Mediolanum International Funds Ltd purchased a new stake in shares of National Grid plc (NYSE:NGG - Free Report) during the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund purchased 545,731 shares of the utilities provider's stock, valued at approximately $38,021,000. Mediolanum International Funds Ltd owned 0.07% of National Grid at the end of the most recent reporting period.

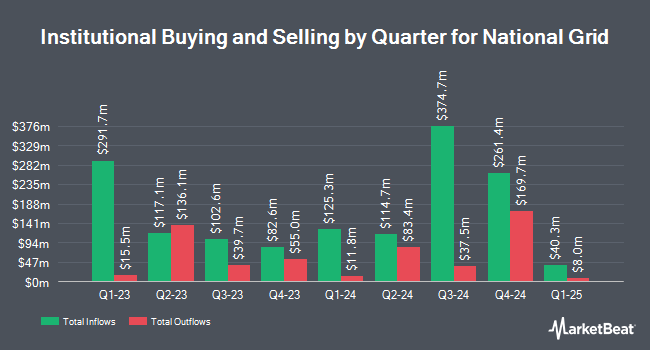

Other hedge funds have also made changes to their positions in the company. BNP Paribas Financial Markets acquired a new stake in National Grid during the 1st quarter worth about $1,372,000. Capital International Investors purchased a new position in National Grid during the first quarter valued at approximately $86,218,000. Atria Investments Inc increased its stake in National Grid by 19.3% in the 1st quarter. Atria Investments Inc now owns 61,319 shares of the utilities provider's stock valued at $4,183,000 after buying an additional 9,931 shares during the period. Gradient Investments LLC lifted its position in National Grid by 8,101.0% in the 2nd quarter. Gradient Investments LLC now owns 8,283 shares of the utilities provider's stock worth $470,000 after buying an additional 8,182 shares in the last quarter. Finally, O Shaughnessy Asset Management LLC boosted its stake in shares of National Grid by 54.6% during the 1st quarter. O Shaughnessy Asset Management LLC now owns 17,185 shares of the utilities provider's stock valued at $1,172,000 after buying an additional 6,070 shares during the period. Hedge funds and other institutional investors own 4.68% of the company's stock.

National Grid Price Performance

Shares of National Grid stock traded down $1.01 during midday trading on Friday, reaching $65.33. 480,202 shares of the company's stock traded hands, compared to its average volume of 532,914. National Grid plc has a 52 week low of $55.13 and a 52 week high of $73.40. The company's 50 day simple moving average is $67.61 and its 200 day simple moving average is $64.60. The company has a quick ratio of 0.84, a current ratio of 0.91 and a debt-to-equity ratio of 1.41.

Wall Street Analysts Forecast Growth

A number of equities analysts have recently weighed in on NGG shares. Citigroup downgraded shares of National Grid from a "buy" rating to a "neutral" rating in a research note on Thursday, October 3rd. Deutsche Bank Aktiengesellschaft started coverage on National Grid in a research note on Wednesday, October 2nd. They set a "buy" rating for the company. Two research analysts have rated the stock with a hold rating and five have issued a buy rating to the company. According to data from MarketBeat, the stock currently has a consensus rating of "Moderate Buy".

Get Our Latest Research Report on NGG

National Grid Profile

(

Free Report)

National Grid plc transmits and distributes electricity and gas. It operates through UK Electricity Transmission, UK Electricity Distribution, UK Electricity System Operator, New England, New York, National Grid Ventures, and Other segments. The UK Electricity Transmission segment provides electricity transmission and construction work services in England and Wales.

Featured Articles

Before you consider National Grid, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and National Grid wasn't on the list.

While National Grid currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.