Calton & Associates Inc. increased its holdings in Lockheed Martin Co. (NYSE:LMT - Free Report) by 190.9% in the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 2,755 shares of the aerospace company's stock after purchasing an additional 1,808 shares during the period. Calton & Associates Inc.'s holdings in Lockheed Martin were worth $1,611,000 at the end of the most recent reporting period.

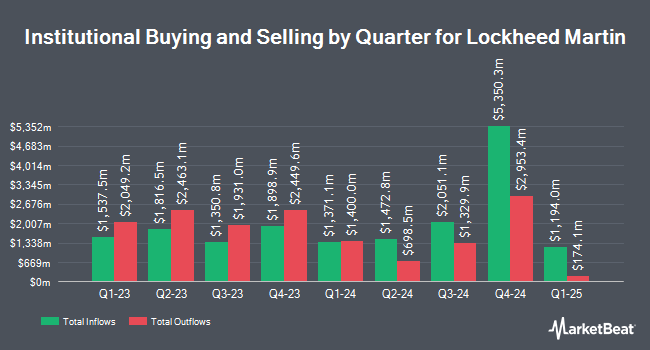

Other large investors have also recently bought and sold shares of the company. GAMMA Investing LLC boosted its holdings in Lockheed Martin by 130.0% during the second quarter. GAMMA Investing LLC now owns 3,572 shares of the aerospace company's stock valued at $1,668,000 after acquiring an additional 2,019 shares during the period. Buck Wealth Strategies LLC bought a new stake in Lockheed Martin during the second quarter valued at about $6,611,000. Verity & Verity LLC boosted its holdings in Lockheed Martin by 3.2% during the second quarter. Verity & Verity LLC now owns 34,236 shares of the aerospace company's stock valued at $15,992,000 after acquiring an additional 1,071 shares during the period. Watts Gwilliam & Co. LLC bought a new stake in Lockheed Martin during the third quarter valued at about $1,096,000. Finally, New Mexico Educational Retirement Board boosted its holdings in Lockheed Martin by 20.5% during the first quarter. New Mexico Educational Retirement Board now owns 14,097 shares of the aerospace company's stock valued at $6,222,000 after acquiring an additional 2,400 shares during the period. 74.19% of the stock is currently owned by institutional investors.

Insider Transactions at Lockheed Martin

In other news, insider Timothy S. Cahill sold 3,975 shares of the stock in a transaction that occurred on Wednesday, July 24th. The shares were sold at an average price of $515.36, for a total transaction of $2,048,556.00. Following the sale, the insider now directly owns 8,877 shares of the company's stock, valued at $4,574,850.72. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Company insiders own 0.17% of the company's stock.

Lockheed Martin Price Performance

Shares of NYSE LMT traded down $37.89 during mid-day trading on Tuesday, hitting $576.72. 2,256,887 shares of the stock were exchanged, compared to its average volume of 1,052,953. The company has a market cap of $138.38 billion, a P/E ratio of 21.02, a PEG ratio of 4.84 and a beta of 0.47. The stock's fifty day simple moving average is $579.45 and its two-hundred day simple moving average is $512.24. The company has a debt-to-equity ratio of 3.10, a quick ratio of 1.07 and a current ratio of 1.24. Lockheed Martin Co. has a twelve month low of $413.92 and a twelve month high of $618.95.

Lockheed Martin (NYSE:LMT - Get Free Report) last posted its quarterly earnings data on Tuesday, July 23rd. The aerospace company reported $7.11 earnings per share for the quarter, topping the consensus estimate of $6.45 by $0.66. The company had revenue of $18.12 billion during the quarter, compared to analyst estimates of $17.05 billion. Lockheed Martin had a net margin of 9.48% and a return on equity of 95.03%. The company's revenue was up 8.6% on a year-over-year basis. During the same quarter last year, the business posted $6.73 earnings per share. As a group, analysts forecast that Lockheed Martin Co. will post 26.68 EPS for the current fiscal year.

Lockheed Martin Increases Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Friday, December 27th. Stockholders of record on Monday, December 2nd will be issued a dividend of $3.30 per share. This is a positive change from Lockheed Martin's previous quarterly dividend of $3.15. The ex-dividend date is Monday, December 2nd. This represents a $13.20 annualized dividend and a dividend yield of 2.29%. Lockheed Martin's dividend payout ratio (DPR) is presently 48.30%.

Analyst Ratings Changes

LMT has been the subject of a number of research analyst reports. JPMorgan Chase & Co. upped their price objective on shares of Lockheed Martin from $560.00 to $630.00 and gave the company an "overweight" rating in a research report on Monday, October 14th. Morgan Stanley upped their price objective on shares of Lockheed Martin from $503.00 to $599.00 and gave the company an "equal weight" rating in a research report on Friday, August 9th. Deutsche Bank Aktiengesellschaft upped their price objective on shares of Lockheed Martin from $600.00 to $620.00 and gave the company a "buy" rating in a research report on Thursday, October 3rd. Citigroup upped their price objective on shares of Lockheed Martin from $570.00 to $700.00 and gave the company a "buy" rating in a research report on Thursday, October 10th. Finally, Royal Bank of Canada upped their price objective on shares of Lockheed Martin from $600.00 to $675.00 and gave the company an "outperform" rating in a research report on Monday, October 7th. One analyst has rated the stock with a sell rating, four have given a hold rating, seven have given a buy rating and three have assigned a strong buy rating to the company. Based on data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and an average target price of $599.93.

Read Our Latest Stock Analysis on LMT

Lockheed Martin Company Profile

(

Free Report)

Lockheed Martin Corporation, a security and aerospace company, engages in the research, design, development, manufacture, integration, and sustainment of technology systems, products, and services worldwide. The company operates through Aeronautics, Missiles and Fire Control, Rotary and Mission Systems, and Space segments.

Featured Stories

Before you consider Lockheed Martin, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lockheed Martin wasn't on the list.

While Lockheed Martin currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.