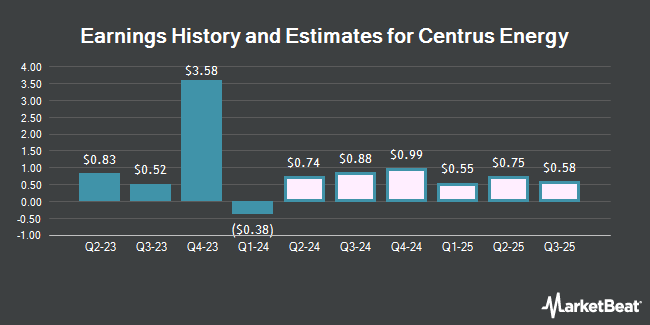

Centrus Energy Corp. (NYSE:LEU - Free Report) - Stock analysts at B. Riley dropped their FY2024 earnings per share (EPS) estimates for Centrus Energy in a note issued to investors on Wednesday, October 30th. B. Riley analyst A. Rygiel now forecasts that the company will post earnings of $2.88 per share for the year, down from their prior forecast of $2.96. B. Riley has a "Buy" rating and a $126.00 price target on the stock. The consensus estimate for Centrus Energy's current full-year earnings is $3.06 per share. B. Riley also issued estimates for Centrus Energy's Q4 2024 earnings at $1.66 EPS and FY2025 earnings at $2.89 EPS.

Centrus Energy (NYSE:LEU - Get Free Report) last posted its quarterly earnings results on Monday, October 28th. The company reported ($0.30) EPS for the quarter, missing analysts' consensus estimates of $0.18 by ($0.48). The company had revenue of $57.70 million during the quarter, compared to analyst estimates of $56.50 million. Centrus Energy had a net margin of 22.96% and a return on equity of 299.92%.

A number of other research analysts also recently commented on the company. Roth Mkm dropped their price target on Centrus Energy from $62.00 to $58.00 and set a "neutral" rating for the company in a research note on Wednesday. Roth Capital cut shares of Centrus Energy from a "strong-buy" rating to a "hold" rating in a report on Thursday, October 10th. Finally, StockNews.com raised shares of Centrus Energy to a "sell" rating in a report on Wednesday, August 7th. One research analyst has rated the stock with a sell rating, two have issued a hold rating and one has given a buy rating to the company's stock. Based on data from MarketBeat.com, the stock currently has a consensus rating of "Hold" and a consensus price target of $92.00.

Get Our Latest Report on LEU

Centrus Energy Price Performance

LEU stock traded up $0.31 during midday trading on Thursday, reaching $103.60. The company had a trading volume of 844,803 shares, compared to its average volume of 348,420. The company has a market capitalization of $1.69 billion, a price-to-earnings ratio of 21.63 and a beta of 1.32. The stock has a 50 day moving average price of $58.76 and a 200-day moving average price of $48.50. Centrus Energy has a 1-year low of $33.51 and a 1-year high of $108.73. The company has a debt-to-equity ratio of 1.47, a current ratio of 1.52 and a quick ratio of 1.02.

Institutional Inflows and Outflows

Institutional investors and hedge funds have recently made changes to their positions in the company. Point72 DIFC Ltd acquired a new position in shares of Centrus Energy in the second quarter valued at approximately $42,000. Wolff Wiese Magana LLC acquired a new position in shares of Centrus Energy in the second quarter valued at approximately $43,000. nVerses Capital LLC increased its stake in shares of Centrus Energy by 133.3% in the second quarter. nVerses Capital LLC now owns 1,400 shares of the company's stock valued at $60,000 after buying an additional 800 shares during the period. Zurcher Kantonalbank Zurich Cantonalbank increased its stake in shares of Centrus Energy by 181.8% in the second quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 2,719 shares of the company's stock valued at $115,000 after buying an additional 1,754 shares during the period. Finally, Heritage Investors Management Corp acquired a new position in shares of Centrus Energy in the third quarter valued at approximately $203,000. Institutional investors and hedge funds own 49.96% of the company's stock.

About Centrus Energy

(

Get Free Report)

Centrus Energy Corp. supplies nuclear fuel components and services for the nuclear power industry in the United States, Belgium, Japan, and internationally. The company operates through two segments, Low-Enriched Uranium (LEU) and Technical Solutions. The LEU segment sells separative work units (SWU) components of LEU; natural uranium hexafluoride, uranium concentrates, and uranium conversion; and enriched uranium products to utilities that operate nuclear power plants.

Read More

Before you consider Centrus Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Centrus Energy wasn't on the list.

While Centrus Energy currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.