MoneyLion (NYSE:ML - Get Free Report) is scheduled to issue its quarterly earnings data before the market opens on Thursday, November 7th. Analysts expect the company to announce earnings of $0.13 per share for the quarter. MoneyLion has set its FY 2024 guidance at EPS and its Q3 2024 guidance at EPS.Parties interested in listening to the company's conference call can do so using this link.

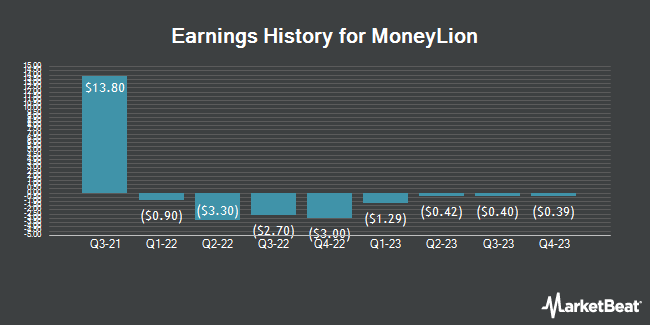

MoneyLion (NYSE:ML - Get Free Report) last posted its quarterly earnings results on Tuesday, August 6th. The company reported $0.26 earnings per share (EPS) for the quarter, topping the consensus estimate of ($0.01) by $0.27. The firm had revenue of $130.90 million for the quarter, compared to analyst estimates of $127.03 million. MoneyLion had a net margin of 0.40% and a return on equity of 0.72%. The firm's quarterly revenue was up 22.9% compared to the same quarter last year. During the same quarter in the previous year, the business posted ($0.42) earnings per share. On average, analysts expect MoneyLion to post $1 EPS for the current fiscal year and $3 EPS for the next fiscal year.

MoneyLion Trading Down 1.1 %

Shares of NYSE ML traded down $0.46 during mid-day trading on Thursday, reaching $42.97. The company had a trading volume of 127,644 shares, compared to its average volume of 195,595. The stock has a market cap of $471.29 million, a PE ratio of 613.86 and a beta of 2.69. The company has a 50-day moving average price of $43.05 and a two-hundred day moving average price of $62.19. MoneyLion has a 1-year low of $17.92 and a 1-year high of $106.82.

Insider Activity

In other news, insider Timmie Hong sold 2,504 shares of the company's stock in a transaction dated Wednesday, October 16th. The stock was sold at an average price of $48.35, for a total transaction of $121,068.40. Following the completion of the sale, the insider now owns 103,353 shares in the company, valued at approximately $4,997,117.55. This represents a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this hyperlink. In other MoneyLion news, CEO Diwakar Choubey sold 20,133 shares of the business's stock in a transaction on Thursday, August 15th. The shares were sold at an average price of $45.10, for a total transaction of $907,998.30. Following the completion of the transaction, the chief executive officer now owns 716,380 shares of the company's stock, valued at $32,308,738. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, insider Timmie Hong sold 2,504 shares of the company's stock in a transaction dated Wednesday, October 16th. The shares were sold at an average price of $48.35, for a total transaction of $121,068.40. Following the sale, the insider now owns 103,353 shares of the company's stock, valued at $4,997,117.55. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last 90 days, insiders have sold 44,059 shares of company stock worth $1,988,757. 11.90% of the stock is owned by corporate insiders.

Analyst Upgrades and Downgrades

ML has been the subject of several recent analyst reports. Northland Securities assumed coverage on shares of MoneyLion in a report on Wednesday, October 16th. They issued an "outperform" rating and a $60.00 target price for the company. Oppenheimer assumed coverage on MoneyLion in a research report on Tuesday, October 1st. They set a "market perform" rating on the stock. Cantor Fitzgerald upgraded MoneyLion to a "strong-buy" rating in a research report on Thursday, October 3rd. Needham & Company LLC reaffirmed a "buy" rating and set a $70.00 target price on shares of MoneyLion in a research note on Friday, October 4th. Finally, Northland Capmk raised shares of MoneyLion to a "strong-buy" rating in a research report on Wednesday, October 16th. One equities research analyst has rated the stock with a hold rating, five have assigned a buy rating and two have given a strong buy rating to the stock. According to data from MarketBeat, MoneyLion currently has an average rating of "Buy" and an average target price of $89.17.

Get Our Latest Research Report on ML

About MoneyLion

(

Get Free Report)

MoneyLion Inc, a financial technology company, provides personalized products and financial content for American consumers. The company's platform offers access to banking, borrowing, and investing solutions for customers. Its principal products include RoarMoney, an insured digital demand deposit account; Instacash, a cash advance product that gives customers early access to their recurring income deposits; Credit Builder Plus membership program; MoneyLion Investing, an online investment account that offers access to separately managed accounts invested based on model exchange-traded fund portfolios; Roundups, which provides features designed to encourage customers to establish good saving and investing habits; and MoneyLion Crypto, an online cryptocurrency account.

Read More

Before you consider MoneyLion, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MoneyLion wasn't on the list.

While MoneyLion currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.