Baxter Bros Inc. grew its holdings in Morgan Stanley (NYSE:MS - Free Report) by 7.1% in the third quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 78,417 shares of the financial services provider's stock after buying an additional 5,193 shares during the period. Morgan Stanley accounts for about 1.1% of Baxter Bros Inc.'s portfolio, making the stock its 26th biggest holding. Baxter Bros Inc.'s holdings in Morgan Stanley were worth $8,174,000 at the end of the most recent quarter.

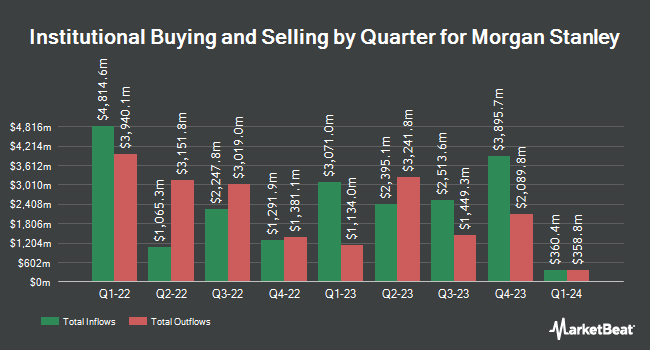

Several other hedge funds and other institutional investors also recently made changes to their positions in the business. Bayesian Capital Management LP bought a new stake in shares of Morgan Stanley in the first quarter valued at about $2,660,000. Resonant Capital Advisors LLC increased its holdings in shares of Morgan Stanley by 17.8% during the second quarter. Resonant Capital Advisors LLC now owns 5,768 shares of the financial services provider's stock worth $561,000 after purchasing an additional 871 shares during the period. Cetera Investment Advisers raised its position in shares of Morgan Stanley by 115.0% in the first quarter. Cetera Investment Advisers now owns 223,668 shares of the financial services provider's stock valued at $20,305,000 after buying an additional 119,633 shares in the last quarter. AIA Group Ltd boosted its stake in shares of Morgan Stanley by 96.6% in the first quarter. AIA Group Ltd now owns 33,598 shares of the financial services provider's stock valued at $3,164,000 after buying an additional 16,507 shares during the period. Finally, Swedbank AB bought a new position in Morgan Stanley during the 1st quarter worth $87,558,000. 84.19% of the stock is currently owned by institutional investors.

Insiders Place Their Bets

In related news, Director Stephen J. Luczo sold 60,000 shares of the company's stock in a transaction dated Thursday, October 17th. The shares were sold at an average price of $119.17, for a total value of $7,150,200.00. Following the sale, the director now owns 138,363 shares in the company, valued at $16,488,718.71. This represents a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available at this link. Corporate insiders own 0.24% of the company's stock.

Morgan Stanley Stock Up 0.5 %

NYSE:MS traded up $0.60 on Friday, hitting $116.85. The stock had a trading volume of 4,372,177 shares, compared to its average volume of 6,697,360. The company has a quick ratio of 0.78, a current ratio of 0.78 and a debt-to-equity ratio of 2.96. Morgan Stanley has a 52 week low of $71.65 and a 52 week high of $121.45. The business's fifty day moving average is $107.02 and its 200 day moving average is $101.34. The company has a market cap of $189.90 billion, a PE ratio of 17.79, a P/E/G ratio of 1.09 and a beta of 1.34.

Morgan Stanley Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Friday, November 15th. Shareholders of record on Thursday, October 31st will be paid a dividend of $0.925 per share. The ex-dividend date of this dividend is Thursday, October 31st. This represents a $3.70 dividend on an annualized basis and a yield of 3.17%. Morgan Stanley's dividend payout ratio (DPR) is presently 56.32%.

Wall Street Analyst Weigh In

A number of research firms have recently weighed in on MS. Hsbc Global Res upgraded Morgan Stanley from a "hold" rating to a "strong-buy" rating in a research report on Friday, October 4th. BMO Capital Markets increased their price objective on shares of Morgan Stanley from $116.00 to $118.00 and gave the stock an "outperform" rating in a research note on Thursday, July 18th. JMP Securities reaffirmed a "market perform" rating on shares of Morgan Stanley in a report on Thursday, July 18th. Royal Bank of Canada lifted their price objective on shares of Morgan Stanley from $108.00 to $122.00 and gave the company a "sector perform" rating in a research note on Thursday, October 17th. Finally, Barclays lifted their price target on Morgan Stanley from $121.00 to $135.00 and gave the company an "overweight" rating in a research note on Thursday, October 17th. One equities research analyst has rated the stock with a sell rating, ten have given a hold rating, seven have issued a buy rating and one has given a strong buy rating to the company. According to data from MarketBeat, the company presently has an average rating of "Hold" and a consensus target price of $109.24.

Get Our Latest Report on Morgan Stanley

About Morgan Stanley

(

Free Report)

Morgan Stanley, a financial holding company, provides various financial products and services to corporations, governments, financial institutions, and individuals in the Americas, Europe, the Middle East, Africa, and Asia. It operates through Institutional Securities, Wealth Management, and Investment Management segments.

Read More

Before you consider Morgan Stanley, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Morgan Stanley wasn't on the list.

While Morgan Stanley currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.