earnings per share. The company's quarterly revenue was down 3.4% on a year-over-year basis. On average, research analysts forecast that Lear Co. will post 12.27 earnings per share for the current year.

Lear Announces Dividend

The firm also recently announced a quarterly dividend, which was paid on Monday, September 23rd. Shareholders of record on Wednesday, September 4th were paid a dividend of $0.77 per share. The ex-dividend date of this dividend was Wednesday, September 4th. This represents a $3.08 annualized dividend and a yield of 3.22%. Lear's dividend payout ratio (DPR) is 32.39%.

Lear Profile

(

Free Report)

Lear Corporation designs, develops, engineers, manufactures, assembles, and supplies automotive seating, and electrical distribution systems and related components for automotive original equipment manufacturers in North America, Europe, Africa, Asia, and South America. Its Seating segment offers seat systems, seat subsystems, keyseat components, seat trim covers, seat mechanisms, seat foams, and headrests, as well as surface materials, such as leather and fabric for automobiles and light trucks, compact cars, pick-up trucks, and sport utility vehicles.

Read More

Before you consider Lear, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lear wasn't on the list.

While Lear currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.