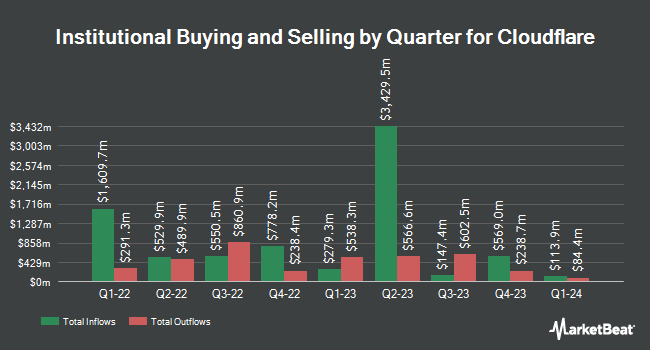

International Assets Investment Management LLC purchased a new stake in Cloudflare, Inc. (NYSE:NET - Free Report) during the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The firm purchased 181,922 shares of the company's stock, valued at approximately $147,160,000. International Assets Investment Management LLC owned 0.05% of Cloudflare at the end of the most recent reporting period.

Other hedge funds and other institutional investors have also recently modified their holdings of the company. Baillie Gifford & Co. increased its position in shares of Cloudflare by 8.5% in the second quarter. Baillie Gifford & Co. now owns 32,722,670 shares of the company's stock valued at $2,710,419,000 after acquiring an additional 2,575,396 shares during the last quarter. Marshall Wace LLP grew its holdings in Cloudflare by 123.4% during the second quarter. Marshall Wace LLP now owns 1,548,535 shares of the company's stock worth $128,265,000 after purchasing an additional 855,334 shares during the period. Capital World Investors grew its holdings in Cloudflare by 2.1% during the first quarter. Capital World Investors now owns 28,128,522 shares of the company's stock worth $2,723,685,000 after purchasing an additional 584,566 shares during the period. Vanguard Group Inc. grew its holdings in Cloudflare by 1.5% during the first quarter. Vanguard Group Inc. now owns 28,572,053 shares of the company's stock worth $2,766,632,000 after purchasing an additional 412,864 shares during the period. Finally, SpiderRock Advisors LLC bought a new position in Cloudflare during the first quarter worth about $37,740,000. Institutional investors and hedge funds own 82.68% of the company's stock.

Analyst Ratings Changes

A number of equities analysts recently commented on NET shares. BNP Paribas started coverage on Cloudflare in a report on Tuesday, October 8th. They set an "underperform" rating and a $65.00 price target for the company. Robert W. Baird lifted their price target on Cloudflare from $94.00 to $100.00 and gave the stock an "outperform" rating in a report on Friday, August 2nd. Susquehanna lifted their price target on Cloudflare from $80.00 to $85.00 and gave the stock a "neutral" rating in a report on Monday, August 5th. Guggenheim lifted their price target on Cloudflare from $50.00 to $57.00 and gave the stock a "sell" rating in a report on Friday, August 2nd. Finally, Needham & Company LLC restated a "buy" rating and set a $135.00 price objective on shares of Cloudflare in a report on Friday, August 2nd. Four investment analysts have rated the stock with a sell rating, twelve have issued a hold rating and ten have given a buy rating to the stock. According to MarketBeat, the stock currently has a consensus rating of "Hold" and an average price target of $91.72.

Read Our Latest Stock Report on NET

Cloudflare Trading Down 0.9 %

Shares of Cloudflare stock traded down $0.81 during trading on Friday, hitting $88.76. The company's stock had a trading volume of 1,437,283 shares, compared to its average volume of 3,164,862. The company has a debt-to-equity ratio of 1.46, a current ratio of 3.51 and a quick ratio of 3.51. Cloudflare, Inc. has a 52 week low of $53.88 and a 52 week high of $116.00. The stock has a market cap of $30.16 billion, a price-to-earnings ratio of -167.47 and a beta of 1.10. The stock has a 50-day moving average price of $83.20 and a two-hundred day moving average price of $80.70.

Cloudflare (NYSE:NET - Get Free Report) last issued its quarterly earnings data on Thursday, August 1st. The company reported $0.20 earnings per share for the quarter, topping the consensus estimate of $0.14 by $0.06. Cloudflare had a negative net margin of 6.90% and a negative return on equity of 8.54%. The company had revenue of $401.00 million for the quarter, compared to analysts' expectations of $394.11 million. During the same quarter in the previous year, the firm posted ($0.12) earnings per share. Cloudflare's revenue for the quarter was up 30.0% on a year-over-year basis. Equities research analysts anticipate that Cloudflare, Inc. will post -0.13 EPS for the current fiscal year.

Insider Buying and Selling at Cloudflare

In other Cloudflare news, insider Douglas James Kramer sold 3,000 shares of the company's stock in a transaction on Thursday, August 1st. The shares were sold at an average price of $77.17, for a total transaction of $231,510.00. Following the sale, the insider now owns 195,303 shares of the company's stock, valued at approximately $15,071,532.51. This represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which can be accessed through this hyperlink. In other news, CEO Matthew Prince sold 52,384 shares of the stock in a transaction dated Tuesday, October 15th. The shares were sold at an average price of $93.95, for a total transaction of $4,921,476.80. Following the transaction, the chief executive officer now owns 10,761 shares of the company's stock, valued at $1,010,995.95. This represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Also, insider Douglas James Kramer sold 3,000 shares of the stock in a transaction dated Thursday, August 1st. The stock was sold at an average price of $77.17, for a total transaction of $231,510.00. Following the transaction, the insider now directly owns 195,303 shares in the company, valued at $15,071,532.51. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Over the last quarter, insiders have sold 522,552 shares of company stock valued at $42,994,705. 12.83% of the stock is currently owned by insiders.

Cloudflare Profile

(

Free Report)

Cloudflare, Inc operates as a cloud services provider that delivers a range of services to businesses worldwide. The company provides an integrated cloud-based security solution to secure a range of combination of platforms, including public cloud, private cloud, on-premise, software-as-a-service applications, and IoT devices; and website and application security products comprising web application firewall, bot management, distributed denial of service, API gateways, SSL/TLS encryption, script management, security center, and rate limiting products.

Recommended Stories

Before you consider Cloudflare, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cloudflare wasn't on the list.

While Cloudflare currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report