Milestones Administradora de Recursos Ltda. lifted its stake in Moody's Co. (NYSE:MCO - Free Report) by 79.2% during the 3rd quarter, according to its most recent disclosure with the SEC. The institutional investor owned 4,480 shares of the business services provider's stock after buying an additional 1,980 shares during the quarter. Moody's makes up about 0.8% of Milestones Administradora de Recursos Ltda.'s investment portfolio, making the stock its 18th largest position. Milestones Administradora de Recursos Ltda.'s holdings in Moody's were worth $2,126,000 as of its most recent filing with the SEC.

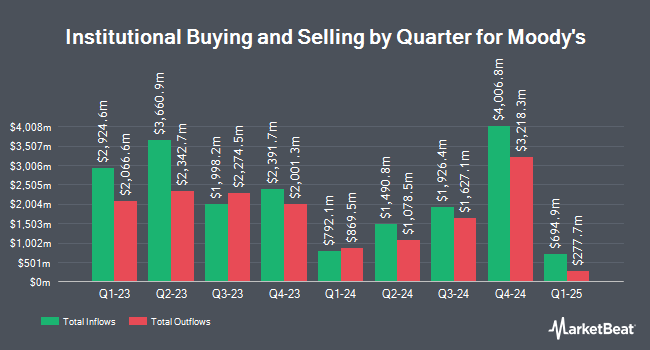

Other institutional investors have also added to or reduced their stakes in the company. PineStone Asset Management Inc. grew its stake in Moody's by 133.9% in the second quarter. PineStone Asset Management Inc. now owns 2,277,056 shares of the business services provider's stock valued at $958,481,000 after purchasing an additional 1,303,434 shares during the last quarter. International Assets Investment Management LLC raised its holdings in Moody's by 74,000.1% in the 3rd quarter. International Assets Investment Management LLC now owns 724,699 shares of the business services provider's stock worth $343,935,000 after purchasing an additional 723,721 shares during the period. Manning & Napier Advisors LLC acquired a new stake in shares of Moody's in the second quarter valued at about $141,336,000. Wulff Hansen & CO. raised its holdings in shares of Moody's by 41,992.9% during the second quarter. Wulff Hansen & CO. now owns 279,918 shares of the business services provider's stock valued at $117,826,000 after acquiring an additional 279,253 shares during the last quarter. Finally, Allen Investment Management LLC lifted its stake in shares of Moody's by 39.7% in the first quarter. Allen Investment Management LLC now owns 895,050 shares of the business services provider's stock worth $351,781,000 after buying an additional 254,178 shares in the last quarter. Hedge funds and other institutional investors own 92.11% of the company's stock.

Moody's Stock Performance

Shares of NYSE:MCO traded up $1.70 during trading hours on Wednesday, hitting $462.20. The stock had a trading volume of 99,289 shares, compared to its average volume of 737,620. Moody's Co. has a 1-year low of $303.98 and a 1-year high of $495.10. The company has a debt-to-equity ratio of 1.59, a quick ratio of 1.52 and a current ratio of 1.52. The firm has a market capitalization of $84.40 billion, a price-to-earnings ratio of 50.27, a PEG ratio of 3.10 and a beta of 1.29. The stock's fifty day simple moving average is $477.63 and its 200 day simple moving average is $440.08.

Moody's (NYSE:MCO - Get Free Report) last posted its quarterly earnings data on Tuesday, October 22nd. The business services provider reported $3.21 EPS for the quarter, topping analysts' consensus estimates of $2.89 by $0.32. The firm had revenue of $1.81 billion during the quarter, compared to analyst estimates of $1.71 billion. Moody's had a net margin of 28.34% and a return on equity of 57.03%. The company's revenue was up 23.2% on a year-over-year basis. During the same quarter last year, the business posted $2.43 EPS. Sell-side analysts anticipate that Moody's Co. will post 11.46 earnings per share for the current fiscal year.

Moody's Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Friday, December 13th. Stockholders of record on Friday, November 22nd will be issued a dividend of $0.85 per share. The ex-dividend date of this dividend is Friday, November 22nd. This represents a $3.40 annualized dividend and a dividend yield of 0.74%. Moody's's payout ratio is 37.12%.

Insider Transactions at Moody's

In other Moody's news, SVP Richard G. Steele sold 1,862 shares of the business's stock in a transaction dated Thursday, August 8th. The shares were sold at an average price of $455.43, for a total value of $848,010.66. Following the transaction, the senior vice president now directly owns 1,040 shares in the company, valued at $473,647.20. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. In related news, SVP Richard G. Steele sold 1,862 shares of the business's stock in a transaction that occurred on Thursday, August 8th. The shares were sold at an average price of $455.43, for a total transaction of $848,010.66. Following the completion of the sale, the senior vice president now directly owns 1,040 shares of the company's stock, valued at $473,647.20. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available at this link. Also, SVP Caroline Sullivan sold 1,681 shares of the business's stock in a transaction that occurred on Monday, October 28th. The stock was sold at an average price of $462.40, for a total transaction of $777,294.40. Following the sale, the senior vice president now directly owns 1,415 shares of the company's stock, valued at approximately $654,296. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last 90 days, insiders have sold 4,612 shares of company stock worth $2,110,119. 0.07% of the stock is currently owned by company insiders.

Analyst Ratings Changes

MCO has been the topic of a number of recent analyst reports. Barclays upped their price objective on Moody's from $500.00 to $570.00 and gave the company an "overweight" rating in a report on Friday, September 13th. Stifel Nicolaus increased their price target on Moody's from $454.00 to $459.00 and gave the company a "hold" rating in a research report on Wednesday, October 23rd. The Goldman Sachs Group increased their target price on Moody's from $460.00 to $514.00 and gave the company a "neutral" rating in a report on Tuesday, September 3rd. UBS Group increased their target price on shares of Moody's from $495.00 to $510.00 and gave the company a "neutral" rating in a research report on Wednesday, October 23rd. Finally, Robert W. Baird lifted their target price on shares of Moody's from $490.00 to $512.00 and gave the company an "outperform" rating in a report on Wednesday, October 23rd. One investment analyst has rated the stock with a sell rating, six have issued a hold rating and eight have given a buy rating to the company's stock. According to MarketBeat.com, the company presently has a consensus rating of "Hold" and a consensus target price of $500.00.

View Our Latest Analysis on MCO

About Moody's

(

Free Report)

Moody's Corporation operates as an integrated risk assessment firm worldwide. It operates in two segments, Moody's Analytics and Moody's Investors Services. The Moody's Analytics segment develops a range of products and services that support the risk management activities of institutional participants in financial markets.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Moody's, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Moody's wasn't on the list.

While Moody's currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report