Lennox International (NYSE:LII - Get Free Report) had its price target hoisted by Royal Bank of Canada from $604.00 to $619.00 in a research note issued to investors on Thursday, Benzinga reports. The brokerage currently has a "sector perform" rating on the construction company's stock. Royal Bank of Canada's price objective suggests a potential downside of 0.27% from the company's current price.

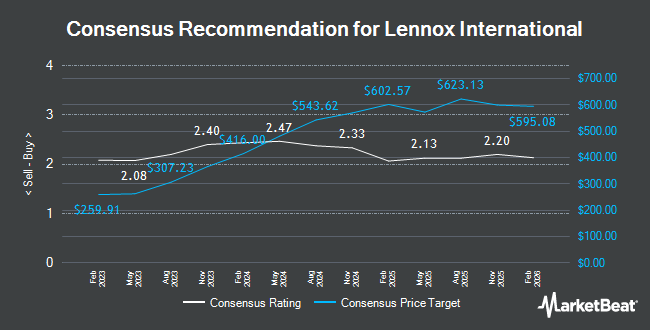

Several other research firms have also weighed in on LII. Wells Fargo & Company upped their target price on shares of Lennox International from $570.00 to $615.00 and gave the stock an "equal weight" rating in a report on Monday, October 7th. Robert W. Baird raised their price objective on shares of Lennox International from $648.00 to $656.00 and gave the stock a "neutral" rating in a report on Thursday. Barclays lifted their target price on shares of Lennox International from $575.00 to $624.00 and gave the company an "equal weight" rating in a research note on Thursday. Mizuho raised their price target on Lennox International from $650.00 to $675.00 and gave the company an "outperform" rating in a report on Thursday. Finally, KeyCorp downgraded Lennox International from an "overweight" rating to a "sector weight" rating in a research report on Tuesday, October 15th. One research analyst has rated the stock with a sell rating, seven have issued a hold rating and five have issued a buy rating to the stock. Based on data from MarketBeat, Lennox International presently has an average rating of "Hold" and an average target price of $583.92.

Read Our Latest Research Report on Lennox International

Lennox International Price Performance

Shares of Lennox International stock traded up $10.92 during trading on Thursday, hitting $620.66. 393,434 shares of the company's stock traded hands, compared to its average volume of 274,277. Lennox International has a twelve month low of $334.53 and a twelve month high of $627.46. The company has a debt-to-equity ratio of 1.95, a current ratio of 1.60 and a quick ratio of 0.90. The company has a market cap of $22.11 billion, a PE ratio of 35.72, a PEG ratio of 1.89 and a beta of 1.07. The firm's fifty day moving average price is $590.77 and its 200 day moving average price is $542.21.

Lennox International (NYSE:LII - Get Free Report) last released its quarterly earnings data on Wednesday, October 23rd. The construction company reported $6.68 earnings per share for the quarter, beating analysts' consensus estimates of $5.91 by $0.77. Lennox International had a return on equity of 198.36% and a net margin of 12.85%. The company had revenue of $1.50 billion for the quarter, compared to the consensus estimate of $1.42 billion. During the same period in the previous year, the business earned $5.37 earnings per share. The company's quarterly revenue was up 9.6% on a year-over-year basis. Analysts forecast that Lennox International will post 20.34 earnings per share for the current year.

Insider Transactions at Lennox International

In related news, CAO Chris Kosel sold 1,744 shares of the stock in a transaction that occurred on Friday, July 26th. The shares were sold at an average price of $573.79, for a total value of $1,000,689.76. Following the transaction, the chief accounting officer now directly owns 1,646 shares in the company, valued at $944,458.34. This represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available at the SEC website. In other news, EVP Prakash Bedapudi sold 3,434 shares of the business's stock in a transaction dated Monday, August 19th. The stock was sold at an average price of $578.00, for a total transaction of $1,984,852.00. Following the completion of the transaction, the executive vice president now directly owns 21,536 shares in the company, valued at approximately $12,447,808. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, CAO Chris Kosel sold 1,744 shares of the stock in a transaction that occurred on Friday, July 26th. The shares were sold at an average price of $573.79, for a total transaction of $1,000,689.76. Following the completion of the sale, the chief accounting officer now owns 1,646 shares in the company, valued at $944,458.34. This represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 13,052 shares of company stock worth $7,563,793 in the last quarter. 10.40% of the stock is owned by company insiders.

Institutional Investors Weigh In On Lennox International

Several large investors have recently bought and sold shares of LII. Massmutual Trust Co. FSB ADV increased its holdings in shares of Lennox International by 38.8% in the second quarter. Massmutual Trust Co. FSB ADV now owns 68 shares of the construction company's stock worth $36,000 after acquiring an additional 19 shares in the last quarter. L & S Advisors Inc grew its holdings in shares of Lennox International by 0.8% during the second quarter. L & S Advisors Inc now owns 5,335 shares of the construction company's stock worth $2,854,000 after buying an additional 40 shares in the last quarter. Argent Trust Co raised its position in Lennox International by 6.6% in the 2nd quarter. Argent Trust Co now owns 665 shares of the construction company's stock valued at $356,000 after buying an additional 41 shares during the last quarter. Innealta Capital LLC bought a new stake in Lennox International in the 2nd quarter valued at approximately $33,000. Finally, Toronto Dominion Bank boosted its position in Lennox International by 2.2% during the 2nd quarter. Toronto Dominion Bank now owns 3,119 shares of the construction company's stock worth $1,669,000 after acquiring an additional 66 shares during the last quarter. Institutional investors own 67.07% of the company's stock.

Lennox International Company Profile

(

Get Free Report)

Lennox International Inc, together with its subsidiaries, designs, manufactures, and markets a range of products for the heating, ventilation, air conditioning, and refrigeration markets in the United States, Canada, and internationally. The Home Comfort Solutions segment provides furnaces, air conditioners, heat pumps, packaged heating and cooling systems, indoor air quality equipment, comfort control products, and replacement parts and supplies; residential heating, ventilation, cooling equipment, and air conditioning; and evaporator coils and unit heaters under Lennox, Dave Lennox Signature Collection, Armstrong Air, Ducane, AirEase, Concord, MagicPak, Advanced Distributor Products, Allied, Elite Series, Merit Series, Comfort Sync, Healthy Climate, iComfort, ComfortSense, and Lennox Stores name.

Featured Articles

Before you consider Lennox International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lennox International wasn't on the list.

While Lennox International currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report