Raymond James & Associates increased its position in Lloyds Banking Group plc (NYSE:LYG - Free Report) by 37.4% in the 3rd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 3,416,484 shares of the financial services provider's stock after purchasing an additional 929,478 shares during the quarter. Raymond James & Associates' holdings in Lloyds Banking Group were worth $10,659,000 at the end of the most recent quarter.

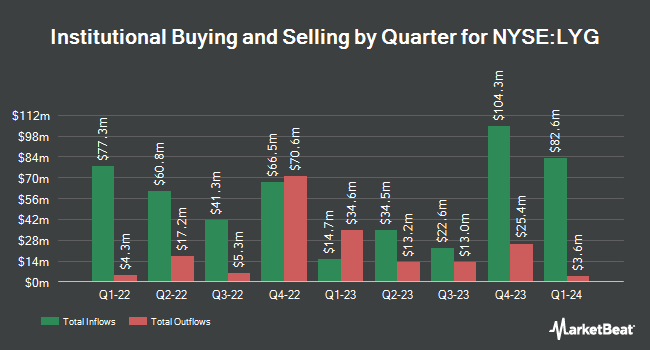

Other hedge funds and other institutional investors have also recently bought and sold shares of the company. Clearbridge Investments LLC bought a new position in shares of Lloyds Banking Group during the second quarter valued at $36,252,000. First Eagle Investment Management LLC increased its stake in shares of Lloyds Banking Group by 9.2% in the first quarter. First Eagle Investment Management LLC now owns 4,060,740 shares of the financial services provider's stock valued at $10,517,000 after buying an additional 343,753 shares in the last quarter. CreativeOne Wealth LLC increased its stake in shares of Lloyds Banking Group by 166.2% in the first quarter. CreativeOne Wealth LLC now owns 47,224 shares of the financial services provider's stock valued at $122,000 after buying an additional 29,486 shares in the last quarter. CWM LLC increased its stake in shares of Lloyds Banking Group by 37.9% in the second quarter. CWM LLC now owns 71,039 shares of the financial services provider's stock valued at $194,000 after buying an additional 19,525 shares in the last quarter. Finally, Sequoia Financial Advisors LLC increased its position in Lloyds Banking Group by 7.3% in the second quarter. Sequoia Financial Advisors LLC now owns 61,586 shares of the financial services provider's stock worth $168,000 after purchasing an additional 4,194 shares during the period. 2.15% of the stock is owned by institutional investors.

Analysts Set New Price Targets

A number of brokerages recently commented on LYG. Royal Bank of Canada lowered Lloyds Banking Group from an "outperform" rating to a "sector perform" rating in a research report on Friday, July 26th. UBS Group restated a "neutral" rating on shares of Lloyds Banking Group in a research report on Tuesday, July 30th. Kepler Capital Markets began coverage on Lloyds Banking Group in a report on Thursday, September 5th. They set a "hold" rating on the stock. Citigroup cut Lloyds Banking Group from a "buy" rating to a "neutral" rating in a report on Monday, August 5th. Finally, The Goldman Sachs Group began coverage on Lloyds Banking Group in a report on Friday, October 4th. They set a "neutral" rating on the stock. Six analysts have rated the stock with a hold rating and four have issued a buy rating to the company. According to MarketBeat, the company currently has an average rating of "Hold" and a consensus price target of $2.75.

View Our Latest Stock Report on Lloyds Banking Group

Lloyds Banking Group Stock Down 2.9 %

NYSE LYG traded down $0.08 during trading on Tuesday, hitting $2.82. The stock had a trading volume of 14,938,500 shares, compared to its average volume of 9,615,778. The company has a market capitalization of $44.00 billion, a PE ratio of 7.62 and a beta of 1.34. The company's 50-day moving average price is $3.07 and its two-hundred day moving average price is $2.89. The company has a debt-to-equity ratio of 1.89, a quick ratio of 1.48 and a current ratio of 1.45. Lloyds Banking Group plc has a 12 month low of $1.90 and a 12 month high of $3.24.

About Lloyds Banking Group

(

Free Report)

Lloyds Banking Group plc, together with its subsidiaries, provides a range of banking and financial services in the United Kingdom and internationally. It operates in three segments: Retail; Commercial Banking; and Insurance, Pensions and Investments. The Retail segment offers a range of financial service products, including current accounts, savings, mortgages, motor finance, unsecured loans, leasing solutions, and credit cards to personal customers.

See Also

Before you consider Lloyds Banking Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lloyds Banking Group wasn't on the list.

While Lloyds Banking Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.