Annaly Capital Management (NYSE:NLY - Get Free Report) had its target price dropped by equities research analysts at JPMorgan Chase & Co. from $22.00 to $21.00 in a report released on Friday, Benzinga reports. The firm presently has an "overweight" rating on the real estate investment trust's stock. JPMorgan Chase & Co.'s price target would indicate a potential upside of 7.86% from the stock's current price.

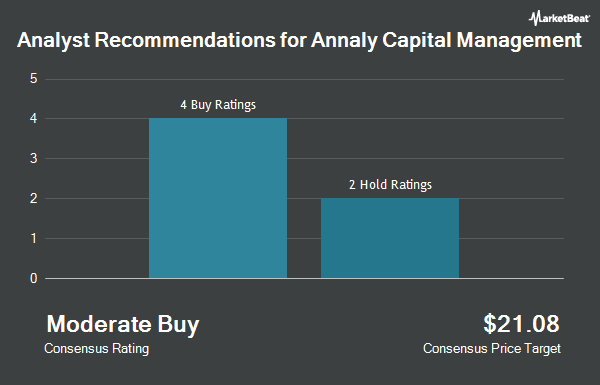

Several other analysts have also recently commented on NLY. StockNews.com cut shares of Annaly Capital Management from a "buy" rating to a "hold" rating in a research note on Thursday, July 25th. Wells Fargo & Company raised shares of Annaly Capital Management from an "equal weight" rating to an "overweight" rating and lifted their target price for the stock from $19.00 to $23.00 in a research note on Friday, September 20th. Compass Point increased their price target on Annaly Capital Management from $22.00 to $23.50 and gave the stock a "buy" rating in a research note on Friday, July 26th. Finally, JMP Securities reissued a "market perform" rating on shares of Annaly Capital Management in a research note on Wednesday, August 28th. Three analysts have rated the stock with a hold rating and seven have assigned a buy rating to the stock. According to data from MarketBeat.com, the company has an average rating of "Moderate Buy" and a consensus target price of $21.38.

Read Our Latest Stock Report on Annaly Capital Management

Annaly Capital Management Stock Performance

Shares of NYSE NLY traded down $0.23 during mid-day trading on Friday, reaching $19.47. 5,519,914 shares of the company's stock were exchanged, compared to its average volume of 4,057,654. Annaly Capital Management has a 52-week low of $14.52 and a 52-week high of $21.11. The company's 50-day moving average is $20.10 and its 200-day moving average is $19.74. The firm has a market capitalization of $10.48 billion, a price-to-earnings ratio of -14.92 and a beta of 1.51.

Annaly Capital Management (NYSE:NLY - Get Free Report) last announced its quarterly earnings data on Wednesday, October 23rd. The real estate investment trust reported $0.66 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.67 by ($0.01). The company had revenue of $1.23 billion during the quarter, compared to analyst estimates of $212.00 million. Annaly Capital Management had a negative net margin of 12.02% and a positive return on equity of 15.24%. During the same quarter in the previous year, the business posted $0.66 earnings per share. As a group, equities analysts predict that Annaly Capital Management will post 2.67 earnings per share for the current fiscal year.

Insider Buying and Selling at Annaly Capital Management

In related news, CEO David L. Finkelstein sold 50,000 shares of the company's stock in a transaction on Friday, August 16th. The stock was sold at an average price of $20.05, for a total value of $1,002,500.00. Following the completion of the transaction, the chief executive officer now directly owns 612,469 shares in the company, valued at approximately $12,280,003.45. This represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. Insiders own 0.21% of the company's stock.

Institutional Investors Weigh In On Annaly Capital Management

Hedge funds and other institutional investors have recently made changes to their positions in the company. Natixis raised its stake in shares of Annaly Capital Management by 16,140.0% during the first quarter. Natixis now owns 68,208 shares of the real estate investment trust's stock worth $1,343,000 after buying an additional 67,788 shares during the last quarter. Russell Investments Group Ltd. lifted its stake in Annaly Capital Management by 27.3% in the first quarter. Russell Investments Group Ltd. now owns 169,043 shares of the real estate investment trust's stock valued at $3,303,000 after buying an additional 36,269 shares during the period. PGGM Investments boosted its holdings in Annaly Capital Management by 152.0% during the second quarter. PGGM Investments now owns 428,406 shares of the real estate investment trust's stock worth $8,165,000 after buying an additional 258,388 shares during the last quarter. Frank Rimerman Advisors LLC acquired a new position in shares of Annaly Capital Management during the 2nd quarter worth about $478,000. Finally, BRITISH COLUMBIA INVESTMENT MANAGEMENT Corp increased its stake in shares of Annaly Capital Management by 60.8% in the 2nd quarter. BRITISH COLUMBIA INVESTMENT MANAGEMENT Corp now owns 95,913 shares of the real estate investment trust's stock valued at $1,828,000 after acquiring an additional 36,266 shares during the last quarter. 51.56% of the stock is owned by institutional investors and hedge funds.

About Annaly Capital Management

(

Get Free Report)

Annaly Capital Management, Inc, a diversified capital manager, engages in mortgage finance. The company invests in agency mortgage-backed securities collateralized by residential mortgages; non-agency residential whole loans and securitized products within the residential and commercial markets; mortgage servicing rights; agency commercial mortgage-backed securities; to-be-announced forward contracts; residential mortgage loans; and agency or private label credit risk transfer securities.

Recommended Stories

Before you consider Annaly Capital Management, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Annaly Capital Management wasn't on the list.

While Annaly Capital Management currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.