Pinnacle Associates Ltd. lessened its stake in MP Materials Corp. (NYSE:MP - Free Report) by 60.7% during the third quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 320,543 shares of the company's stock after selling 495,018 shares during the quarter. Pinnacle Associates Ltd. owned approximately 0.19% of MP Materials worth $5,658,000 at the end of the most recent reporting period.

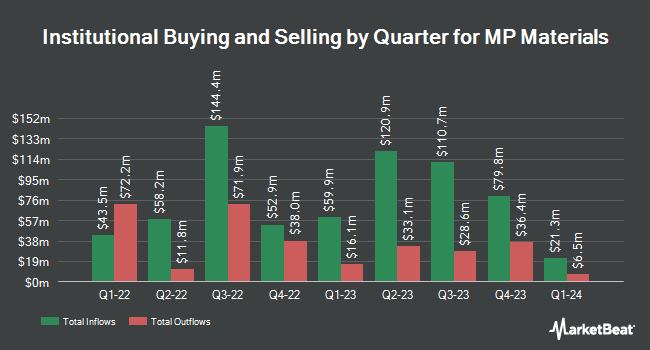

Other hedge funds also recently modified their holdings of the company. GAMMA Investing LLC increased its position in shares of MP Materials by 136.0% during the third quarter. GAMMA Investing LLC now owns 2,230 shares of the company's stock valued at $39,000 after acquiring an additional 1,285 shares during the last quarter. Signaturefd LLC increased its position in shares of MP Materials by 817.5% during the 3rd quarter. Signaturefd LLC now owns 3,661 shares of the company's stock valued at $65,000 after purchasing an additional 3,262 shares during the last quarter. Nisa Investment Advisors LLC raised its stake in shares of MP Materials by 3,803.8% during the 2nd quarter. Nisa Investment Advisors LLC now owns 4,060 shares of the company's stock worth $52,000 after purchasing an additional 3,956 shares during the period. Point72 Hong Kong Ltd purchased a new position in shares of MP Materials in the 2nd quarter worth about $72,000. Finally, Point72 Asia Singapore Pte. Ltd. bought a new position in MP Materials during the second quarter valued at about $100,000. Hedge funds and other institutional investors own 52.55% of the company's stock.

MP Materials Price Performance

NYSE MP traded down $0.74 during trading on Thursday, reaching $18.00. The company's stock had a trading volume of 2,150,191 shares, compared to its average volume of 3,278,111. The stock has a market capitalization of $2.98 billion, a PE ratio of -45.00 and a beta of 2.23. The company has a debt-to-equity ratio of 0.84, a current ratio of 6.90 and a quick ratio of 6.17. The firm has a fifty day moving average of $15.93 and a 200 day moving average of $15.07. MP Materials Corp. has a one year low of $10.02 and a one year high of $20.85.

MP Materials (NYSE:MP - Get Free Report) last announced its earnings results on Thursday, August 1st. The company reported ($0.17) earnings per share (EPS) for the quarter, missing the consensus estimate of ($0.09) by ($0.08). MP Materials had a negative net margin of 21.94% and a negative return on equity of 4.28%. The company had revenue of $31.26 million for the quarter, compared to the consensus estimate of $40.03 million. During the same quarter in the previous year, the firm earned $0.07 earnings per share. The company's revenue for the quarter was down 51.2% compared to the same quarter last year. Analysts expect that MP Materials Corp. will post -0.54 EPS for the current fiscal year.

MP Materials announced that its board has authorized a stock repurchase program on Tuesday, September 3rd that allows the company to repurchase $300.00 million in shares. This repurchase authorization allows the company to repurchase up to 13.4% of its shares through open market purchases. Shares repurchase programs are usually a sign that the company's leadership believes its stock is undervalued.

Analyst Ratings Changes

Several analysts have commented on MP shares. DA Davidson lifted their price objective on shares of MP Materials from $20.00 to $23.00 and gave the stock a "buy" rating in a research report on Tuesday, October 1st. Deutsche Bank Aktiengesellschaft decreased their target price on MP Materials from $13.50 to $12.50 and set a "hold" rating for the company in a research report on Tuesday, August 6th. Robert W. Baird upped their price target on MP Materials from $20.00 to $25.00 and gave the company an "outperform" rating in a research report on Friday, September 27th. Benchmark reissued a "buy" rating and issued a $30.00 price objective on shares of MP Materials in a report on Friday, August 2nd. Finally, BMO Capital Markets upped their price objective on shares of MP Materials from $16.00 to $18.50 and gave the company a "market perform" rating in a report on Friday, October 25th. Four research analysts have rated the stock with a hold rating and six have given a buy rating to the company's stock. Based on data from MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and a consensus price target of $21.40.

Check Out Our Latest Stock Report on MP Materials

Insider Activity at MP Materials

In other news, COO Michael Stuart Rosenthal acquired 30,000 shares of the firm's stock in a transaction that occurred on Tuesday, August 6th. The shares were bought at an average cost of $10.84 per share, with a total value of $325,200.00. Following the acquisition, the chief operating officer now owns 1,402,975 shares in the company, valued at approximately $15,208,249. This represents a 0.00 % increase in their position. The acquisition was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. 12.60% of the stock is owned by insiders.

MP Materials Profile

(

Free Report)

MP Materials Corp., together with its subsidiaries, produces rare earth materials. The company owns and operates the Mountain Pass Rare Earth mine and processing facility in North America. It holds the mineral rights to the Mountain Pass mine and surrounding areas, as well as intellectual property rights related to the processing and development of rare earth minerals.

Recommended Stories

Before you consider MP Materials, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MP Materials wasn't on the list.

While MP Materials currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.