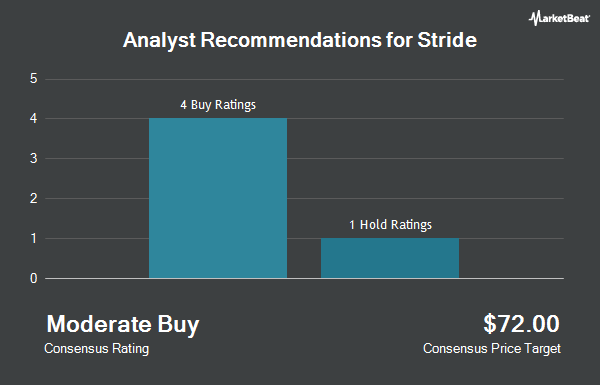

Shares of Stride, Inc. (NYSE:LRN - Get Free Report) have been given a consensus rating of "Moderate Buy" by the seven ratings firms that are currently covering the firm, MarketBeat reports. Two research analysts have rated the stock with a hold recommendation and five have issued a buy recommendation on the company. The average twelve-month target price among brokers that have issued a report on the stock in the last year is $90.17.

A number of analysts have commented on LRN shares. StockNews.com lowered shares of Stride from a "buy" rating to a "hold" rating in a report on Wednesday, October 23rd. Canaccord Genuity Group started coverage on shares of Stride in a report on Thursday, August 8th. They set a "buy" rating and a $94.00 target price for the company. Citigroup boosted their price target on Stride from $90.00 to $94.00 and gave the stock a "neutral" rating in a research report on Tuesday. Canaccord Genuity Group lifted their price target on Stride from $94.00 to $100.00 and gave the stock a "buy" rating in a report on Wednesday, October 23rd. Finally, Barrington Research increased their price objective on shares of Stride from $90.00 to $100.00 and gave the company an "outperform" rating in a research report on Wednesday, October 23rd.

View Our Latest Stock Report on Stride

Stride Trading Up 3.3 %

Shares of Stride stock traded up $3.00 on Wednesday, reaching $94.07. 1,155,971 shares of the company were exchanged, compared to its average volume of 841,405. Stride has a fifty-two week low of $54.61 and a fifty-two week high of $95.47. The company has a current ratio of 5.10, a quick ratio of 4.95 and a debt-to-equity ratio of 0.38. The firm has a market capitalization of $4.07 billion, a price-to-earnings ratio of 22.08, a price-to-earnings-growth ratio of 0.64 and a beta of 0.26. The stock has a fifty day moving average price of $80.05 and a 200-day moving average price of $73.63.

Stride (NYSE:LRN - Get Free Report) last issued its quarterly earnings data on Tuesday, October 22nd. The company reported $0.94 EPS for the quarter, beating analysts' consensus estimates of $0.22 by $0.72. The business had revenue of $551.08 million for the quarter, compared to analyst estimates of $504.29 million. Stride had a return on equity of 21.76% and a net margin of 11.38%. The firm's revenue for the quarter was up 14.8% on a year-over-year basis. During the same quarter in the prior year, the firm posted $0.11 EPS. On average, analysts expect that Stride will post 5.04 EPS for the current year.

Insider Buying and Selling at Stride

In other Stride news, Director Todd Goldthwaite sold 8,028 shares of the business's stock in a transaction on Friday, October 25th. The shares were sold at an average price of $91.54, for a total transaction of $734,883.12. Following the sale, the director now owns 85,058 shares of the company's stock, valued at $7,786,209.32. The trade was a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this link. Company insiders own 2.76% of the company's stock.

Institutional Investors Weigh In On Stride

Several large investors have recently added to or reduced their stakes in the business. Mendota Financial Group LLC purchased a new position in Stride in the third quarter worth $86,000. nVerses Capital LLC purchased a new position in shares of Stride in the 2nd quarter worth about $78,000. Motco bought a new position in shares of Stride during the 1st quarter valued at about $74,000. EntryPoint Capital LLC purchased a new position in shares of Stride during the 1st quarter valued at about $77,000. Finally, GAMMA Investing LLC lifted its position in Stride by 45.3% in the 3rd quarter. GAMMA Investing LLC now owns 2,061 shares of the company's stock worth $176,000 after buying an additional 643 shares during the last quarter. Institutional investors own 98.24% of the company's stock.

Stride Company Profile

(

Get Free ReportStride, Inc, a technology-based education service company, engages in the provision of proprietary and third-party online curriculum, software systems, and educational services in the United States and internationally. Its technology-based products and services enable clients to attract, enroll, educate, track progress, support, and facilitate individualized learning for students.

Featured Articles

Before you consider Stride, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Stride wasn't on the list.

While Stride currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.