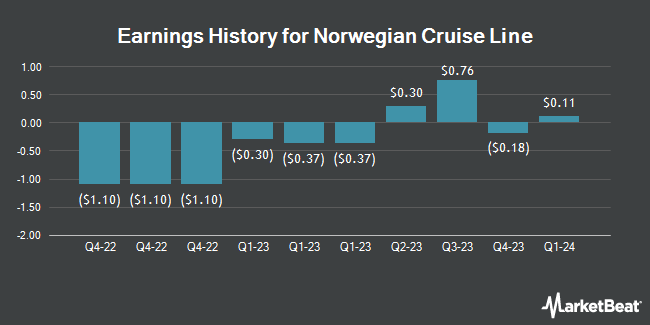

Norwegian Cruise Line (NYSE:NCLH - Get Free Report) posted its quarterly earnings results on Thursday. The company reported $0.99 earnings per share for the quarter, topping analysts' consensus estimates of $0.94 by $0.05, Briefing.com reports. Norwegian Cruise Line had a net margin of 5.87% and a return on equity of 99.31%. The business had revenue of $2.81 billion during the quarter, compared to the consensus estimate of $2.77 billion. During the same period in the previous year, the firm posted $0.71 earnings per share. Norwegian Cruise Line's revenue for the quarter was up 10.7% compared to the same quarter last year.

Norwegian Cruise Line Stock Performance

Shares of Norwegian Cruise Line stock traded down $0.46 on Friday, hitting $24.88. The stock had a trading volume of 12,222,766 shares, compared to its average volume of 12,283,719. The stock has a market cap of $10.94 billion, a price-to-earnings ratio of 22.83, a price-to-earnings-growth ratio of 0.33 and a beta of 2.67. The business's 50 day moving average is $20.86 and its two-hundred day moving average is $18.61. The company has a quick ratio of 0.22, a current ratio of 0.20 and a debt-to-equity ratio of 10.35. Norwegian Cruise Line has a twelve month low of $12.70 and a twelve month high of $26.73.

Wall Street Analysts Forecast Growth

Several research firms recently weighed in on NCLH. Citigroup raised shares of Norwegian Cruise Line from a "neutral" rating to a "buy" rating and lifted their price objective for the stock from $20.00 to $30.00 in a research note on Wednesday, October 9th. Truist Financial boosted their price objective on shares of Norwegian Cruise Line from $21.00 to $25.00 and gave the company a "buy" rating in a research report on Thursday, September 26th. Morgan Stanley increased their target price on Norwegian Cruise Line from $17.50 to $19.00 and gave the stock an "underweight" rating in a report on Wednesday. Bank of America boosted their price target on Norwegian Cruise Line from $20.00 to $23.00 and gave the company a "neutral" rating in a report on Tuesday, July 23rd. Finally, Deutsche Bank Aktiengesellschaft increased their price objective on Norwegian Cruise Line from $21.00 to $24.00 and gave the stock a "hold" rating in a report on Friday. Two research analysts have rated the stock with a sell rating, eight have given a hold rating, five have issued a buy rating and one has issued a strong buy rating to the stock. According to MarketBeat.com, the company presently has a consensus rating of "Hold" and an average price target of $25.80.

Read Our Latest Research Report on NCLH

About Norwegian Cruise Line

(

Get Free Report)

Norwegian Cruise Line Holdings Ltd., together with its subsidiaries, operates as a cruise company in North America, Europe, the Asia-Pacific, and internationally. The company operates through the Norwegian Cruise Line, Oceania Cruises, and Regent Seven Seas Cruises brands. It offers itineraries ranging from three days to a 180-days calling on various ports, including Scandinavia, Northern Europe, the Mediterranean, the Greek Isles, Alaska, Canada and New England, Hawaii, Asia, Tahiti and the South Pacific, Australia and New Zealand, Africa, India, South America, the Panama Canal, and the Caribbean.

Featured Articles

Before you consider Norwegian Cruise Line, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Norwegian Cruise Line wasn't on the list.

While Norwegian Cruise Line currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.