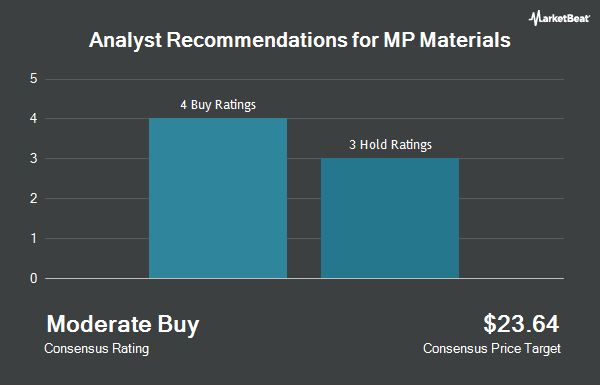

Shares of MP Materials Corp. (NYSE:MP - Get Free Report) have been assigned a consensus recommendation of "Moderate Buy" from the ten analysts that are currently covering the company, Marketbeat reports. Four investment analysts have rated the stock with a hold rating and six have issued a buy rating on the company. The average twelve-month target price among analysts that have issued a report on the stock in the last year is $21.40.

Several equities research analysts have weighed in on the stock. Morgan Stanley increased their price target on shares of MP Materials from $13.50 to $16.00 and gave the company an "equal weight" rating in a research report on Thursday, September 19th. BMO Capital Markets raised their target price on shares of MP Materials from $16.00 to $18.50 and gave the stock a "market perform" rating in a research report on Friday. Benchmark reaffirmed a "buy" rating and issued a $30.00 target price on shares of MP Materials in a research report on Friday, August 2nd. DA Davidson raised their target price on shares of MP Materials from $20.00 to $23.00 and gave the stock a "buy" rating in a research report on Tuesday, October 1st. Finally, Deutsche Bank Aktiengesellschaft dropped their target price on shares of MP Materials from $13.50 to $12.50 and set a "hold" rating for the company in a research report on Tuesday, August 6th.

Get Our Latest Analysis on MP Materials

Insider Transactions at MP Materials

In related news, COO Michael Stuart Rosenthal purchased 30,000 shares of MP Materials stock in a transaction dated Tuesday, August 6th. The stock was purchased at an average cost of $10.84 per share, for a total transaction of $325,200.00. Following the completion of the purchase, the chief operating officer now directly owns 1,402,975 shares of the company's stock, valued at $15,208,249. The trade was a 0.00 % increase in their position. The purchase was disclosed in a legal filing with the SEC, which is accessible through the SEC website. Company insiders own 12.60% of the company's stock.

Hedge Funds Weigh In On MP Materials

A number of hedge funds have recently modified their holdings of MP. Price T Rowe Associates Inc. MD boosted its position in shares of MP Materials by 2,536.8% during the first quarter. Price T Rowe Associates Inc. MD now owns 1,661,887 shares of the company's stock worth $23,767,000 after acquiring an additional 1,598,861 shares during the last quarter. Millennium Management LLC boosted its position in shares of MP Materials by 425.5% during the second quarter. Millennium Management LLC now owns 801,328 shares of the company's stock worth $10,201,000 after acquiring an additional 648,838 shares during the last quarter. Bank of Montreal Can boosted its position in shares of MP Materials by 188.1% during the second quarter. Bank of Montreal Can now owns 898,960 shares of the company's stock worth $11,462,000 after acquiring an additional 586,906 shares during the last quarter. Pinnacle Associates Ltd. boosted its position in shares of MP Materials by 151.1% during the second quarter. Pinnacle Associates Ltd. now owns 815,561 shares of the company's stock worth $10,382,000 after acquiring an additional 490,767 shares during the last quarter. Finally, Regal Partners Ltd boosted its position in shares of MP Materials by 275.4% during the second quarter. Regal Partners Ltd now owns 464,016 shares of the company's stock worth $5,907,000 after acquiring an additional 340,426 shares during the last quarter. 52.55% of the stock is currently owned by institutional investors.

MP Materials Trading Up 0.6 %

Shares of MP stock traded up $0.12 on Tuesday, hitting $19.00. 1,349,945 shares of the company's stock traded hands, compared to its average volume of 3,288,774. The company has a debt-to-equity ratio of 0.84, a quick ratio of 6.17 and a current ratio of 6.90. MP Materials has a one year low of $10.02 and a one year high of $20.85. The company's fifty day simple moving average is $15.58 and its 200 day simple moving average is $15.01. The stock has a market capitalization of $3.14 billion, a price-to-earnings ratio of -47.50 and a beta of 2.23.

MP Materials (NYSE:MP - Get Free Report) last released its earnings results on Thursday, August 1st. The company reported ($0.17) EPS for the quarter, missing the consensus estimate of ($0.09) by ($0.08). The business had revenue of $31.26 million for the quarter, compared to the consensus estimate of $40.03 million. MP Materials had a negative net margin of 21.94% and a negative return on equity of 4.28%. MP Materials's revenue for the quarter was down 51.2% on a year-over-year basis. During the same period in the prior year, the business posted $0.07 EPS. Equities analysts forecast that MP Materials will post -0.54 EPS for the current year.

MP Materials announced that its board has authorized a share repurchase plan on Tuesday, September 3rd that permits the company to buyback $300.00 million in shares. This buyback authorization permits the company to purchase up to 13.4% of its stock through open market purchases. Stock buyback plans are often an indication that the company's board believes its shares are undervalued.

MP Materials Company Profile

(

Get Free ReportMP Materials Corp., together with its subsidiaries, produces rare earth materials. The company owns and operates the Mountain Pass Rare Earth mine and processing facility in North America. It holds the mineral rights to the Mountain Pass mine and surrounding areas, as well as intellectual property rights related to the processing and development of rare earth minerals.

Further Reading

Before you consider MP Materials, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MP Materials wasn't on the list.

While MP Materials currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.