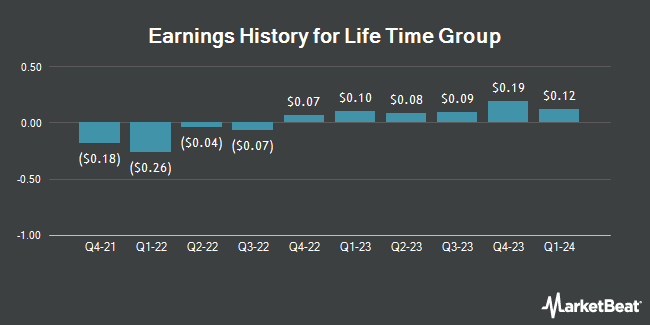

Life Time Group (NYSE:LTH - Get Free Report) posted its earnings results on Thursday. The company reported $0.19 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.20 by ($0.01), Briefing.com reports. The firm had revenue of $693.20 million during the quarter, compared to analysts' expectations of $684.13 million. Life Time Group had a return on equity of 5.36% and a net margin of 4.54%. The business's revenue for the quarter was up 18.5% compared to the same quarter last year. During the same quarter in the prior year, the company earned $0.09 earnings per share. Life Time Group updated its FY 2024 guidance to EPS.

Life Time Group Trading Down 8.1 %

NYSE:LTH traded down $2.05 during trading hours on Thursday, reaching $23.27. The company's stock had a trading volume of 2,647,473 shares, compared to its average volume of 1,109,028. The company has a debt-to-equity ratio of 0.77, a quick ratio of 0.32 and a current ratio of 0.44. The firm has a market capitalization of $4.63 billion, a price-to-earnings ratio of 64.64, a PEG ratio of 3.20 and a beta of 1.87. The firm has a 50-day simple moving average of $24.47 and a 200-day simple moving average of $20.04. Life Time Group has a 1 year low of $11.10 and a 1 year high of $27.11.

Insider Buying and Selling at Life Time Group

In other news, major shareholder Partners Group Private Equity sold 650,000 shares of Life Time Group stock in a transaction dated Wednesday, August 14th. The stock was sold at an average price of $20.88, for a total value of $13,572,000.00. Following the transaction, the insider now owns 5,929,348 shares in the company, valued at approximately $123,804,786.24. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. In other Life Time Group news, Director John G. Danhakl sold 3,575,000 shares of the stock in a transaction on Wednesday, August 14th. The shares were sold at an average price of $20.88, for a total transaction of $74,646,000.00. Following the completion of the sale, the director now owns 55,166,700 shares of the company's stock, valued at $1,151,880,696. This represents a 0.00 % decrease in their position. The sale was disclosed in a filing with the SEC, which is available at the SEC website. Also, major shareholder Partners Group Private Equity sold 650,000 shares of the business's stock in a transaction dated Wednesday, August 14th. The shares were sold at an average price of $20.88, for a total transaction of $13,572,000.00. Following the completion of the transaction, the insider now owns 5,929,348 shares in the company, valued at $123,804,786.24. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 4,229,662 shares of company stock worth $88,338,653 over the last three months. Company insiders own 12.50% of the company's stock.

Wall Street Analysts Forecast Growth

LTH has been the subject of several recent analyst reports. Morgan Stanley boosted their target price on Life Time Group from $21.00 to $29.00 and gave the stock an "equal weight" rating in a research report on Wednesday, October 16th. Bank of America boosted their price objective on Life Time Group from $29.00 to $30.00 and gave the stock a "buy" rating in a report on Friday, September 6th. The Goldman Sachs Group raised their target price on shares of Life Time Group from $15.00 to $22.00 and gave the company a "neutral" rating in a research note on Friday, August 2nd. Wells Fargo & Company increased their price target on shares of Life Time Group from $21.00 to $25.00 and gave the stock an "equal weight" rating in a report on Wednesday, October 16th. Finally, Royal Bank of Canada lifted their price objective on shares of Life Time Group from $20.00 to $27.00 and gave the stock an "outperform" rating in a report on Friday, August 2nd. Three equities research analysts have rated the stock with a hold rating and five have given a buy rating to the company's stock. According to data from MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and an average price target of $27.56.

View Our Latest Stock Report on LTH

About Life Time Group

(

Get Free Report)

Life Time Group Holdings, Inc provides health, fitness, and wellness experiences to a community of individual members in the United States and Canada. It primarily engages in designing, building, and operating of sports and athletic, professional fitness, family recreation, and spa centers in a resort-like environment, principally in suburban and urban locations of metropolitan areas.

Further Reading

Before you consider Life Time Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Life Time Group wasn't on the list.

While Life Time Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.