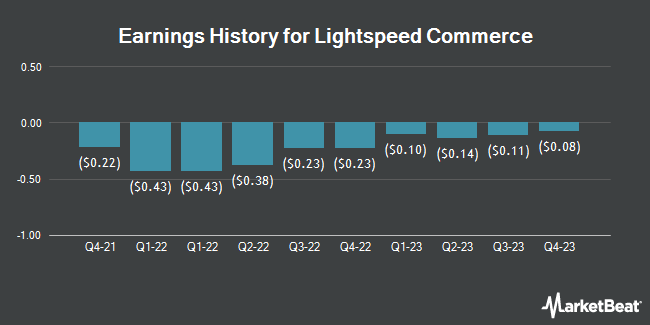

Lightspeed Commerce (NYSE:LSPD - Get Free Report) will be releasing its earnings data before the market opens on Thursday, November 7th. Analysts expect Lightspeed Commerce to post earnings of $0.10 per share for the quarter.

Lightspeed Commerce (NYSE:LSPD - Get Free Report) last issued its earnings results on Thursday, August 1st. The company reported $0.10 EPS for the quarter, topping the consensus estimate of $0.07 by $0.03. Lightspeed Commerce had a negative return on equity of 0.99% and a negative net margin of 15.55%. The company had revenue of $266.10 million during the quarter, compared to the consensus estimate of $258.58 million. During the same period in the previous year, the company posted ($0.14) EPS. The firm's revenue for the quarter was up 27.3% compared to the same quarter last year. On average, analysts expect Lightspeed Commerce to post $0 EPS for the current fiscal year and $0 EPS for the next fiscal year.

Lightspeed Commerce Stock Performance

LSPD traded up $0.07 during trading hours on Thursday, reaching $15.12. The company's stock had a trading volume of 1,591,384 shares, compared to its average volume of 1,102,479. The company has a debt-to-equity ratio of 0.01, a quick ratio of 6.06 and a current ratio of 6.19. The company's 50-day moving average is $14.43 and its 200-day moving average is $13.96. Lightspeed Commerce has a 52 week low of $11.01 and a 52 week high of $21.71. The firm has a market cap of $2.29 billion, a PE ratio of -15.36, a price-to-earnings-growth ratio of 9.73 and a beta of 2.34.

Analyst Upgrades and Downgrades

Several analysts recently weighed in on the company. Benchmark reissued a "buy" rating and set a $20.00 price target on shares of Lightspeed Commerce in a report on Thursday, September 26th. BMO Capital Markets raised their target price on shares of Lightspeed Commerce from $18.00 to $20.00 and gave the stock an "outperform" rating in a report on Thursday, September 26th. BTIG Research restated a "buy" rating and set a $21.00 price objective on shares of Lightspeed Commerce in a research note on Thursday, September 26th. Piper Sandler reduced their target price on Lightspeed Commerce from $17.00 to $15.00 and set a "neutral" rating on the stock in a report on Friday, August 2nd. Finally, Royal Bank of Canada downgraded Lightspeed Commerce from a "moderate buy" rating to a "strong sell" rating in a research note on Thursday, August 15th. One analyst has rated the stock with a sell rating, nine have issued a hold rating, six have issued a buy rating and one has given a strong buy rating to the stock. According to MarketBeat.com, the company presently has an average rating of "Hold" and a consensus target price of $18.69.

Get Our Latest Stock Report on LSPD

About Lightspeed Commerce

(

Get Free Report)

Lightspeed Commerce Inc engages in sale of cloud-based software subscriptions and payments solutions for small and midsize businesses, retailers, restaurants, and golf course operators in North America, Europe, the United Kingdom, Australia, New Zealand, and internationally. Its Software as a Service platform enables customers to engage with consumers, manage operations, accept payments, etc.

See Also

Before you consider Lightspeed Commerce, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lightspeed Commerce wasn't on the list.

While Lightspeed Commerce currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.