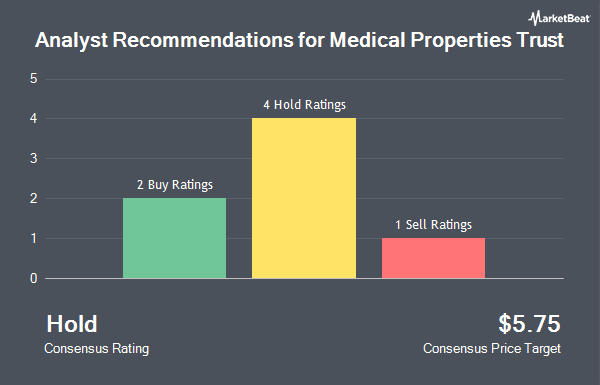

Shares of Medical Properties Trust, Inc. (NYSE:MPW - Get Free Report) have been assigned a consensus rating of "Hold" from the ten ratings firms that are presently covering the company, Marketbeat reports. One investment analyst has rated the stock with a sell recommendation, eight have given a hold recommendation and one has given a buy recommendation to the company. The average 12-month target price among brokers that have updated their coverage on the stock in the last year is $5.38.

Several research analysts have recently commented on the company. Colliers Securities raised Medical Properties Trust from a "neutral" rating to a "buy" rating and set a $6.50 price objective for the company in a report on Friday, September 13th. BNP Paribas cut shares of Medical Properties Trust from an "outperform" rating to a "neutral" rating and cut their price target for the stock from $6.00 to $4.00 in a research note on Tuesday, July 2nd. Wolfe Research raised shares of Medical Properties Trust to a "hold" rating in a report on Monday, September 23rd. Finally, Truist Financial lifted their price objective on shares of Medical Properties Trust from $5.00 to $6.00 and gave the stock a "hold" rating in a report on Friday, September 13th.

Check Out Our Latest Analysis on Medical Properties Trust

Medical Properties Trust Price Performance

MPW stock traded down $0.01 during mid-day trading on Tuesday, reaching $4.72. 4,636,514 shares of the company traded hands, compared to its average volume of 17,325,100. Medical Properties Trust has a 52-week low of $2.92 and a 52-week high of $6.55. The company has a market capitalization of $2.83 billion, a P/E ratio of -2.14, a P/E/G ratio of 0.76 and a beta of 1.29. The company has a debt-to-equity ratio of 1.51, a current ratio of 2.93 and a quick ratio of 2.93. The company has a fifty day moving average price of $5.15 and a 200-day moving average price of $4.90.

Medical Properties Trust (NYSE:MPW - Get Free Report) last released its quarterly earnings results on Thursday, August 8th. The real estate investment trust reported ($0.54) EPS for the quarter, missing analysts' consensus estimates of $0.21 by ($0.75). The firm had revenue of $266.60 million for the quarter, compared to analysts' expectations of $259.53 million. Medical Properties Trust's quarterly revenue was down 21.0% on a year-over-year basis. During the same period in the prior year, the business earned $0.48 EPS. As a group, analysts anticipate that Medical Properties Trust will post 0.85 earnings per share for the current year.

Medical Properties Trust Cuts Dividend

The business also recently disclosed a quarterly dividend, which was paid on Thursday, October 10th. Shareholders of record on Monday, September 9th were given a $0.08 dividend. The ex-dividend date of this dividend was Monday, September 9th. This represents a $0.32 annualized dividend and a yield of 6.78%. Medical Properties Trust's payout ratio is currently -14.41%.

Insider Activity at Medical Properties Trust

In related news, Director Michael G. Stewart sold 32,780 shares of the business's stock in a transaction dated Wednesday, October 9th. The stock was sold at an average price of $5.46, for a total transaction of $178,978.80. Following the transaction, the director now owns 221,245 shares in the company, valued at $1,207,997.70. The trade was a 0.00 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. In other Medical Properties Trust news, Director Elizabeth N. Pitman purchased 8,087 shares of the firm's stock in a transaction that occurred on Wednesday, September 18th. The stock was bought at an average cost of $6.01 per share, for a total transaction of $48,602.87. Following the purchase, the director now directly owns 76,740 shares in the company, valued at $461,207.40. The trade was a 0.00 % increase in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, Director Michael G. Stewart sold 32,780 shares of Medical Properties Trust stock in a transaction dated Wednesday, October 9th. The shares were sold at an average price of $5.46, for a total transaction of $178,978.80. Following the transaction, the director now directly owns 221,245 shares of the company's stock, valued at approximately $1,207,997.70. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 63,335 shares of company stock worth $318,825 in the last three months. 1.53% of the stock is owned by insiders.

Hedge Funds Weigh In On Medical Properties Trust

Several large investors have recently made changes to their positions in MPW. Future Financial Wealth Managment LLC purchased a new position in Medical Properties Trust during the third quarter valued at $29,000. GAMMA Investing LLC raised its position in shares of Medical Properties Trust by 107.3% in the 3rd quarter. GAMMA Investing LLC now owns 6,077 shares of the real estate investment trust's stock worth $36,000 after purchasing an additional 3,145 shares during the last quarter. Versant Capital Management Inc boosted its stake in Medical Properties Trust by 435.0% in the 2nd quarter. Versant Capital Management Inc now owns 7,972 shares of the real estate investment trust's stock worth $34,000 after purchasing an additional 6,482 shares in the last quarter. Iron Horse Wealth Management LLC grew its position in Medical Properties Trust by 166.7% during the 2nd quarter. Iron Horse Wealth Management LLC now owns 8,000 shares of the real estate investment trust's stock valued at $34,000 after purchasing an additional 5,000 shares during the last quarter. Finally, Fidelis Capital Partners LLC bought a new stake in Medical Properties Trust during the 1st quarter valued at about $43,000. 71.79% of the stock is currently owned by hedge funds and other institutional investors.

Medical Properties Trust Company Profile

(

Get Free ReportMedical Properties Trust, Inc is a self-advised real estate investment trust formed in 2003 to acquire and develop net-leased hospital facilities. From its inception in Birmingham, Alabama, the Company has grown to become one of the world's largest owners of hospital real estate with 441 facilities and approximately 44,000 licensed beds as of September 30, 2023.

Further Reading

Before you consider Medical Properties Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Medical Properties Trust wasn't on the list.

While Medical Properties Trust currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.