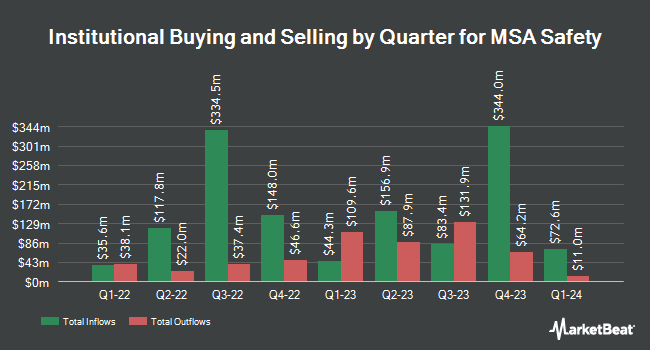

Conestoga Capital Advisors LLC boosted its position in shares of MSA Safety Incorporated (NYSE:MSA - Free Report) by 43.5% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 440,316 shares of the industrial products company's stock after buying an additional 133,373 shares during the period. Conestoga Capital Advisors LLC owned 1.12% of MSA Safety worth $78,086,000 at the end of the most recent quarter.

Other hedge funds have also made changes to their positions in the company. GAMMA Investing LLC boosted its position in MSA Safety by 198.8% during the second quarter. GAMMA Investing LLC now owns 245 shares of the industrial products company's stock worth $46,000 after acquiring an additional 163 shares during the last quarter. Blue Trust Inc. increased its holdings in shares of MSA Safety by 486.0% in the third quarter. Blue Trust Inc. now owns 252 shares of the industrial products company's stock valued at $47,000 after purchasing an additional 209 shares during the last quarter. Allegheny Financial Group LTD acquired a new stake in shares of MSA Safety in the first quarter valued at approximately $203,000. Kowal Investment Group LLC purchased a new position in MSA Safety during the second quarter worth approximately $204,000. Finally, CIBC Asset Management Inc acquired a new position in MSA Safety during the second quarter worth $206,000. Institutional investors and hedge funds own 92.51% of the company's stock.

MSA Safety Stock Down 1.4 %

MSA traded down $2.34 during trading hours on Friday, hitting $163.61. 261,674 shares of the company's stock were exchanged, compared to its average volume of 153,090. The firm has a 50 day moving average of $174.34 and a 200 day moving average of $181.19. The firm has a market cap of $6.43 billion, a P/E ratio of 23.84 and a beta of 0.99. The company has a current ratio of 2.68, a quick ratio of 1.56 and a debt-to-equity ratio of 0.48. MSA Safety Incorporated has a 12-month low of $157.11 and a 12-month high of $200.60.

MSA Safety (NYSE:MSA - Get Free Report) last posted its quarterly earnings results on Wednesday, October 23rd. The industrial products company reported $1.83 EPS for the quarter, topping the consensus estimate of $1.78 by $0.05. MSA Safety had a net margin of 15.16% and a return on equity of 29.14%. The company had revenue of $432.68 million during the quarter, compared to analysts' expectations of $449.95 million. During the same quarter in the previous year, the business posted $1.78 EPS. The firm's revenue was down 3.1% on a year-over-year basis. Analysts predict that MSA Safety Incorporated will post 7.75 EPS for the current fiscal year.

MSA Safety Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Tuesday, December 10th. Shareholders of record on Friday, November 15th will be paid a $0.51 dividend. The ex-dividend date is Friday, November 15th. This represents a $2.04 annualized dividend and a yield of 1.25%. MSA Safety's dividend payout ratio is currently 29.48%.

Wall Street Analysts Forecast Growth

A number of analysts recently issued reports on the company. William Blair raised MSA Safety to a "strong-buy" rating in a research report on Tuesday, July 16th. Stifel Nicolaus lifted their price target on shares of MSA Safety from $200.00 to $215.00 and gave the company a "buy" rating in a research report on Friday, July 26th.

View Our Latest Analysis on MSA Safety

About MSA Safety

(

Free Report)

MSA Safety Incorporated develops, manufactures, and supplies safety products and technology solutions that protect people and facility infrastructures in the fire service, energy, utility, construction, and industrial manufacturing applications, as well as heating, ventilation, air conditioning, and refrigeration industries worldwide.

Recommended Stories

Before you consider MSA Safety, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MSA Safety wasn't on the list.

While MSA Safety currently has a "Strong Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.