Molina Healthcare (NYSE:MOH - Get Free Report) had its price objective boosted by stock analysts at Wells Fargo & Company from $360.00 to $362.00 in a research report issued on Monday, Benzinga reports. The brokerage presently has an "equal weight" rating on the stock. Wells Fargo & Company's price objective indicates a potential upside of 9.48% from the stock's current price.

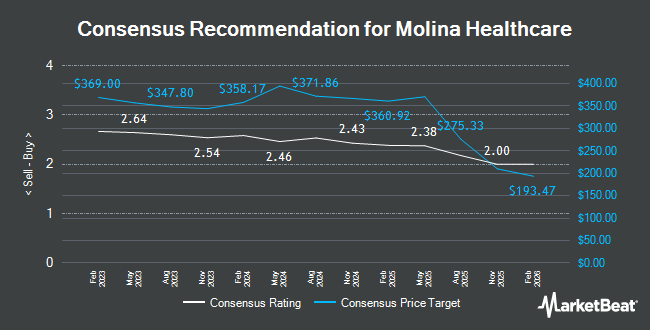

Several other equities research analysts have also issued reports on the stock. StockNews.com raised shares of Molina Healthcare from a "hold" rating to a "buy" rating in a report on Friday, October 18th. Deutsche Bank Aktiengesellschaft dropped their price target on shares of Molina Healthcare from $354.00 to $353.00 and set a "hold" rating for the company in a research report on Monday, July 29th. JPMorgan Chase & Co. decreased their price objective on Molina Healthcare from $420.00 to $395.00 and set an "overweight" rating on the stock in a report on Wednesday, July 10th. Cantor Fitzgerald reissued an "overweight" rating and issued a $406.00 target price on shares of Molina Healthcare in a report on Thursday, October 24th. Finally, Truist Financial decreased their price target on Molina Healthcare from $440.00 to $400.00 and set a "buy" rating on the stock in a research note on Monday, July 15th. One investment analyst has rated the stock with a sell rating, six have assigned a hold rating, six have assigned a buy rating and one has assigned a strong buy rating to the company. Based on data from MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and a consensus target price of $367.17.

Read Our Latest Report on MOH

Molina Healthcare Stock Performance

Shares of Molina Healthcare stock traded up $3.91 during trading on Monday, reaching $330.66. The company's stock had a trading volume of 633,456 shares, compared to its average volume of 529,374. Molina Healthcare has a one year low of $272.69 and a one year high of $423.92. The company has a debt-to-equity ratio of 0.53, a quick ratio of 1.55 and a current ratio of 1.54. The firm has a market cap of $18.91 billion, a price-to-earnings ratio of 16.86, a price-to-earnings-growth ratio of 1.11 and a beta of 0.59. The business's fifty day moving average price is $332.81 and its 200-day moving average price is $327.83.

Molina Healthcare (NYSE:MOH - Get Free Report) last released its earnings results on Wednesday, October 23rd. The company reported $6.01 EPS for the quarter, beating the consensus estimate of $5.96 by $0.05. The firm had revenue of $10.34 billion during the quarter, compared to analysts' expectations of $9.92 billion. Molina Healthcare had a net margin of 2.92% and a return on equity of 27.88%. The business's quarterly revenue was up 21.0% compared to the same quarter last year. During the same period in the prior year, the company earned $5.05 EPS. As a group, equities research analysts predict that Molina Healthcare will post 23.44 earnings per share for the current year.

Insider Activity at Molina Healthcare

In related news, CAO Maurice Hebert sold 393 shares of the company's stock in a transaction on Thursday, August 15th. The shares were sold at an average price of $346.52, for a total value of $136,182.36. Following the completion of the sale, the chief accounting officer now owns 9,473 shares in the company, valued at $3,282,583.96. This represents a 0.00 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. 1.10% of the stock is currently owned by corporate insiders.

Institutional Trading of Molina Healthcare

A number of institutional investors have recently made changes to their positions in MOH. Custom Index Systems LLC grew its stake in shares of Molina Healthcare by 5.0% in the second quarter. Custom Index Systems LLC now owns 690 shares of the company's stock valued at $205,000 after buying an additional 33 shares in the last quarter. AlphaMark Advisors LLC raised its holdings in shares of Molina Healthcare by 1.1% in the 2nd quarter. AlphaMark Advisors LLC now owns 3,543 shares of the company's stock valued at $1,053,000 after purchasing an additional 40 shares during the period. Oliver Luxxe Assets LLC lifted its stake in Molina Healthcare by 1.3% in the 3rd quarter. Oliver Luxxe Assets LLC now owns 4,428 shares of the company's stock valued at $1,526,000 after purchasing an additional 55 shares during the last quarter. Arizona State Retirement System grew its holdings in Molina Healthcare by 0.4% during the second quarter. Arizona State Retirement System now owns 16,092 shares of the company's stock worth $4,784,000 after purchasing an additional 57 shares during the period. Finally, Sumitomo Mitsui DS Asset Management Company Ltd increased its position in Molina Healthcare by 1.0% during the third quarter. Sumitomo Mitsui DS Asset Management Company Ltd now owns 5,942 shares of the company's stock worth $2,047,000 after buying an additional 61 shares during the last quarter. Institutional investors own 98.50% of the company's stock.

Molina Healthcare Company Profile

(

Get Free Report)

Molina Healthcare, Inc provides managed healthcare services to low-income families and individuals under the Medicaid and Medicare programs and through the state insurance marketplaces. It operates in four segments: Medicaid, Medicare, Marketplace, and Other. The company served in across 19 states. The company was founded in 1980 and is headquartered in Long Beach, California.

Read More

Before you consider Molina Healthcare, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Molina Healthcare wasn't on the list.

While Molina Healthcare currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.