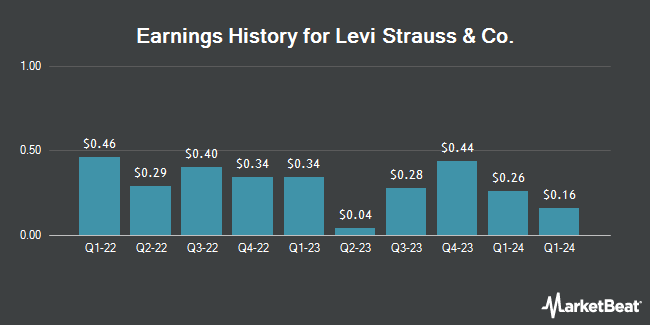

Levi Strauss & Co. (NYSE:LEVI - Get Free Report) issued its quarterly earnings results on Wednesday. The blue-jean maker reported $0.33 earnings per share for the quarter, beating the consensus estimate of $0.31 by $0.02, Briefing.com reports. Levi Strauss & Co. had a return on equity of 23.21% and a net margin of 2.34%. The company had revenue of $1.52 billion during the quarter, compared to the consensus estimate of $1.55 billion. During the same period in the previous year, the firm posted $0.28 EPS. Levi Strauss & Co.'s revenue was up .4% on a year-over-year basis. Levi Strauss & Co. updated its FY24 guidance to $1.17-1.27 EPS and its FY 2024 guidance to 1.170-1.270 EPS.

Levi Strauss & Co. Stock Down 7.7 %

Levi Strauss & Co. stock traded down $1.62 during midday trading on Thursday, hitting $19.44. 11,250,634 shares of the company were exchanged, compared to its average volume of 2,265,744. The company has a market cap of $7.73 billion, a PE ratio of 55.63, a price-to-earnings-growth ratio of 1.19 and a beta of 1.14. Levi Strauss & Co. has a fifty-two week low of $12.41 and a fifty-two week high of $24.34. The company's fifty day moving average price is $19.11 and its 200-day moving average price is $20.34. The company has a debt-to-equity ratio of 0.51, a current ratio of 1.42 and a quick ratio of 0.77.

Levi Strauss & Co. Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Thursday, November 14th. Investors of record on Tuesday, October 29th will be issued a dividend of $0.13 per share. The ex-dividend date of this dividend is Tuesday, October 29th. This represents a $0.52 annualized dividend and a dividend yield of 2.67%. Levi Strauss & Co.'s payout ratio is currently 148.57%.

Analyst Upgrades and Downgrades

Several analysts have commented on LEVI shares. Stifel Nicolaus dropped their price objective on shares of Levi Strauss & Co. from $28.00 to $25.00 and set a "buy" rating for the company in a research note on Thursday. JPMorgan Chase & Co. increased their price target on shares of Levi Strauss & Co. from $20.00 to $21.00 and gave the stock a "neutral" rating in a research note on Thursday. Telsey Advisory Group reiterated an "outperform" rating and issued a $26.00 price target on shares of Levi Strauss & Co. in a report on Thursday. TD Cowen dropped their price objective on Levi Strauss & Co. from $25.00 to $23.00 and set a "buy" rating for the company in a report on Thursday. Finally, Bank of America lifted their target price on Levi Strauss & Co. from $19.00 to $22.00 and gave the company a "neutral" rating in a report on Thursday, June 27th. Four investment analysts have rated the stock with a hold rating and five have assigned a buy rating to the company. According to MarketBeat.com, Levi Strauss & Co. presently has an average rating of "Moderate Buy" and an average price target of $22.75.

View Our Latest Report on LEVI

Insider Buying and Selling at Levi Strauss & Co.

In other news, Director David A. Friedman sold 4,166 shares of the business's stock in a transaction on Tuesday, September 3rd. The shares were sold at an average price of $19.15, for a total transaction of $79,778.90. Following the transaction, the director now directly owns 154,178 shares of the company's stock, valued at $2,952,508.70. The transaction was disclosed in a filing with the SEC, which is available at the SEC website. In other Levi Strauss & Co. news, Director David A. Friedman sold 25,002 shares of the firm's stock in a transaction that occurred on Monday, September 16th. The stock was sold at an average price of $20.00, for a total transaction of $500,040.00. Following the completion of the sale, the director now owns 229,176 shares in the company, valued at approximately $4,583,520. The sale was disclosed in a legal filing with the SEC, which is available through the SEC website. Also, Director David A. Friedman sold 4,166 shares of Levi Strauss & Co. stock in a transaction that occurred on Tuesday, September 3rd. The stock was sold at an average price of $19.15, for a total value of $79,778.90. Following the sale, the director now owns 154,178 shares in the company, valued at $2,952,508.70. The disclosure for this sale can be found here. Insiders sold 33,334 shares of company stock valued at $655,765 over the last 90 days. 3.14% of the stock is owned by corporate insiders.

About Levi Strauss & Co.

(

Get Free Report)

Levi Strauss & Co designs, markets, and sells apparels and related accessories for men, women, and children worldwide. The company offers jeans, casual and dress pants, activewears, tops, shorts, skirts, dresses, jumpsuits, shirts, sweaters, jackets, footwear, and related accessories under the Levi's, Dockers, Signature by Levi Strauss & Co, Denizen, and Beyond Yoga brands.

Read More

Before you consider Levi Strauss & Co., you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Levi Strauss & Co. wasn't on the list.

While Levi Strauss & Co. currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.