Allspring Global Investments Holdings LLC boosted its holdings in MSA Safety Incorporated (NYSE:MSA - Free Report) by 51.6% during the third quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 97,571 shares of the industrial products company's stock after acquiring an additional 33,204 shares during the quarter. Allspring Global Investments Holdings LLC owned 0.25% of MSA Safety worth $17,303,000 at the end of the most recent quarter.

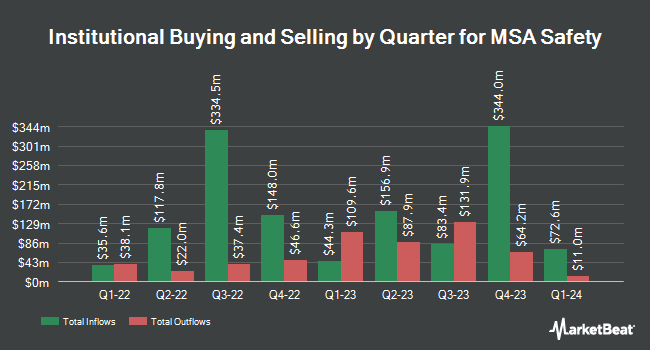

Other hedge funds and other institutional investors have also recently added to or reduced their stakes in the company. Cooke & Bieler LP acquired a new stake in MSA Safety in the 2nd quarter valued at $60,236,000. Janus Henderson Group PLC boosted its position in MSA Safety by 1,601.5% in the first quarter. Janus Henderson Group PLC now owns 312,222 shares of the industrial products company's stock valued at $60,443,000 after buying an additional 293,872 shares in the last quarter. Conestoga Capital Advisors LLC grew its stake in MSA Safety by 219.8% during the second quarter. Conestoga Capital Advisors LLC now owns 306,943 shares of the industrial products company's stock worth $57,610,000 after buying an additional 210,968 shares during the last quarter. Price T Rowe Associates Inc. MD raised its stake in shares of MSA Safety by 12.2% in the first quarter. Price T Rowe Associates Inc. MD now owns 718,969 shares of the industrial products company's stock valued at $139,186,000 after acquiring an additional 77,960 shares during the last quarter. Finally, Victory Capital Management Inc. raised its stake in shares of MSA Safety by 748.6% in the second quarter. Victory Capital Management Inc. now owns 65,552 shares of the industrial products company's stock valued at $12,303,000 after acquiring an additional 57,827 shares during the last quarter. Institutional investors own 92.51% of the company's stock.

MSA Safety Trading Down 0.5 %

MSA traded down $0.86 during mid-day trading on Friday, reaching $166.06. The stock had a trading volume of 189,785 shares, compared to its average volume of 151,960. The firm's fifty day simple moving average is $175.14 and its two-hundred day simple moving average is $181.90. The stock has a market capitalization of $6.53 billion, a P/E ratio of 24.14 and a beta of 0.99. MSA Safety Incorporated has a 52 week low of $155.34 and a 52 week high of $200.60. The company has a debt-to-equity ratio of 0.55, a quick ratio of 1.54 and a current ratio of 2.45.

MSA Safety (NYSE:MSA - Get Free Report) last issued its quarterly earnings results on Wednesday, October 23rd. The industrial products company reported $1.83 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.78 by $0.05. The business had revenue of $432.68 million for the quarter, compared to analyst estimates of $449.95 million. MSA Safety had a return on equity of 30.64% and a net margin of 14.97%. The firm's revenue for the quarter was down 3.1% compared to the same quarter last year. During the same quarter in the prior year, the firm posted $1.78 earnings per share. On average, equities analysts predict that MSA Safety Incorporated will post 7.75 EPS for the current year.

MSA Safety Announces Dividend

The firm also recently announced a quarterly dividend, which was paid on Tuesday, September 10th. Stockholders of record on Thursday, August 15th were paid a $0.51 dividend. This represents a $2.04 annualized dividend and a dividend yield of 1.23%. The ex-dividend date was Thursday, August 15th. MSA Safety's dividend payout ratio (DPR) is presently 29.65%.

Insider Transactions at MSA Safety

In related news, CEO Nishan J. Vartanian sold 3,945 shares of the stock in a transaction that occurred on Wednesday, July 31st. The shares were sold at an average price of $189.00, for a total value of $745,605.00. Following the transaction, the chief executive officer now directly owns 31,953 shares in the company, valued at $6,039,117. This represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available at the SEC website. 6.20% of the stock is owned by corporate insiders.

Analysts Set New Price Targets

A number of equities research analysts recently weighed in on MSA shares. Stifel Nicolaus raised their price target on MSA Safety from $200.00 to $215.00 and gave the company a "buy" rating in a report on Friday, July 26th. William Blair raised MSA Safety to a "strong-buy" rating in a report on Tuesday, July 16th.

Get Our Latest Stock Analysis on MSA Safety

MSA Safety Company Profile

(

Free Report)

MSA Safety Incorporated develops, manufactures, and supplies safety products and technology solutions that protect people and facility infrastructures in the fire service, energy, utility, construction, and industrial manufacturing applications, as well as heating, ventilation, air conditioning, and refrigeration industries worldwide.

Featured Stories

Before you consider MSA Safety, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MSA Safety wasn't on the list.

While MSA Safety currently has a "Strong Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.