MONECO Advisors LLC purchased a new position in Mid-America Apartment Communities, Inc. (NYSE:MAA - Free Report) during the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm purchased 11,941 shares of the real estate investment trust's stock, valued at approximately $1,897,000.

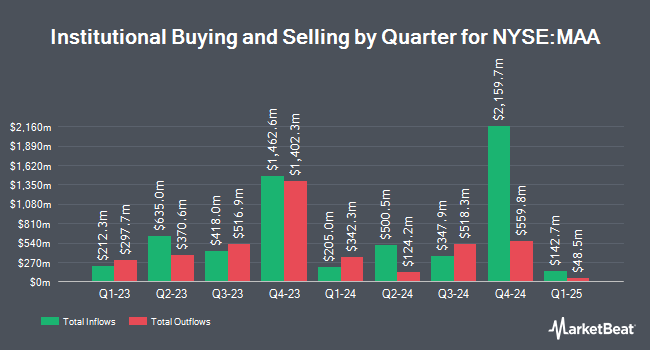

Other hedge funds and other institutional investors have also recently modified their holdings of the company. Johnson Investment Counsel Inc. increased its position in shares of Mid-America Apartment Communities by 1.1% during the second quarter. Johnson Investment Counsel Inc. now owns 6,986 shares of the real estate investment trust's stock valued at $996,000 after acquiring an additional 77 shares during the last quarter. Telos Capital Management Inc. lifted its position in shares of Mid-America Apartment Communities by 0.8% during the 2nd quarter. Telos Capital Management Inc. now owns 10,076 shares of the real estate investment trust's stock worth $1,437,000 after buying an additional 78 shares during the last quarter. V Square Quantitative Management LLC lifted its position in shares of Mid-America Apartment Communities by 6.4% during the 3rd quarter. V Square Quantitative Management LLC now owns 1,444 shares of the real estate investment trust's stock worth $229,000 after buying an additional 87 shares during the last quarter. B. Riley Wealth Advisors Inc. lifted its position in shares of Mid-America Apartment Communities by 5.4% during the 1st quarter. B. Riley Wealth Advisors Inc. now owns 1,762 shares of the real estate investment trust's stock worth $227,000 after buying an additional 90 shares during the last quarter. Finally, Covestor Ltd lifted its position in shares of Mid-America Apartment Communities by 12.3% during the 1st quarter. Covestor Ltd now owns 848 shares of the real estate investment trust's stock worth $112,000 after buying an additional 93 shares during the last quarter. 93.60% of the stock is owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

Several analysts recently commented on MAA shares. Raymond James upgraded shares of Mid-America Apartment Communities from a "market perform" rating to a "strong-buy" rating and set a $175.00 price target for the company in a research report on Monday, October 21st. Deutsche Bank Aktiengesellschaft upped their price target on shares of Mid-America Apartment Communities from $139.00 to $163.00 and gave the company a "hold" rating in a research report on Tuesday, September 10th. Truist Financial upped their price target on shares of Mid-America Apartment Communities from $156.00 to $167.00 and gave the company a "buy" rating in a research report on Monday, August 26th. JMP Securities boosted their price objective on shares of Mid-America Apartment Communities from $145.00 to $160.00 and gave the company a "market outperform" rating in a research note on Friday, August 2nd. Finally, Wedbush boosted their price objective on shares of Mid-America Apartment Communities from $154.00 to $184.00 and gave the company an "outperform" rating in a research note on Monday, August 5th. One analyst has rated the stock with a sell rating, eight have issued a hold rating, eight have issued a buy rating and one has given a strong buy rating to the company's stock. Based on data from MarketBeat.com, Mid-America Apartment Communities has an average rating of "Moderate Buy" and an average target price of $160.75.

Get Our Latest Report on Mid-America Apartment Communities

Mid-America Apartment Communities Trading Down 1.8 %

NYSE:MAA traded down $2.82 on Tuesday, reaching $150.97. The stock had a trading volume of 664,930 shares, compared to its average volume of 749,592. The company has a market cap of $17.64 billion, a price-to-earnings ratio of 31.65, a P/E/G ratio of 2.48 and a beta of 0.88. The company has a debt-to-equity ratio of 0.76, a current ratio of 0.12 and a quick ratio of 0.12. The firm's fifty day moving average is $158.32 and its two-hundred day moving average is $145.69. Mid-America Apartment Communities, Inc. has a 12-month low of $115.56 and a 12-month high of $167.39.

Mid-America Apartment Communities Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Thursday, October 31st. Shareholders of record on Tuesday, October 15th will be issued a $1.47 dividend. The ex-dividend date of this dividend is Tuesday, October 15th. This represents a $5.88 dividend on an annualized basis and a yield of 3.89%. Mid-America Apartment Communities's dividend payout ratio (DPR) is 123.27%.

Mid-America Apartment Communities Company Profile

(

Free Report)

MAA, an S&P 500 company, is a real estate investment trust (REIT) focused on delivering full-cycle and superior investment performance for shareholders through the ownership, management, acquisition, development and redevelopment of quality apartment communities primarily in the Southeast, Southwest and Mid-Atlantic regions of the United States.

Featured Articles

Before you consider Mid-America Apartment Communities, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mid-America Apartment Communities wasn't on the list.

While Mid-America Apartment Communities currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.