Nordic American Tankers Limited (NYSE:NAT - Free Report) - Equities researchers at B. Riley raised their FY2025 earnings estimates for shares of Nordic American Tankers in a research report issued to clients and investors on Thursday, October 24th. B. Riley analyst L. Burke now anticipates that the shipping company will earn $0.49 per share for the year, up from their previous forecast of $0.48. The consensus estimate for Nordic American Tankers' current full-year earnings is $0.38 per share.

NAT has been the subject of a number of other reports. Jefferies Financial Group restated a "hold" rating and issued a $4.00 target price on shares of Nordic American Tankers in a research note on Thursday, September 12th. Evercore ISI reduced their price objective on shares of Nordic American Tankers from $4.50 to $4.00 and set an "in-line" rating for the company in a report on Friday, August 30th. Finally, StockNews.com raised shares of Nordic American Tankers from a "sell" rating to a "hold" rating in a research note on Wednesday, October 2nd.

Get Our Latest Stock Analysis on Nordic American Tankers

Nordic American Tankers Stock Performance

Nordic American Tankers stock traded down $0.03 during trading hours on Friday, hitting $3.35. The stock had a trading volume of 2,573,214 shares, compared to its average volume of 2,501,529. Nordic American Tankers has a fifty-two week low of $3.31 and a fifty-two week high of $4.83. The company has a market cap of $698.44 million, a PE ratio of 11.67 and a beta of -0.20. The company has a 50-day moving average of $3.64 and a two-hundred day moving average of $3.81. The company has a quick ratio of 0.63, a current ratio of 0.79 and a debt-to-equity ratio of 0.36.

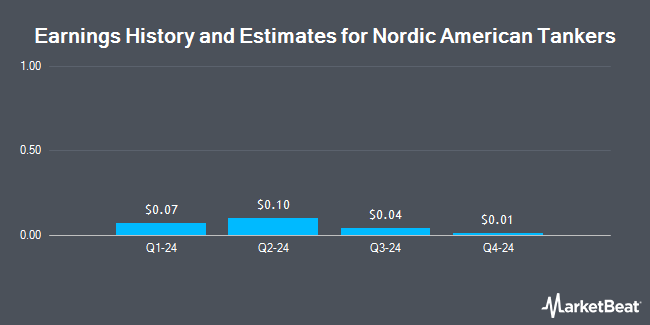

Nordic American Tankers (NYSE:NAT - Get Free Report) last announced its quarterly earnings data on Tuesday, September 3rd. The shipping company reported $0.10 EPS for the quarter, beating analysts' consensus estimates of $0.07 by $0.03. Nordic American Tankers had a net margin of 26.35% and a return on equity of 11.60%. The business had revenue of $66.10 million during the quarter, compared to analyst estimates of $54.34 million. During the same quarter in the prior year, the business earned $0.13 earnings per share.

Nordic American Tankers Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Tuesday, November 26th. Stockholders of record on Thursday, September 26th will be paid a $0.12 dividend. The ex-dividend date is Thursday, September 26th. This represents a $0.48 annualized dividend and a dividend yield of 14.35%. Nordic American Tankers's dividend payout ratio is presently 165.52%.

Hedge Funds Weigh In On Nordic American Tankers

A number of institutional investors and hedge funds have recently added to or reduced their stakes in the company. Headlands Technologies LLC bought a new position in shares of Nordic American Tankers in the second quarter valued at approximately $25,000. Diversify Advisory Services LLC bought a new stake in shares of Nordic American Tankers during the first quarter worth $41,000. B. Riley Wealth Advisors Inc. bought a new stake in shares of Nordic American Tankers during the first quarter worth $45,000. SG Americas Securities LLC bought a new position in shares of Nordic American Tankers in the first quarter valued at about $47,000. Finally, Bluefin Capital Management LLC bought a new stake in Nordic American Tankers during the 2nd quarter worth about $47,000. 44.29% of the stock is currently owned by institutional investors and hedge funds.

About Nordic American Tankers

(

Get Free Report)

Nordic American Tankers Limited, a tanker company, acquires and charters double-hull tankers in Bermuda and internationally. It operates a fleet of 20 Suezmax crude oil tankers. The company was incorporated in 1995 and is headquartered in Hamilton, Bermuda.

See Also

Before you consider Nordic American Tankers, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nordic American Tankers wasn't on the list.

While Nordic American Tankers currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.