Norwegian Cruise Line (NYSE:NCLH - Get Free Report) had its price objective hoisted by research analysts at Barclays from $26.00 to $28.00 in a research note issued to investors on Friday, Benzinga reports. The brokerage presently has an "equal weight" rating on the stock. Barclays's price target suggests a potential upside of 12.54% from the company's previous close.

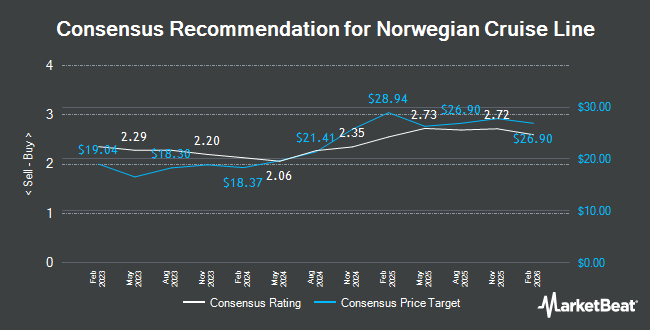

Other research analysts have also issued reports about the stock. Tigress Financial restated a "strong-buy" rating and set a $32.00 price objective on shares of Norwegian Cruise Line in a research note on Friday, August 9th. JPMorgan Chase & Co. upped their price objective on Norwegian Cruise Line from $23.00 to $25.00 and gave the company a "neutral" rating in a research note on Monday, September 16th. Stifel Nicolaus lifted their target price on Norwegian Cruise Line from $27.00 to $29.00 and gave the stock a "buy" rating in a research note on Friday, October 4th. Mizuho raised their price target on Norwegian Cruise Line from $26.00 to $28.00 and gave the company an "outperform" rating in a report on Friday. Finally, The Goldman Sachs Group increased their price objective on shares of Norwegian Cruise Line from $24.00 to $29.00 and gave the company a "neutral" rating in a research report on Friday. Two analysts have rated the stock with a sell rating, eight have issued a hold rating, five have issued a buy rating and one has issued a strong buy rating to the stock. According to data from MarketBeat, Norwegian Cruise Line presently has a consensus rating of "Hold" and an average price target of $25.80.

View Our Latest Analysis on Norwegian Cruise Line

Norwegian Cruise Line Stock Down 1.8 %

NYSE NCLH traded down $0.46 during trading on Friday, hitting $24.88. The stock had a trading volume of 12,150,534 shares, compared to its average volume of 12,937,590. The company has a market capitalization of $10.94 billion, a PE ratio of 29.27, a P/E/G ratio of 0.31 and a beta of 2.71. Norwegian Cruise Line has a 12 month low of $12.70 and a 12 month high of $26.73. The company's 50-day moving average price is $20.86 and its two-hundred day moving average price is $18.60. The company has a debt-to-equity ratio of 17.19, a quick ratio of 0.22 and a current ratio of 0.24.

Norwegian Cruise Line (NYSE:NCLH - Get Free Report) last issued its quarterly earnings results on Wednesday, July 31st. The company reported $0.40 EPS for the quarter, topping the consensus estimate of $0.35 by $0.05. The firm had revenue of $2.37 billion for the quarter, compared to analysts' expectations of $2.38 billion. Norwegian Cruise Line had a net margin of 4.62% and a return on equity of 105.44%. The company's revenue for the quarter was up 7.6% on a year-over-year basis. During the same period in the previous year, the firm posted $0.20 EPS. As a group, sell-side analysts forecast that Norwegian Cruise Line will post 1.38 EPS for the current year.

Institutional Trading of Norwegian Cruise Line

Several large investors have recently modified their holdings of the stock. Sumitomo Mitsui Trust Holdings Inc. acquired a new stake in shares of Norwegian Cruise Line in the 1st quarter valued at approximately $217,000. Norden Group LLC bought a new position in Norwegian Cruise Line during the 1st quarter worth $352,000. Allspring Global Investments Holdings LLC lifted its holdings in Norwegian Cruise Line by 2.5% during the 1st quarter. Allspring Global Investments Holdings LLC now owns 21,605 shares of the company's stock worth $452,000 after buying an additional 537 shares during the period. Van ECK Associates Corp increased its stake in shares of Norwegian Cruise Line by 875.2% in the first quarter. Van ECK Associates Corp now owns 122,448 shares of the company's stock valued at $2,563,000 after buying an additional 109,892 shares during the period. Finally, Private Advisor Group LLC increased its stake in shares of Norwegian Cruise Line by 30.0% in the first quarter. Private Advisor Group LLC now owns 33,192 shares of the company's stock valued at $695,000 after buying an additional 7,652 shares during the period. 69.58% of the stock is owned by institutional investors and hedge funds.

About Norwegian Cruise Line

(

Get Free Report)

Norwegian Cruise Line Holdings Ltd., together with its subsidiaries, operates as a cruise company in North America, Europe, the Asia-Pacific, and internationally. The company operates through the Norwegian Cruise Line, Oceania Cruises, and Regent Seven Seas Cruises brands. It offers itineraries ranging from three days to a 180-days calling on various ports, including Scandinavia, Northern Europe, the Mediterranean, the Greek Isles, Alaska, Canada and New England, Hawaii, Asia, Tahiti and the South Pacific, Australia and New Zealand, Africa, India, South America, the Panama Canal, and the Caribbean.

Recommended Stories

Before you consider Norwegian Cruise Line, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Norwegian Cruise Line wasn't on the list.

While Norwegian Cruise Line currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.