MaxLinear (NYSE:MXL - Free Report) had its price target cut by Craig Hallum from $28.00 to $25.00 in a report released on Thursday, Benzinga reports. They currently have a buy rating on the semiconductor company's stock.

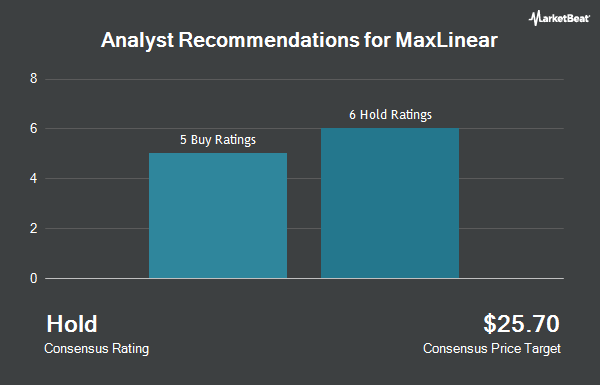

A number of other brokerages have also recently issued reports on MXL. Susquehanna cut shares of MaxLinear from a "positive" rating to a "neutral" rating and reduced their price objective for the stock from $26.00 to $15.00 in a research note on Tuesday, October 1st. Needham & Company LLC restated a "hold" rating on shares of MaxLinear in a report on Thursday. Northland Securities lowered their price target on MaxLinear from $30.00 to $25.00 and set an "outperform" rating for the company in a report on Thursday, July 25th. Stifel Nicolaus boosted their target price on shares of MaxLinear from $26.00 to $30.00 and gave the company a "buy" rating in a research report on Thursday, July 18th. Finally, Benchmark reaffirmed a "buy" rating and issued a $22.00 price target on shares of MaxLinear in a report on Thursday. One equities research analyst has rated the stock with a sell rating, five have issued a hold rating and four have issued a buy rating to the company's stock. According to data from MarketBeat.com, MaxLinear currently has an average rating of "Hold" and an average price target of $23.13.

Check Out Our Latest Stock Report on MXL

MaxLinear Price Performance

NYSE MXL traded up $0.22 during trading hours on Thursday, reaching $15.09. 4,859,181 shares of the stock traded hands, compared to its average volume of 948,699. The company has a market cap of $1.25 billion, a price-to-earnings ratio of -7.98 and a beta of 1.83. The stock has a 50 day simple moving average of $13.83 and a two-hundred day simple moving average of $17.17. The company has a debt-to-equity ratio of 0.20, a current ratio of 2.09 and a quick ratio of 1.59. MaxLinear has a 1 year low of $11.08 and a 1 year high of $26.59.

MaxLinear (NYSE:MXL - Get Free Report) last announced its quarterly earnings results on Wednesday, October 23rd. The semiconductor company reported ($0.36) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.32) by ($0.04). MaxLinear had a negative return on equity of 12.39% and a negative net margin of 42.38%. The firm had revenue of $81.10 million during the quarter, compared to the consensus estimate of $80.40 million. During the same period last year, the business earned ($0.02) EPS. MaxLinear's revenue was down 40.2% on a year-over-year basis. On average, analysts predict that MaxLinear will post -1.74 EPS for the current fiscal year.

Insiders Place Their Bets

In other news, CEO Kishore Seendripu bought 108,303 shares of the firm's stock in a transaction dated Tuesday, July 30th. The stock was acquired at an average price of $12.94 per share, for a total transaction of $1,401,440.82. Following the acquisition, the chief executive officer now owns 531,937 shares of the company's stock, valued at $6,883,264.78. This trade represents a 0.00 % increase in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available at this link. 8.60% of the stock is owned by corporate insiders.

Institutional Trading of MaxLinear

Several hedge funds and other institutional investors have recently bought and sold shares of MXL. Headlands Technologies LLC bought a new stake in shares of MaxLinear during the first quarter valued at about $27,000. Innealta Capital LLC purchased a new position in MaxLinear during the 2nd quarter worth approximately $30,000. International Assets Investment Management LLC purchased a new stake in MaxLinear in the 2nd quarter worth about $31,000. GAMMA Investing LLC lifted its position in MaxLinear by 151.8% in the 3rd quarter. GAMMA Investing LLC now owns 3,472 shares of the semiconductor company's stock worth $50,000 after buying an additional 2,093 shares in the last quarter. Finally, Canada Pension Plan Investment Board acquired a new stake in shares of MaxLinear during the 2nd quarter valued at about $56,000. 90.79% of the stock is owned by institutional investors.

MaxLinear Company Profile

(

Get Free Report)

MaxLinear, Inc provides communications systems-on-chip solutions worldwide. Its products integrate various portions of a high-speed communication system, including radio frequency, high-performance analog, mixed-signal, digital signal processing, security engines, data compression and networking layers, and power management.

See Also

Before you consider MaxLinear, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MaxLinear wasn't on the list.

While MaxLinear currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.