M/I Homes (NYSE:MHO - Get Free Report) is scheduled to be releasing its earnings data before the market opens on Wednesday, October 30th. Analysts expect M/I Homes to post earnings of $4.94 per share for the quarter. Individual that wish to listen to the company's earnings conference call can do so using this link.

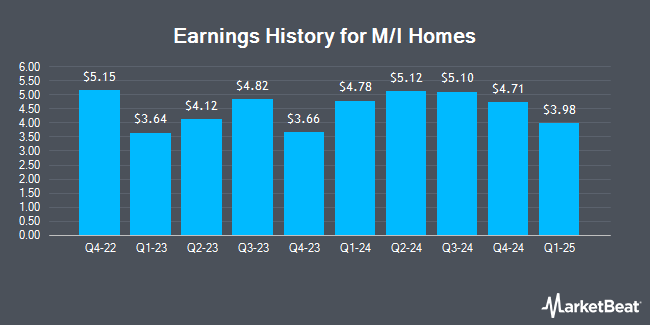

M/I Homes (NYSE:MHO - Get Free Report) last posted its quarterly earnings data on Tuesday, July 30th. The construction company reported $5.12 EPS for the quarter, beating analysts' consensus estimates of $4.60 by $0.52. The company had revenue of $1.11 billion during the quarter, compared to analysts' expectations of $1.06 billion. M/I Homes had a return on equity of 20.50% and a net margin of 12.67%. During the same quarter in the prior year, the business earned $4.12 earnings per share. On average, analysts expect M/I Homes to post $20 EPS for the current fiscal year and $21 EPS for the next fiscal year.

M/I Homes Stock Performance

Shares of M/I Homes stock traded up $0.18 during trading hours on Wednesday, reaching $158.26. 179,016 shares of the stock traded hands, compared to its average volume of 275,632. M/I Homes has a one year low of $76.38 and a one year high of $176.18. The firm has a market capitalization of $4.39 billion, a price-to-earnings ratio of 9.09 and a beta of 2.23. The company has a quick ratio of 1.76, a current ratio of 6.62 and a debt-to-equity ratio of 0.33. The company has a 50 day moving average price of $161.91 and a 200 day moving average price of $140.61.

Insider Activity at M/I Homes

In other news, CFO Phillip G. Creek sold 2,767 shares of the company's stock in a transaction dated Thursday, August 1st. The stock was sold at an average price of $166.24, for a total value of $459,986.08. Following the completion of the transaction, the chief financial officer now owns 18,545 shares of the company's stock, valued at $3,082,920.80. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available at this hyperlink. In other news, CFO Phillip G. Creek sold 2,767 shares of the business's stock in a transaction on Thursday, August 1st. The shares were sold at an average price of $166.24, for a total value of $459,986.08. Following the transaction, the chief financial officer now owns 18,545 shares of the company's stock, valued at approximately $3,082,920.80. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, CEO Robert H. Schottenstein sold 2,089 shares of the company's stock in a transaction on Thursday, August 1st. The stock was sold at an average price of $166.12, for a total transaction of $347,024.68. Following the transaction, the chief executive officer now owns 122,951 shares of the company's stock, valued at approximately $20,424,620.12. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. 3.70% of the stock is owned by corporate insiders.

Analysts Set New Price Targets

MHO has been the subject of a number of research reports. StockNews.com cut shares of M/I Homes from a "strong-buy" rating to a "buy" rating in a report on Friday, October 18th. Raymond James boosted their price target on M/I Homes from $200.00 to $210.00 and gave the company a "strong-buy" rating in a report on Friday, August 2nd.

Get Our Latest Analysis on MHO

M/I Homes Company Profile

(

Get Free Report)

M/I Homes, Inc, together with its subsidiaries, engages in the construction and sale of single-family residential homes in Ohio, Indiana, Illinois, Minnesota, Michigan, Florida, Texas, North Carolina, and Tennessee. The company operates through Northern Homebuilding, Southern Homebuilding, and Financial Services segments.

Read More

Before you consider M/I Homes, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and M/I Homes wasn't on the list.

While M/I Homes currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.